-

One criticism of the CARES Act is that it provides relief only to borrowers with government-backed loans. Bills in New York and California would cover the remaining 30% of homeowners.

June 4 -

The measure, which garnered near-unanimous support, would triple the period during which businesses can spend their coronavirus relief funds and make it easier for loans to be forgiven.

May 28 -

In some cases, financial institutions are required by court order to divert funds to private creditors. But the industry has added its voice to a consensus for a legislative update to ensure Americans receive their full amount.

April 16 -

The third credit union-related bill introduced this week would cut credit unions’ annual required board meetings to just six times per year.

February 26 -

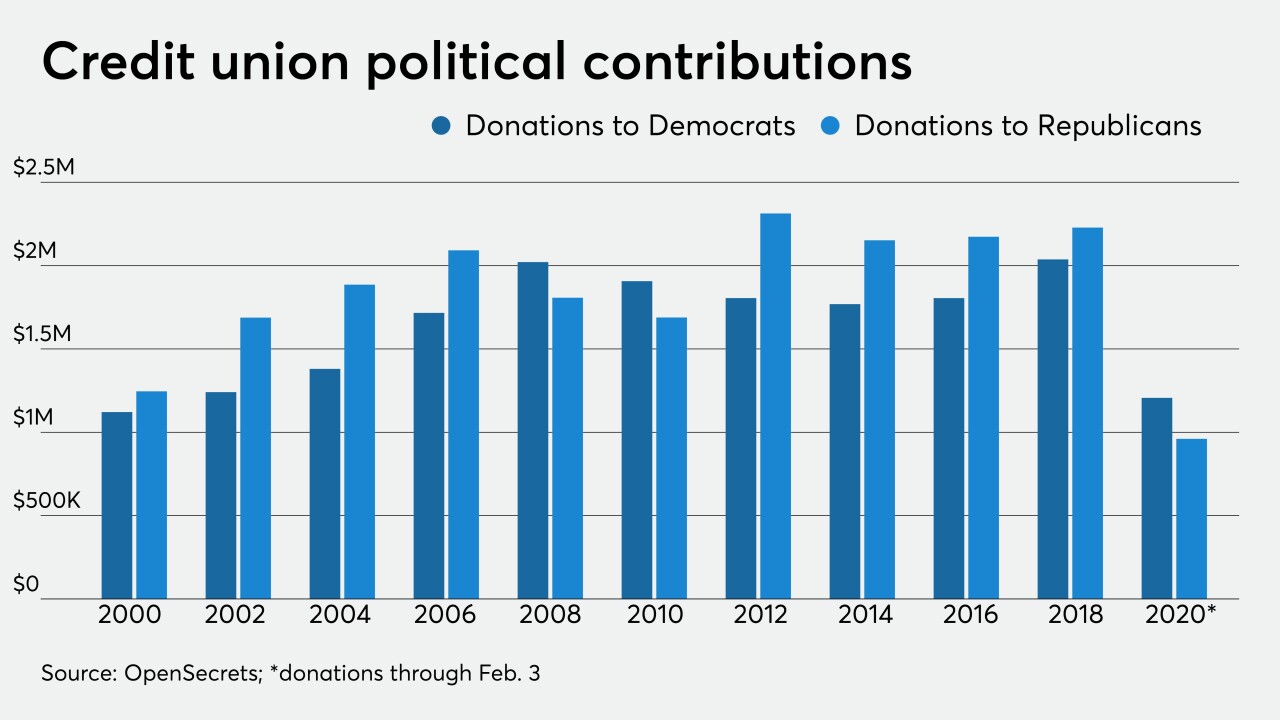

The industry loves to tout its bipartisanship, but it has very publicly embraced the Trump administration at times.

February 24 -

Lawmakers advanced legislation that would require financial regulators to give annual testimony to lawmakers and would mandate regular reports on cybersecurity efforts.

January 14 -

Lawmakers advanced legislation that would require banking regulators to give annual testimony to lawmakers and would mandate regular reports on cybersecurity efforts.

January 14 -

The Department of Business Oversight said TitleMax charged consumers fees to push loan amounts above the threshold at which the state's rate cap applies.

December 16 -

Chairman Jelena McWilliams previewed a proposal to update the agency’s definition of brokered funds, but also suggested steps lawmakers could take to improve the rule’s underlying statute.

December 11 -

With 2019 winding to a close, regulators and members of Congress are working to wrap up key items for credit unions before the end of the year.

December 9