-

It's unclear how the new political environment will affect the platform's viability or how investors will view the securities issued on it. The next year could determine the project's success and role reshaping the secondary mortgage market.

December 27 -

Congress wants to put federal flood program on sounder financial footing, encourage the development of private flood insurance market and stop the insanity of rebuilding properties subject to repetitive flooding.

December 23 -

The case against Fannie Mae and Freddie Mac is stronger than the argument for their survival.

December 23 Mitsubishi UFJ Securities International

Mitsubishi UFJ Securities International -

Treasury sweep agreement set to deplete Fannie and Freddie's capital reserves by the end of 2017.

December 23 -

The Federal Reserve has freed Cole Taylor Bank from an enforcement action two years after the Chicago bank was acquired by MB Financial.

December 22 -

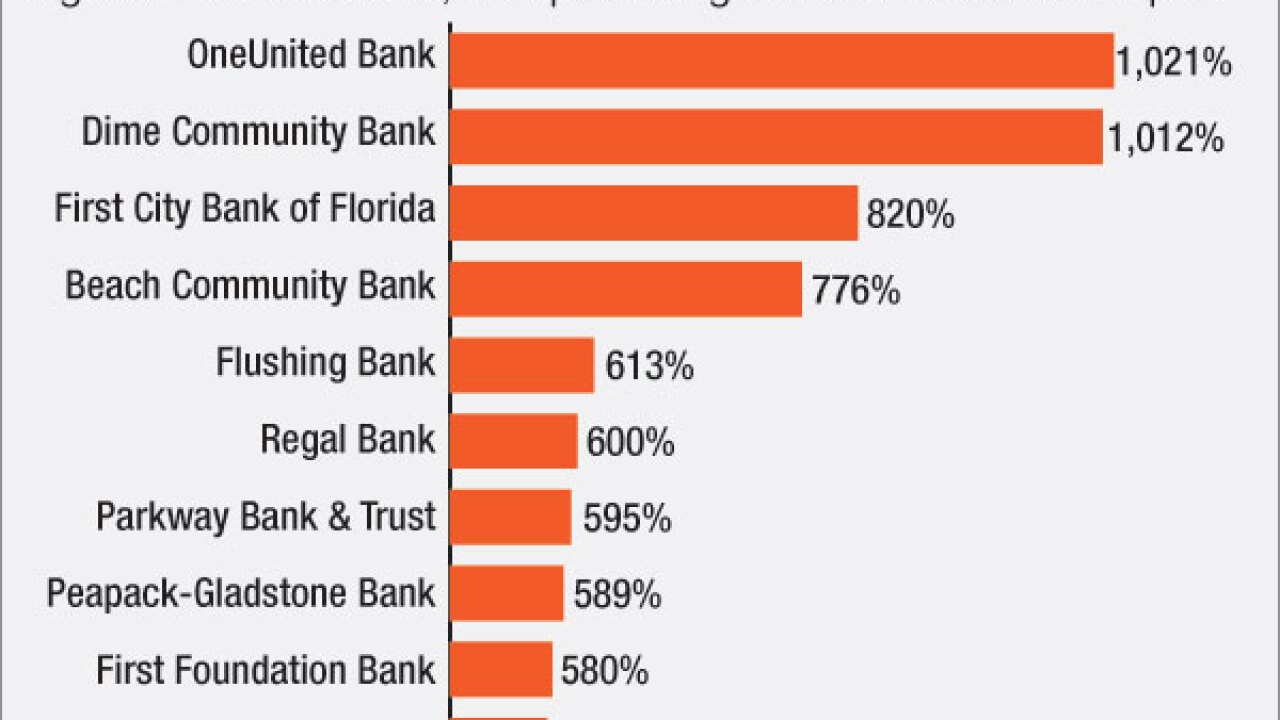

Regulators have warned about the dangers of high commercial real estate concentrations despite bankers' assertions that they are managing risk better than they did before the financial crisis. Still, CRE concerns could influence M&A and loan diversification in 2017.

December 22 -

Andrew Jetter is stepping down as the chief executive of the Federal Home Loan Bank of Topeka after serving as the president and the CEO for 14 years.

December 21 -

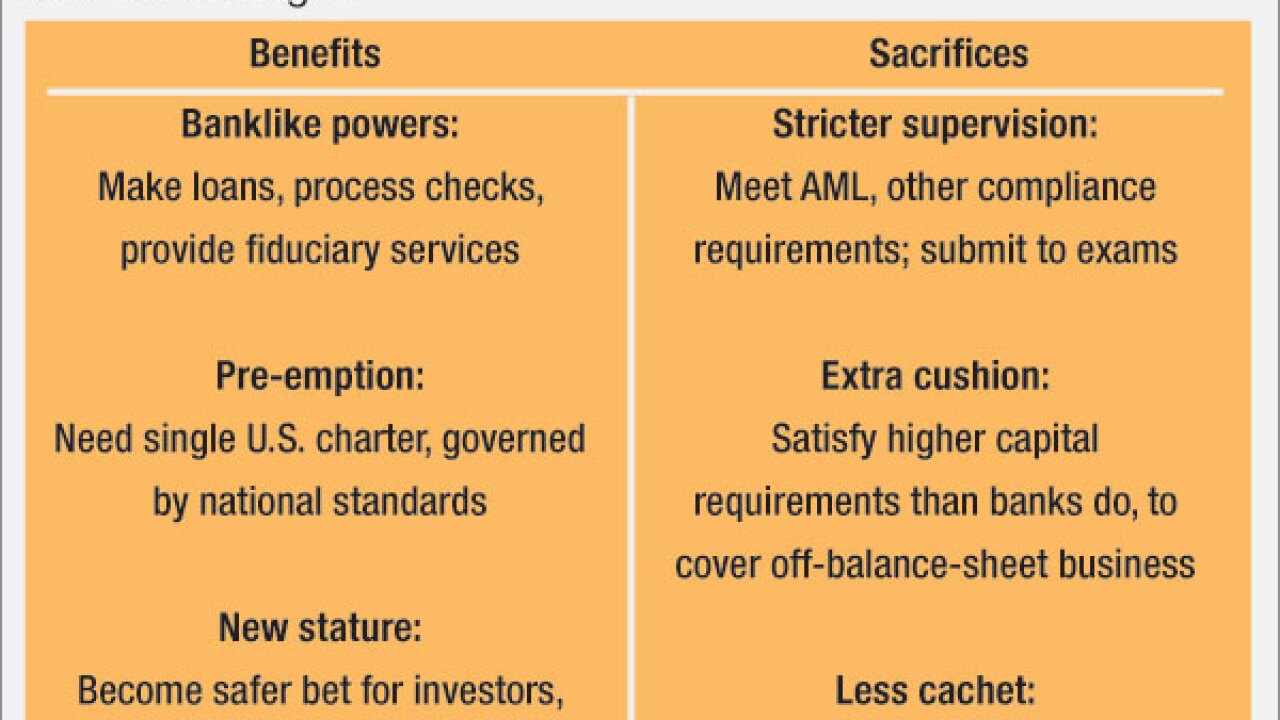

Now that the OCC has proposed a limited-purpose bank charter for fintech companies, a host of innovative new banks will soon flood the market or maybe not.

December 21 -

The National Credit Union Administration acted appropriately, within its legal authority, when issuing its member business lending rule.

December 21

-

Ginnie Mae has revised the wording of the acknowledgment agreements necessary to finance mortgage servicing rights. It sought to resolve a concern warehouse lenders had in the event issuers become troubled.

December 21