-

Nearly a third of NBT Bancorp's revenue comes from fee businesses, though it took patience, several acquisitions and a tolerance for added regulation to get there.

April 23 -

The Cleveland company's acquisition of a boutique investment banking firm contributed to an increase in its fee income.

April 19 -

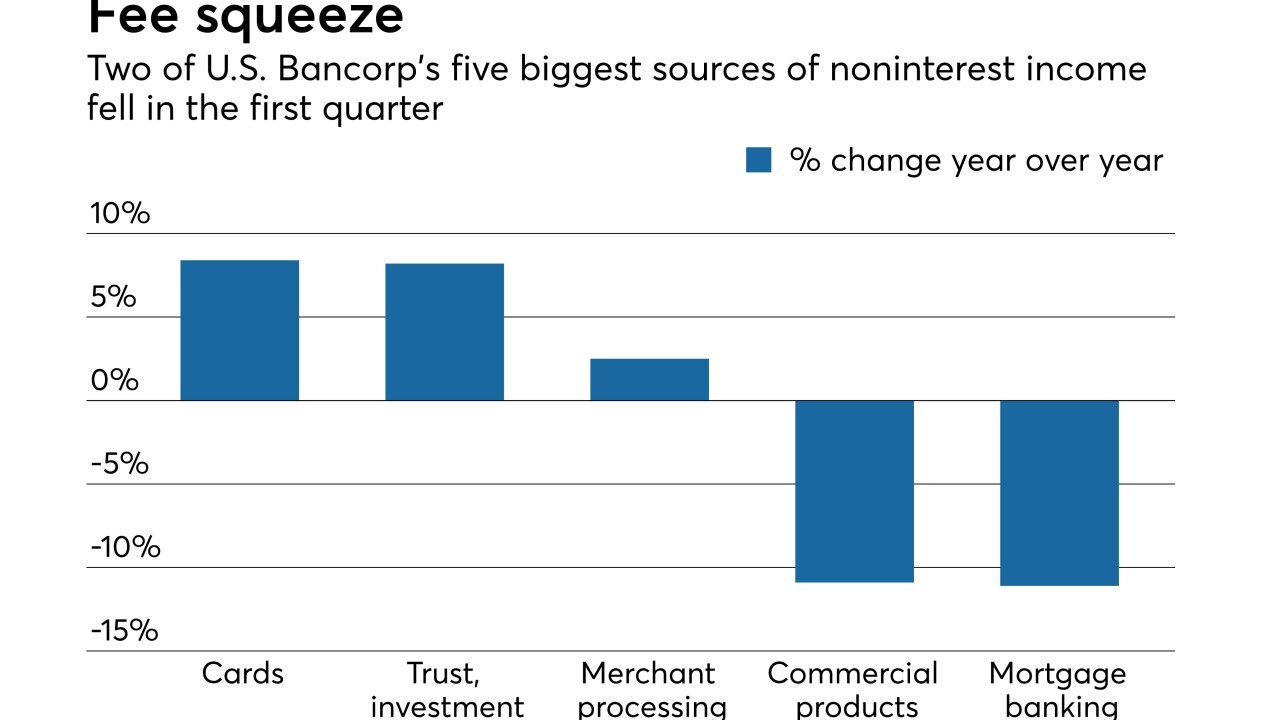

A sharp decline in capital markets fees at the Minneapolis company shows tepid loan growth is not the only side effect of tax reform at banks. How hard will it be to bounce back?

April 18 -

Quarterly earnings at the Minneapolis company were boosted instead by a wider net interest margin and a lower tax rate.

April 18 -

The deal for Retirement Plan Services, which provides recordkeeping for employers nationally, is NBT's fourth acquisition of a retirement services firm since 2015.

April 6 -

The San Diego company said the deal will bring in low-cost deposits and create a new source of fee income.

April 5 -

Rep. Maxine Waters, D-Calif., questioned Bank of America's decision to discontinue free online checking accounts used by many low-income consumers in light of the bank's recent profits and corporate tax cuts.

April 4 -

The Portland, Ore., company has hired four private bankers from City National as part of a broader effort to provide a full range of services to business owners and high-net-worth households in Orange County and San Diego.

March 22 -

The major prepaid card issuer agreed to the penalty to settle allegations that it had charged higher fees than what was disclosed to customers.

March 7 -

There are ways to add revenue without ruffling features, behavioral economist Wei Ke explains.

March 1