-

President Trump is expected to announce his Fed chair nominee this week; three deals earned JPM's boss almost $100 million.

October 30 -

Investors Bancorp in Short Hills, N.J., chased deposits in the third quarter in a move that drove up interest expenses and lowered profits.

October 27 -

The accord is the latest development in investigations by governments across the globe into banks’ manipulation of benchmark interest rates.

October 25 -

As many as a dozen financial institutions are deploying IBM’s Watson to search for signs of employee misconduct so they can avoid a Wells Fargo-size scandal. But the legal and technical limits of its use are major issues.

October 16 -

Wilmington Trust and some of its executives had been accused of intentionally understating past-due loans in 2009 and 2010.

October 11 -

The bank plans to contact all customers who paid fees for rate lock extensions during a three-and-a-half-year period and to refund any who believe they should not have been charged.

October 4 -

Ocwen Financial reached a settlement with 10 states under which it can't acquire servicing rights for eight months but will not face any financial penalties.

September 29 -

Both former credit union employees are prohibited from participating in the affairs of any federally insured financial institution.

September 29 -

Washington Federal is the latest bank to pull an application after being flagged for insufficient Bank Secrecy Act compliance.

September 29 -

Ellen Patterson is one of just 21 TD employees with an EVP title globally and the only female EVP based in the United States.

September 25 -

First Green Bank in Florida started researching the business after its chairman saw how medical marijuana had helped his wife cope with a severe injury. The bank is now turning a profit a year after adding its first pot-related client -- and there could be lessons there for credit unions.

September 21 -

The Florida bank started researching the business after Ken LaRoe, its chairman, saw how medical marijuana had helped his wife cope with a severe injury. First Green is now turning a profit on this business a year after adding its first pot-related client.

September 21 -

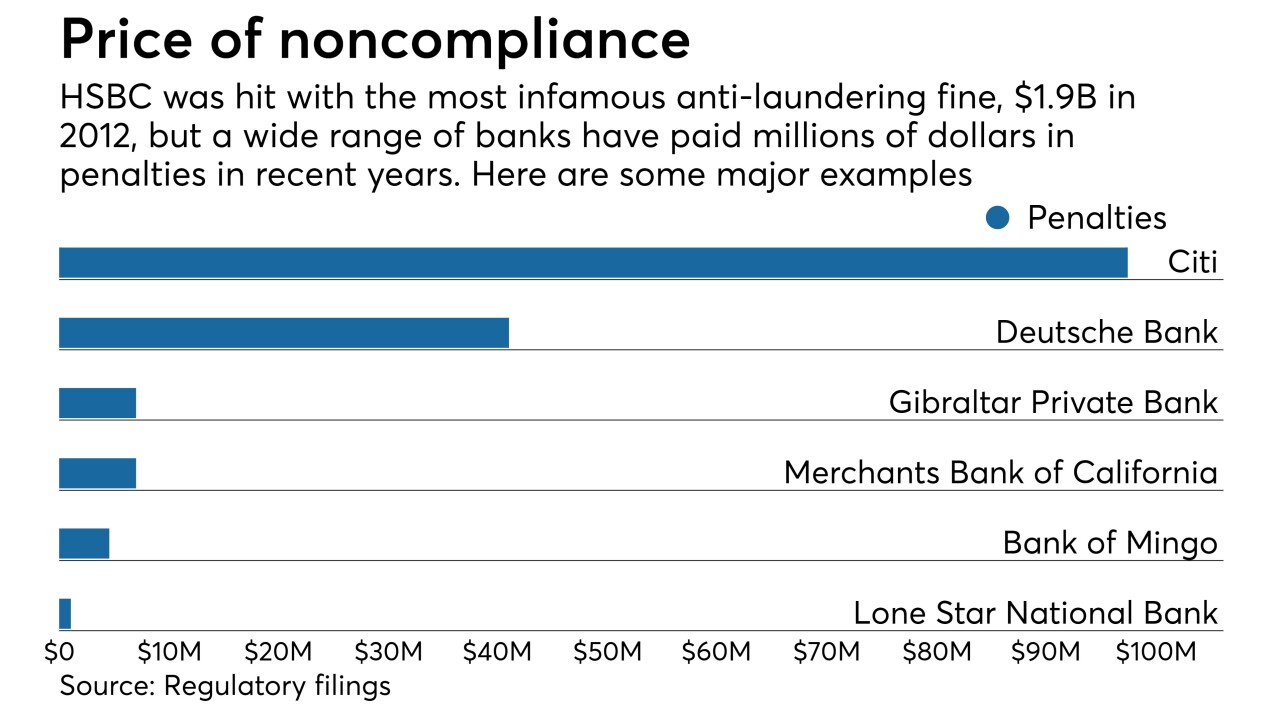

Unlike a visiting sports team, foreign banks can't just blame local referees they perceive as biased for penalties or fines.

September 21 IBM Global Business Services

IBM Global Business Services -

Armed heists are becoming less common, but the overall number of robbery attempts has ticked back up in recent years. The opioid epidemic is a likely reason, according to an industry expert.

September 19 -

By replacing human judgment with other identity technologies, higher levels of verification accuracy can be achieved in a fraction of the time, writes Romana Sachová, co-chair of the Security and Biometrics Workgroup at Mobey Forum.

September 14 Mobey Forum

Mobey Forum -

Credit bureau says records of 143 million consumers were compromised; state agency penalizes Habib Bank for enabling terror financing.

September 8 -

New York’s banking regulator ordered Habib Bank Ltd. to pay $225 million and surrender its license to operate in the state, effectively removing Pakistan’s largest lender from the U.S. financial system.

September 7 -

Husband and wife claim they were fired for raising concerns about the bank’s sales practices; commercial mortgage-backed securities on pace to top last year’s volume.

September 6 -

Nothing like revelations of a client’s Ponzi scheme that lead to your bank paying $4 million in anti-money-laundering fines. That’s what happened at Gibraltar Private Bank & Trust, but its CEO argues its compliance overhaul has given the bank a competitive advantage in cosmopolitan New York and South Florida.

September 5 -

The 3-year-old order was related to Discover Bank’s programs for combating money laundering. A related agreement with the Federal Reserve Bank of Chicago remains in effect.

August 30