-

The central bank is bringing back examinations but said it will continue to conduct monitoring remotely "until conditions improve."

June 15 -

After three months of supervising national banks remotely, examiners will soon resume visiting them in person and working in regional offices, says acting Comptroller of the Currency Brian Brooks.

June 11 -

The acting head of the agency says it cannot continue relying on web-based exams put in place during the coronavirus and will start sending staff into banks.

June 11

-

The regulator has conducted remote exam work at more than 100 institutions since March and does not plan to return to its normal examination process "until further notice."

May 29 -

Mortgage lenders impose steep pricing adjustments for cash-out refinancing; bankers fear massive borrower fraud in the Paycheck Protection Program; some worry the coronavirus is giving banks an excuse to spy on employees; and more from this week's most-read stories.

May 8 -

Federal regulators are now conducting nearly all supervision off-site as a result of the pandemic. The temporary measures are stoking a debate about whether they should be permanent.

May 1 -

The credit union regulator released its annual diversity report, which showed that more minorities were in senior roles but examiners remained predominantly white and male.

April 21 -

The regulator must speed up its capital reform efforts while taking immediate steps to reduce the examination burden.

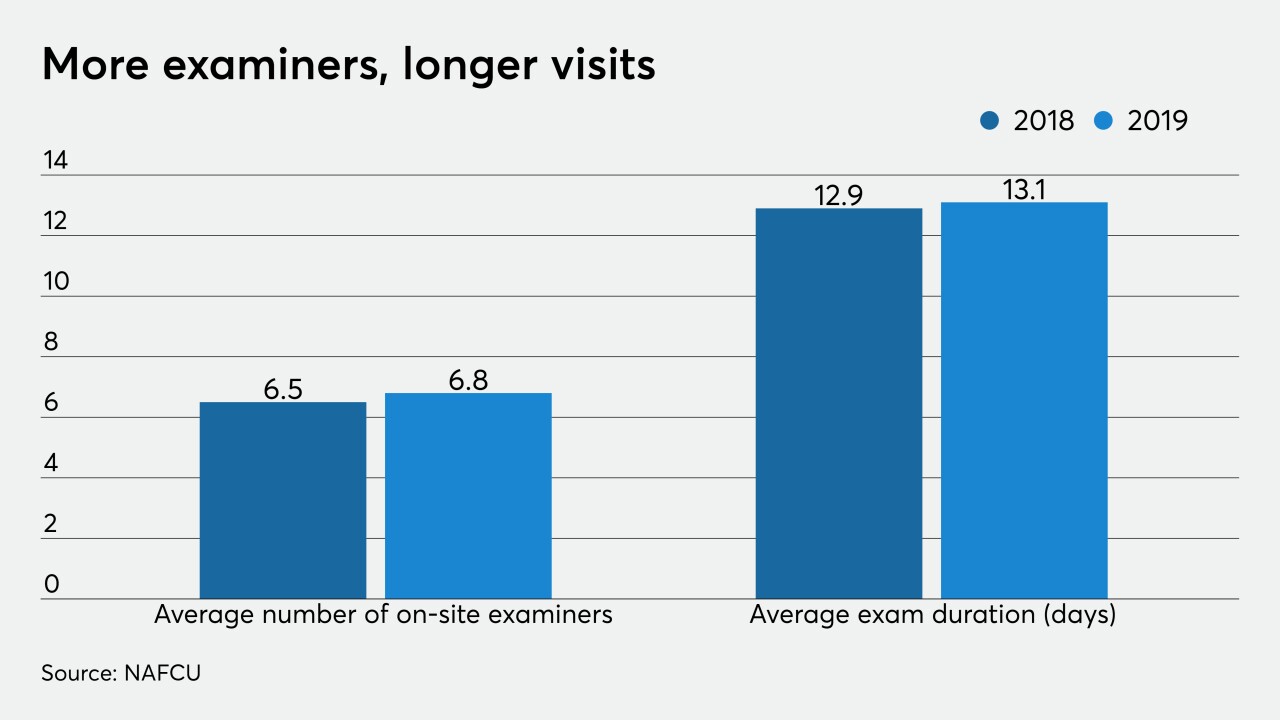

April 7 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

Some regulators had started shifting to more remote oversight before the pandemic, though the initiatives haven't been a priority for credit unions and their advocates.

April 7 -

The industry still grapples with stopping corrupt employees — the failure of CBS Employee FCU last year highlights that — and now that could become even harder with the pandemic.

March 31 -

The central bank will prioritize monitoring and outreach while reducing examination activity due to the coronavirus pandemic until at least the end of April.

March 24 -

The National Credit Union Administration also ordered its own employees to work from home until at least the end of March.

March 16 -

State and federal officials committed to providing “appropriate regulatory assistance” to banks whose customers may be hurt by the coronavirus outbreak and said prudent measures would not be subject to criticism by examiners.

March 9 -

The National Credit Union Administration promised qualified credit unions under $1 billion in assets would be on an 18-month exam timeline by the end of 2019. A recent report says that hasn't happened.

January 21 -

The Credit Union National Association believes the NCUA has not moved quickly enough to grant an 18-month exam cycle to credit unions with $3 billion or less in assets.

September 13 -

Before the passage of the recent regulatory relief law, only banks with assets of less than $1 billion were on an 18-month exam schedule.

August 23 -

The Office of the Comptroller of the Currency is eliminating a plan designed to ensure its examiners did not get too close to the big banks they supervise.

December 6 -

A Federal Reserve proposal acknowledges that good board governance results from directors being credible overseers of strategy instead of a redundant form of management.

September 1 SMAART.Consulting

SMAART.Consulting -

Four key areas examiners will be looking at related to the new rule that CUs should brush up on today.

June 20 nCino

nCino -

Violations of Bank Secrecy Act and anti-money-laundering compliance remain a hot topic for financial institutions as regulators can bar them from branch building and bank acquisitions. Here are some notable regulatory actions that are still unresolved.

January 13