-

Trump-appointed regulators are making headway on easing regulations. But there's one critical voice missing.

May 4 -

The class-action lawsuit filed by investors alleged that bank executives deliberately failed to disclose the full nature of its cross-selling practices to shareholders.

May 4 -

Bankers have long complained that anti-money-laundering regulations impose an extra burden without really stopping major crime. D.C. is finally listening.

May 4 -

Costs rose at the global bank, profit in North America fell 16% and questions are mounting for new CEO John Flint ahead of the release of his strategic plan.

May 4 -

A new strain of malware that targets cryptocurrency users — but not users of mainstream payment options like bank accounts — highlights how much the cybercrime game is changing behind the scenes.

May 4 -

Attorneys for then-President Robert Harra said he is innocent and will file an appeal. The case centers on a scheme said to have been carried out during the crisis years, before the bank was sold to M&T.

May 3 -

Bankers have long complained that anti-money-laundering regulations impose an extra burden without really stopping major crime. D.C. is finally listening.

May 3 -

Prometheum wants to win the SEC’s approval of its own token offering, paving the way for others shortly afterward.

May 2 -

The Federal Savings Bank has been under a spotlight since it was revealed that it provided $16 million in mortgages to onetime Trump campaign manager Paul Manafort.

May 1 -

The National Credit Union Administration has banned seven former credit union employees from participating in the affairs of any federally insured financial institution.

April 30 -

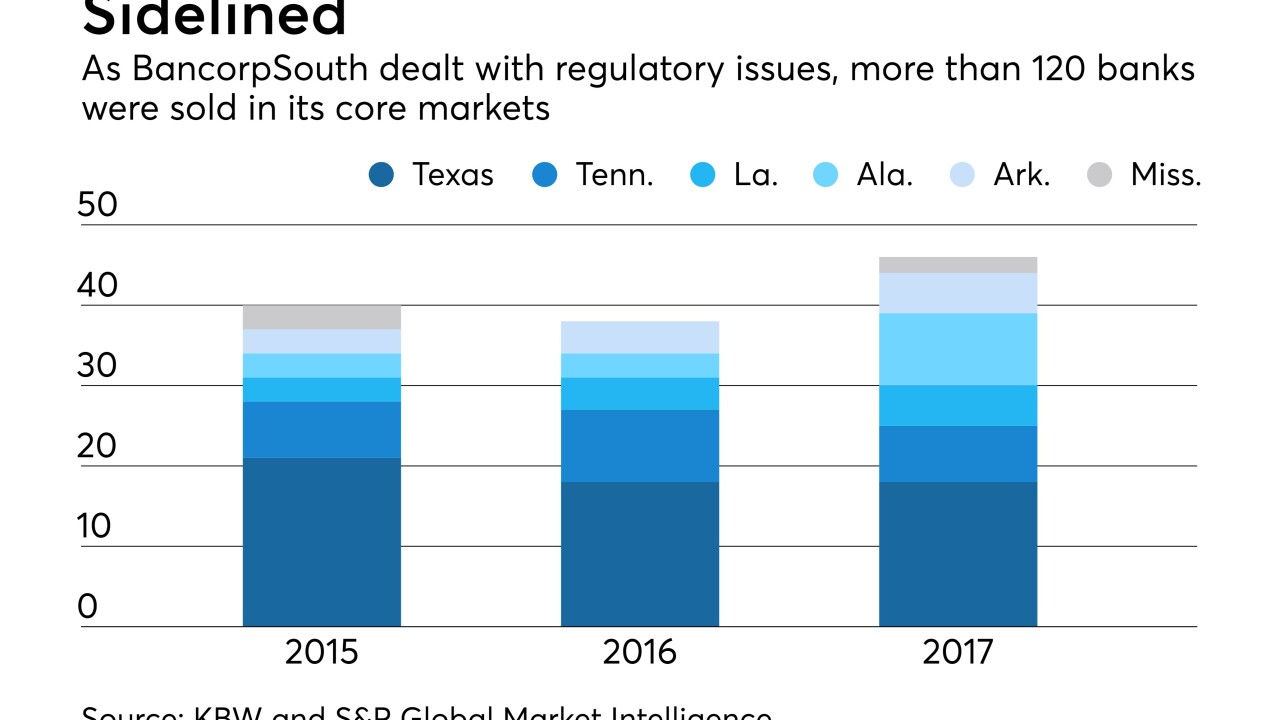

Dan Rollins engineered nearly a dozen deals while at Prosperity Bank. Now CEO at BancorpSouth, he has returned to M&A after spending four frustrating years dealing with compliance issues.

April 26 -

When regulators recognize ICOs as securities offerings, they will likely require issuers to fully comply with standard Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, increasing compliance pressure, according to Ron Teicher, CEO of EverCompliant.

April 25 EverCompliant

EverCompliant -

CEO Tim Sloan and board chair Elizabeth Duke fielded tough questions Tuesday on everything from the embattled bank’s culture to its ties to the private prison industry.

April 24 -

A federal grand jury in Charlotte, N.C., has indicted a former credit union CEO with fraud in connection with the U.S. government's Troubled Asset Relief Program.

April 20 -

Comptroller of the Currency Joseph Otting took office only late last year, but he is wasting little time in tackling a series of hot-button topics, including easing anti-money laundering regulations and lowering national bank fees.

April 15 -

Reps. Elijah Cummings and Stephen Lynch sought records related to a banker's communications with former Trump campaign manager Paul Manafort and the Trump campaign, and about his bank's loans to Manafort.

April 12 -

The Seattle bank's improved loan yields offset higher expenses tied to Bank Secrecy Act remediation. Washington Federal had to delay a pending acquisition after issues emerged with its anti-money-laundering compliance.

April 11 -

The comptroller said he is looking to capitalize on the industry's strong profits and high capital reserves to reduce costs and lower exam fees next year.

April 10 -

British banks that deal with the Russian oligarchs and companies on a new American sanctions list will face "consequences," according to a senior U.S. Treasury official.

April 10 -

Comptroller of the Currency Joseph Otting laid out an ambitious regulatory reform agenda Monday, telling a group of community bankers that he is committed to CRA upgrades, new flexibility in BSA compliance and other measures.

April 9