One criticism of a federal law granting forbearance to homeowners affected by the coronavirus pandemic was it only applied to government-backed loans. Two states are aiming to cover the rest of the mortgage sphere.

Industry experts say bills in New York and California could be the impetus for other states to provide necessary relief for the 30% of the mortgage market not backed by Uncle Sam.

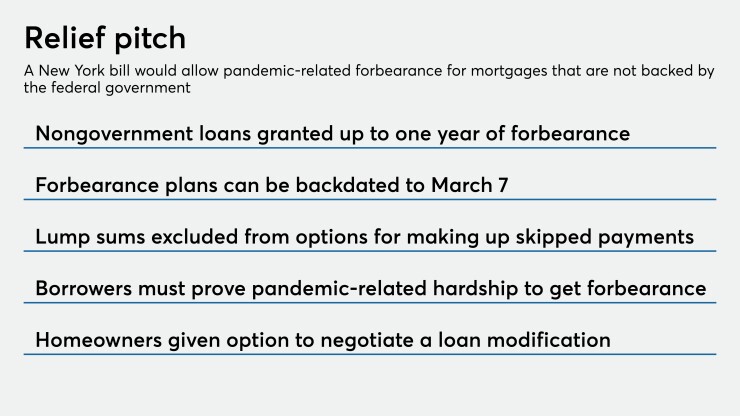

Lawmakers in both states want to enable homeowners with non-government loans to obtain forbearance for up to a year and to prohibit servicers of such loans from charging lump-sum payments right after the forbearance ends.

“I would expect similar legislation by states to ensure customers are receiving forbearance relief, no matter who holds or services their mortgage," said Allison Schoenthal, a partner and head of consumer finance litigation at Hogan Lovells.

In March, Congress passed the Coronavirus Aid, Relief, and Economic Security Act, which provided 180 days of forbearance and another 180 days, if needed, to struggling borrowers while waiving late fees and additional interest. But that relief only applied to loans backed by Fannie Mae, Freddie Mac, the Federal Housing Administration and other smaller agencies.

Meanwhile, whereas the CARES Act largely left it up to agencies such as the Federal Housing Finance Agency and FHA to instruct servicers on how they can collect payments post-forbearance, the New York and California bills more clearly restrict mortgage servicers and state-chartered banks from collecting payments immediately.

The bills in New York and California provide up to a year of forbearance to non-government-backed jumbo loans, loans held in portfolio on bank balance sheets, and loans packaged into private-label securitizations.

"We do think this bill will serve as a model for what the federal government and other states may do if they want to make homeowners whole," said New York state Sen. Brian Kavanagh, the bill's Democratic sponsor who represents Manhattan's Lower East Side. "We want to give the borrower options and this makes it clear that the payments are not due in full immediately at the end of the forbearance, so they have options."

Many large banks and credit unions that hold loans on balance sheet have voluntarily offered forbearance to borrowers but typically only for three months. Both bills would establish forbearance up to six months if a borrower can prove a pandemic-related hardship and offer another six-month extension.

The

The CARES Act left it unclear whether borrowers would have to make skipped payments immediately after a forbearance period ends; instead agencies like the FHFA and FHA

But Kavanagh said borrowers need stronger protection from being hit with huge payments after the emergency public health orders are lifted.

"These are New York state's first steps toward addressing the economic crisis from the perspective of people’s homes," Kavanagh said.

Kavanagh acknowledged that the New York bill could further exacerbate liquidity issues for some small banks and nonbank servicers, which cannot survive if they have to make payments for up to a year on behalf of borrowers.

An amendment was added to allow servicers and state-chartered banks with liquidity issues to refrain from giving forbearance relief provided they notify New York's Department of Financial Services to provide details of their own hardship.

The California bill also offers a carve-out whereby state-regulated entities can ask for an exemption from the Department of Business Oversight if investor requirements prohibit extending forbearance.

On Thursday, the Consumer Financial Protection Bureau and the Conference of State Bank Supervisors attempted to provide more clarity on the procedures for granting forbearance under the CARES Act. They issued joint guidance that servicers of federally backed mortgages must grant forbearance to borrowers with pandemic-related hardships that may last up to a year. The CFPB said mortgage servicers could violate the law if they require documentation from borrowers to prove financial hardship, if they did not grant the forbearance once properly requested, or if they steered borrowers away from forbearance or misled them.

The New York bill provides three options for borrowers to repay skipped payments: by extending them over the life of the loan, by extending the loan’s term, or by paying a balloon payment at maturity or when the loan is refinanced or the home is sold.

Both bills exempt federally backed loans covered by the CARES Act.

Yet the state bills could face legal challenges over whether they seek to require forbearance and restrict repayment plan options for federally chartered servicers in addition to state-chartered financial institutions, observers said.

Some suggest that it's an open legal question whether states can require federally regulated companies to offer a specific type of mortgage relief.

“There is a lot of confusion about the CARES Act,” Schoenthal said. “With a few [state bills] percolating, I do wonder if they will be challenged as unconstitutional in violation of the contracts clause and the takings clause — a key component of a mortgage contract — and if they are going to be effective.”

Yet the relief offered to consumers in the state bills is more restrictive than the CARES Act in one key area.

Some mortgage experts have said Congress erred in providing such a lengthy forbearance period to homeowners without any requirement to prove hardship, which puts an undue burden on some institutions. But the New York and California bills put some onus on borrowers to demonstrate a need.

"The problem with the CARES Act is it allows anybody with a federally backed loan to get a forbearance so there’s no proof of hardship, it's just giving a free hall pass," said Dave Stevens, chief executive of Mountain Lake Consulting and a former FHA commissioner in the Obama administration.

In just over two months more than 4.2 million homeowners have received forbearance relief, according to the Mortgage Bankers Association.

The New York bill initially sought to cancel all interest payments on home loans for the term of the forbearance, but subsequent changes amended that language to avoid an interest waiver.

"While we remain concerned about states creating separate and unaligned forbearance frameworks, we appreciate the amendments that defer to compliance with the CARES Act ... and agency forbearance standards, as well as the removal of the interest waiver provisions,” said Pete Mills, the MBA's senior vice president of residential policy and member services.