-

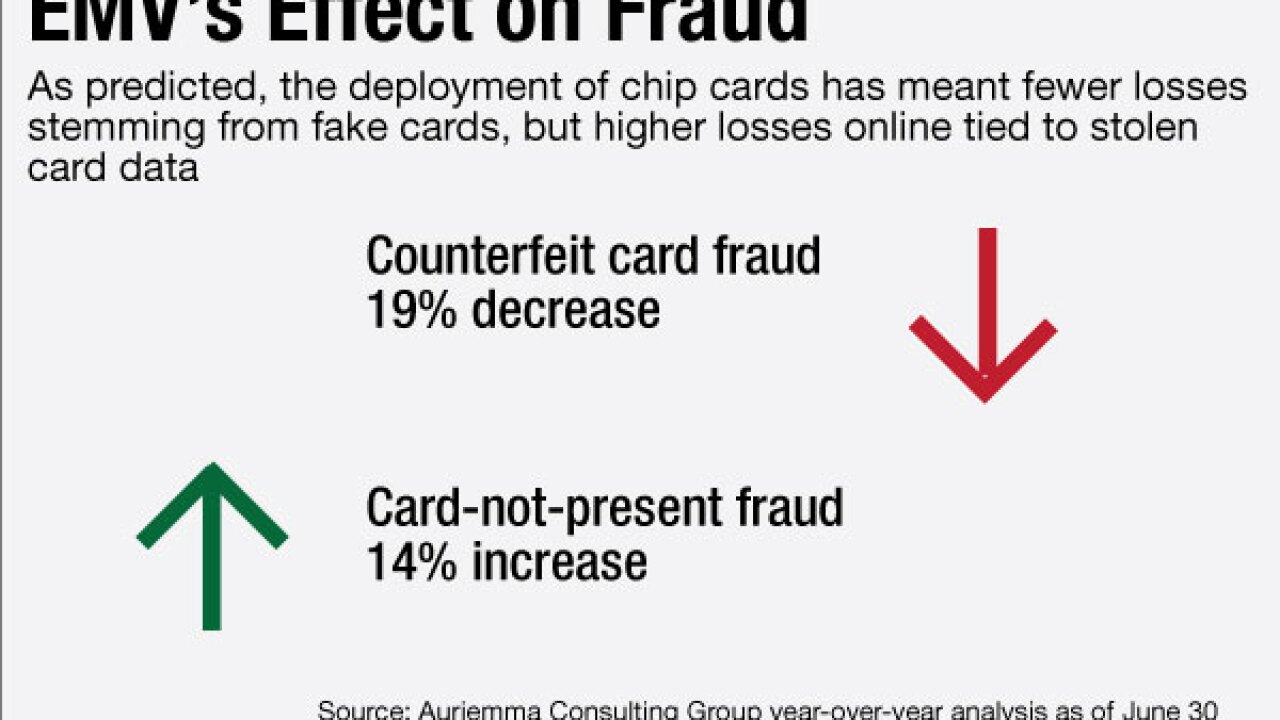

The migration has been slow, but COOP Financial Services says there's momentum for adoption and usage. There are also signs that card fraud risk is improving.

December 22CO-OP Financial Services -

The Federal Reserve and Federal Trade Commission investigated Visa for debit practices, a move that enhances competition in the marketplace for merchants.

December 21 National Association of Convenience Stores

National Association of Convenience Stores -

Online shoppers can expect fraudsters to be at the height of their creativity during the 2016 holiday season.

December 16 -

The chip card migration is drawing more attention to card not present fraud. Account takeover risk is also on the rise.

December 16 LexisNexis

LexisNexis -

The percentage of EMV transactions in the United States is miniscule compared to other parts of the world, but the migration to chip cards in the U.S. is lifting the technology's global growth — now at 42.4% of all card transactions.

December 14 -

As online shopping and card fraud increase, startups offering easy-to-use “burner” cards could see strong traction.

December 13 -

As online shopping and card fraud increase, startups offering easy-to-use "burner" cards could see strong traction.

December 13 -

Both major brands are accelerating a move away from traditional checkout, and all retailers need to make adjustments for the future.

December 13 Judo Payments

Judo Payments -

The opening of the 2016 holiday season, which marks the first full year since the country's major EMV fraud liability shift, is proving what data security experts feared all along.

December 6 -

With Visa and Mastercard extending their EMV compliance deadline to 2020 for fuel pumps, EMV is less likely to overshadow anti-fraud technology that is faster and more practical to implement.

December 1