-

The San Francisco bank's interest expenses continue to rise as depositors switch to higher-yielding options. At the same time, soft loan demand from business customers is putting a lid on how much interest Wells is collecting from borrowers.

July 12 -

The New York-based company saw assets under custody and management jump, driving strong increases in both fees and overall revenues for the quarter ending June 30.

July 12 -

Evergreen Money offers affluent savers both high returns and ready access to their money. The startup's founder, former PayPal CEO Bill Harris, says that increased regulatory scrutiny of bank-fintech partnerships is a positive development.

July 11 -

Higher funding costs, lower loan demand and the potential for increased credit costs continue to drag on the sector heading into second-quarter earnings season.

July 11 -

In this month's roundup of top banking news: a cease-and-desist issued by the Federal Reserve, high CFO turnover, the end of Chevron deference and more.

July 3 -

First Foundation will use the large investment to shrink its multifamily loan portfolio, which has weighed down its earnings since interest rates began rising.

July 2 -

The Council of Federal Home Loan Banks executive shares his thoughts on a particularly active period for advances, and system reviews with a lot riding on them.

July 2 -

With the Federal Reserve holding interest rates at elevated levels through the first half of the year, analysts are sharpening their collective focus on possible fallout from high deposit and borrowing costs.

July 2 -

Two days after the Fed released the results of its annual stress tests, the nation's eight largest banks all announced plans to supplement their payouts to shareholders. At the same time, most of the banks also said that their capital requirements are expected to rise.

June 28 -

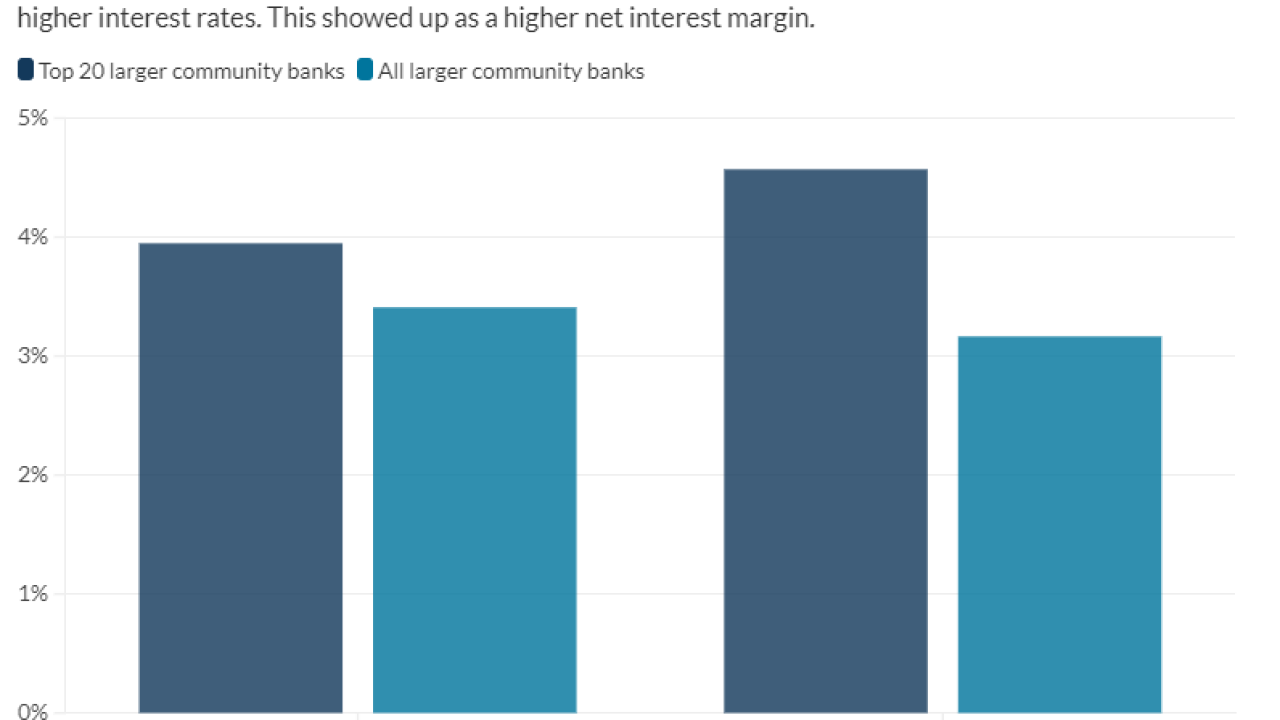

The best-performing larger Main Street Banks, those in the $2 billion to $10 billion asset class, were asset sensitive, a position that worked to their advantage as rates continued to climb in 2023.

June 23 -

Publicly traded companies are showing signs of improvement, but it may take some time until venture capital funding for fintechs recovers.

June 20 -

Due to retirement, burnout, heightened regulatory standards and profitability challenges, lots of lenders are looking for new chief financial officers. The wave of departures is giving banks a chance to bring in more highly skilled finance chiefs.

June 16 -

Investors homed in on the benefits of positive economic data for lenders, rather than the possibility of a strong job market delaying interest rate cuts that would help to lower deposit costs and boost credit demand.

June 10 -

Though hard times put a dent in profitability, asset quality and net interest margin continued to shine among the list of the best performing publicly traded community banks.

June 9 -

-

The beleaguered Los Angeles-based bank reported its strongest quarterly results in more than a year, but executives at its Canadian parent company cautioned that improvements may not be linear.

May 30 -

The Toronto-based company's U.S. banking segment continues to face headwinds from muted loan growth and higher deposit pricing. Net income for the division tumbled by more than 25% last quarter.

May 29 -

Executives at the Toronto-based bank said last year that they planned to add 150 branches in the United States. But when pressed on Thursday, they could not say how much they'll scale back their ambitions due to investigations over TD's anti-money laundering practices.

May 23 -

Irvine-based CBC Bancorp's $121 million deal for Bay Community Bancorp in Oakland stands out at a time when high rates have put a damper on both the number of deals taking place and the multiples sellers are paying.

May 21 -

The Federal Housing Administration also instituted a new language preference requirement that servicers must observe in transfers.

May 20