-

Toronto-Dominion Bank has taken an initial provision of $450 million in connection with U.S. investigations into its anti-money-laundering practices and said it expects additional penalties to come.

April 30 -

Banks reported nearly $27 billion had been tied up in scams or theft against elderly people in a recent 12-month period, according to a report from the U.S. Treasury.

April 22 -

With financial crime surging worldwide, it is critical that the public and private sectors align on a shared vision to collectively focus on combating bad actors and to eliminate their ability to launder the proceeds of criminal activity.

April 22

-

The collection of beneficial ownership data is vital to fighting money laundering. It should be more broadly accessible, and should cover more businesses.

April 11

-

A new report sheds light on the lack of player protections against scams and exploitive data collection practices of video game companies.

April 8 -

The steady drumbeat of consent orders against banks that offer banking as a service continues, with regulators telling banks to keep a closer eye on their fintech partners' compliance with the Bank Secrecy Act and money laundering rules.

March 29 -

A month after the collapse of FTX, federal prosecutors filed eight charges against crypto mogul Sam Bankman-Fried. Four of them involved wire fraud.

March 26 -

Wars in Ukraine and the Middle East. Fiercely polarized U.S. politics. Rapidly multiplying payments options on social media networks and elsewhere. Those factors and more are making it harder than ever for banks to combat illicit financial transactions.

March 25 -

Companies lose an estimated 5% of their revenue each year due to fraud, according to a report from the Association of Certified Fraud Examiners.

March 20 -

Prosecutors claim Dan Rotta, 77, hid more than $20 million from the IRS, using "pseudonyms, complicated corporate structures, and nominees" to conceal offshore assets and income.

March 13 -

-

The ruling further complicates an already complicated area — the law's mandate around beneficial ownership information reporting.

March 5 -

Banco San Juan Internacional is suing the Federal Reserve Bank of New York and the Board of Governors in Washington claiming they wrongfully terminated its access to the federal payments system.

March 4 -

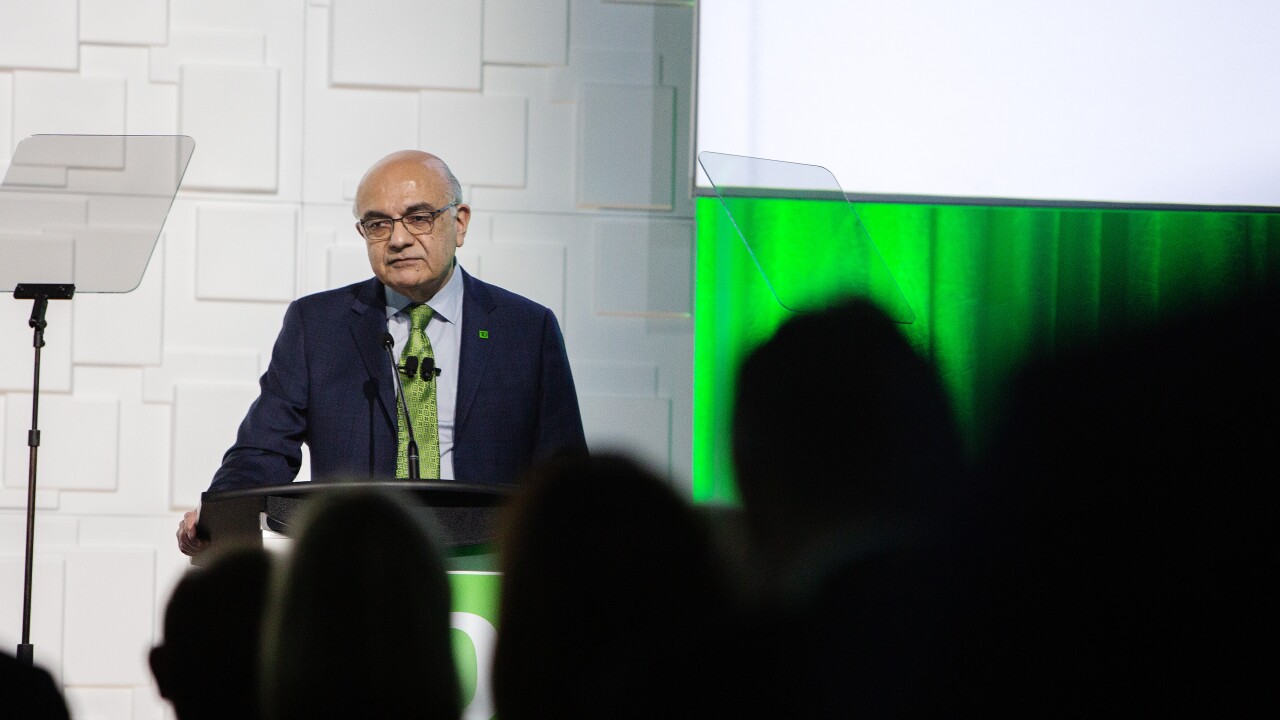

The Toronto bank has been under investigation by U.S. and Canadian supervisors for alleged shortcomings in anti-money-laundering compliance. CEO Bharat Masrani pledged "comprehensive enhancements" but declined to pinpoint the exact fixes and their costs.

February 29 -

According to a new study, pig-butchering scammers have likely stolen more than $75 billion from victims around the world.

February 29 -

Bharat Masrani has spent a decade as the Canadian bank's top executive and is pushing 70. But as the bank undergoes a U.S. Justice Department probe, it's unclear when he'll step down or who's next in line.

February 27 -

The Financial Crimes Enforcement Network Tuesday proposed a rule to include investment advisors in the compliance regime under the Bank Secrecy Act, aiming to close regulatory gaps exploited by criminals.

February 13 -

Federal prosecutors allege that Shan Hanes, the former CEO of the now defunct Heartland Tri-State Bank, illegally took money from customers to fund cryptocurrency investments. He could face up to 30 years in prison if convicted.

February 8 -

The Treasury Department's Financial Crimes Enforcement Network fined a New York credit union employee $100,000 Wednesday in connection with a scheme to launder $1 billion using armored trucks and the credit union's Fed master account.

February 1 -

January is Human Trafficking Prevention Month, and the financial services industry should take the opportunity to step up for survivors.

January 22 Moore & Van Allen

Moore & Van Allen