-

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

March 3 -

On Sep. 30, 2019. Dollars in thousands.

March 2 -

On Sep. 30, 2019. Dollars in thousands.

March 2 -

On Sep. 30, 2019. Dollars in thousands.

March 2 -

An effort by the Federal Housing Finance Agency to examine membership rules for the Federal Home Loan Bank System is reigniting an argument over whether to allow more nonbanks in or impose tougher barriers.

March 1 -

The Massachusetts senator and presidential candidate sent a letter to CEOs of five of the largest U.S. banks asking about their response to the outbreak.

February 28 -

As the COVID-19 virus spreads globally, many U.S. financial institutions are said to be taking steps to protect employees and minimize disruption. But only a handful are sharing specifics, to avoid contributing to any public panic.

February 26 -

The technology can quickly sift through and analyze contracts, nondisclosure agreements and other legal documents, says InCloudCounsel's Troy Pospisil.

February 26 InCloudCounsel

InCloudCounsel -

Giving more Community Reinvestment Act credit to such partnerships will help low-income communities, despite industry concerns.

February 25 Clearinghouse CDFI

Clearinghouse CDFI -

Organizers of Gulf Atlantic Bank must raise $12 million in capital before opening.

February 25 -

The agency plans to conduct a review of how it regulates the 11 Federal Home Loan banks amid concerns that some companies are inappropriately seeking a back door into the Home Loan Bank System.

February 24 -

The author of a recent op-ed fails to realize that making credit unions pay corporate taxes would drive up costs for customers and weaken the economy.

February 24 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

The game has changed and bank executives will have to do more homework before striking a deal.

February 19 CCG Catalyst

CCG Catalyst -

Long-term success in the adoption of cloud technology requires a focus and integration of cloud within the broader business transformation plan, says Unisys' Maria Allen.

February 18 Unisys

Unisys -

Wells Fargo appears to be outpacing its rivals in the API race; CFPB's unexpected showdown with Citizens; Varo gets vital FDIC OK for bank charter; and more from this week's most-read stories.

February 14 -

The tight labor market and public pressure to raise minimum wages are expected to nudge noninterest expenses upward in a year when the watchword is cost control.

February 13 -

Broadway Financial prefers a small balance sheet and loans to real estate investors that offer affordable housing. Capital Corps and its founder, Steven Sugarman, want the bank to expand by making more loans directly to low- and moderate-income borrowers.

February 13 -

Congress should further expand a tiered regulatory system to help community banks better serve local neighborhoods.

February 13

-

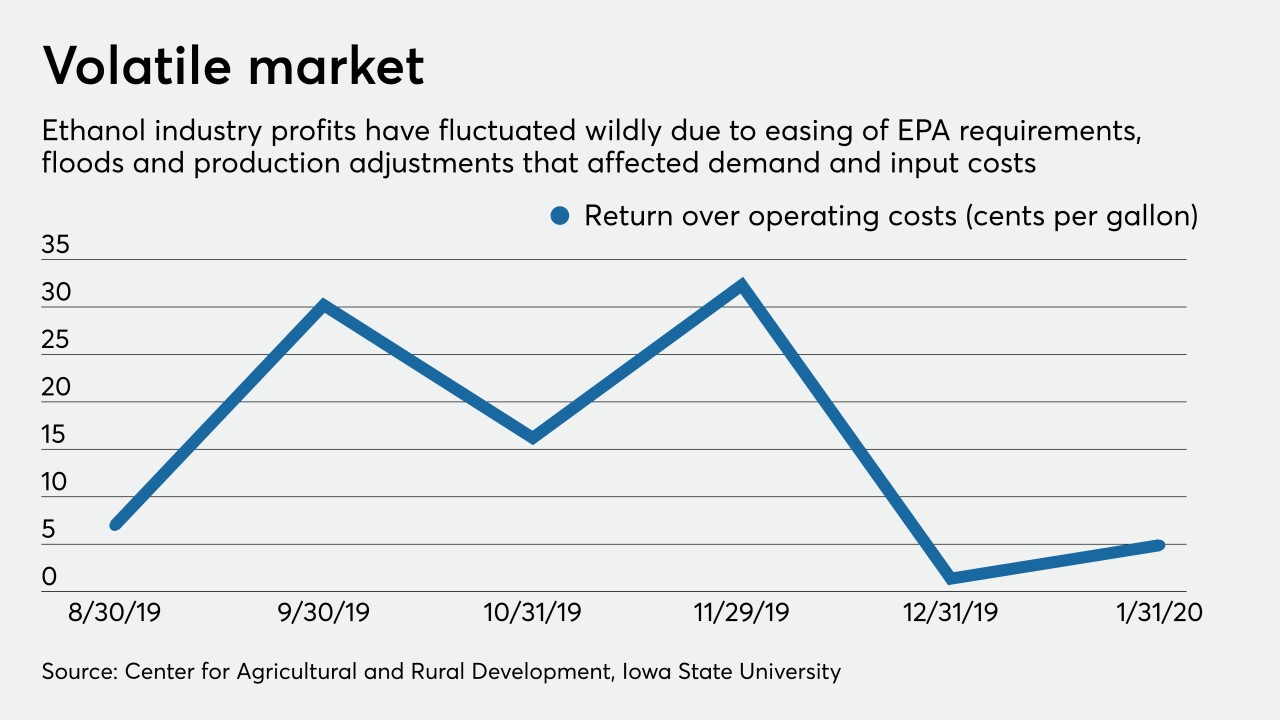

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

By pooling fraud data and making it accessible in real time, FIs can scan check deposits to identify fraudulent checks before a loss occurs, says Advanced Fraud Solutions' Ted Kirk.

February 11 Advanced Fraud Solutions

Advanced Fraud Solutions