-

The Consumer Financial Protection Bureau's outline for upcoming regulations reflects the efforts of Director Rohit Chopra to reduce credit card late fees and overdraft fees.

January 6 -

Entrepreneurs often call fees a drawback of their current financial institution, according to research from Arizent. Banks should focus on developing long-term relationships with these customers, rather than charging for every service, experts say.

November 25 -

The Providence, Rhode Island, bank expects to finalize its purchase of 80 HSBC Bank branches on Friday and complete a systems conversion over the weekend. Its pending deal for Investors Bancorp is on track to go through early next quarter, Chief Financial Officer John Woods said.

February 18 -

Consumer advocates have long wanted to restrict banks' ability to collect overdraft fees. The Empire State's new law represents a small but consequential breakthrough as they push for nationwide reform.

August 26 -

The sale to the Florida-based insurer Brown & Brown would give Berkshire Hills Bancorp an infusion of capital that it intends to invest in more profitable businesses, executives said.

August 25 -

Signed Thursday by Gov. Andrew Cuomo, the new law requires state-chartered banks to pay checks in the order they are received or from smallest to largest. The bill comes as banks nationally are revamping their overdraft policies.

August 19 -

The Rhode Island company has been snapping up banks and nonbanks alike. It says that buying Willamette Management Associates in Oregon will augment its 2017 purchase of Western Reserve Partners.

August 5 -

The best performers in our annual ranking of banks with $10 billion to $50 billion of assets benefited from a big lending push. But like their peers, the top 10 as a group saw their profitability slip last year compared with 2019.

July 23 -

The Pittsburgh company offset relatively flat revenue and lending in the second quarter with strong service charges, wealth management fees and a $1.1 million reserve release.

July 20 -

The Rhode Island bank endured a sharp decline in fee income from home loans, which had spiked earlier in the pandemic. But CEO Bruce Van Saun says the company is well positioned as the refinancing boom fades and the home purchase market becomes more important.

July 20 -

The bank is planning to make product changes and roll out new digital tools that will allow customers to avoid the charges, according to CEO Kevin Blair.

July 20 -

BNY Mellon and State Street have been granting millions of dollars in discounts to ensure investors in money market mutual funds stay in the black. Recent moves by the Fed are expected to relieve the pressure.

July 19 -

Mortgages and wealth management generated fees that gave top midtiers an edge, as the pandemic halted most lending outside of the Paycheck Protection Program.

July 19 -

A strong showing by the North Carolina bank’s insurance arm helped to overcome lower interest rates and sluggish lending in the second quarter.

July 15 -

PNC, Regions and TD are among the banks that have taken steps to reduce their reliance on charges that disproportionately hit consumers living paycheck to paycheck. The changes come at a time when the Biden administration is expected to take a tougher stance on overdrafts.

July 13 -

Executives at Citizens Financial and Regions Financial said they plan to make policy changes that will reduce their reliance on the controversial but already dwindling charges.

June 15 -

Ally and Huntington are the latest banks to take steps that will reduce revenue from customers who spend money they don’t have. The moves come at a time when technological, regulatory and social forces are converging to encourage change.

June 3 -

The online bank's decision to stop charging the fees is part of a broader reassessment across the industry. Ally had waived overdraft fees early in the pandemic and has historically been less reliant on them than many other institutions.

June 2 -

With rock-bottom rates suppressing interest income, some buyers are looking beyond traditional M&A and striking deals for asset managers, insurance firms and other businesses that generate the bulk of their revenue from fees.

May 25 -

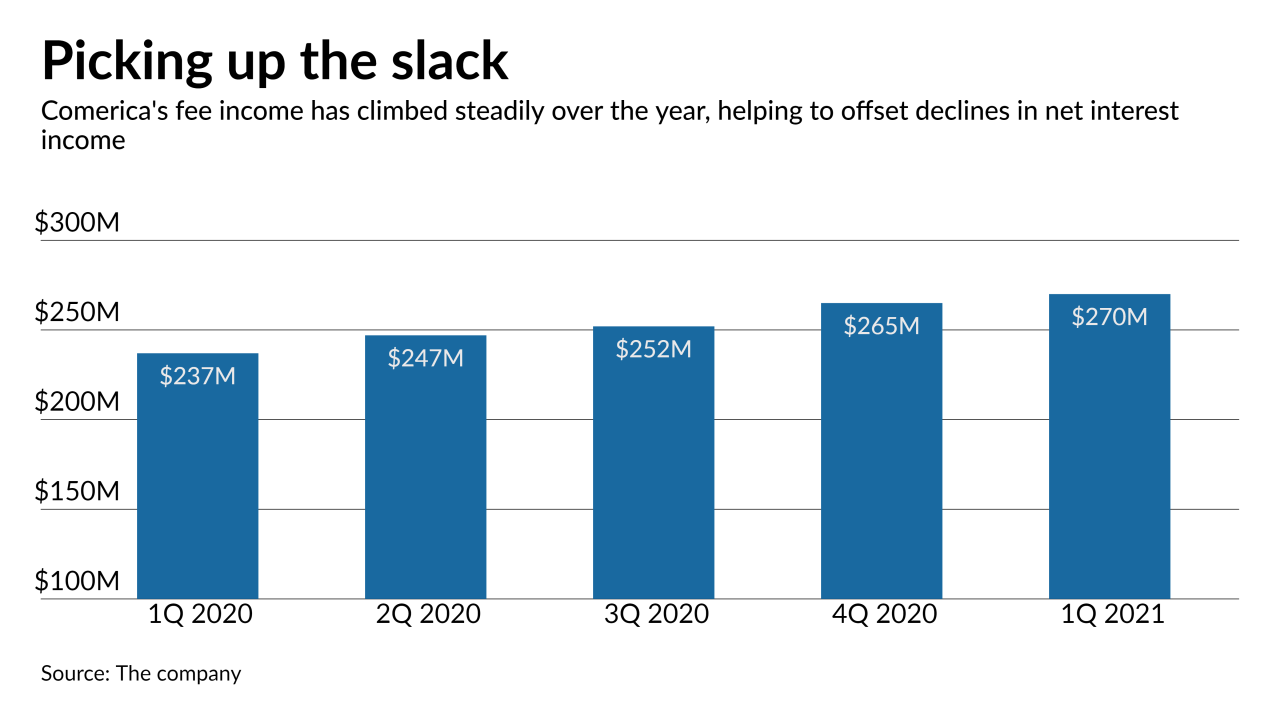

At Comerica and Synovus, higher fees from cards, mortgage banking and other sources helped to offset declines in net interest income.

April 20