-

Named interim CEO in August, Noel Quinn now appears to be the front-runner to lead the global bank's next turnaround.

December 11 -

The Rakuten application has piqued interest in reviving legislation aimed at stopping commercial firms from owning banks. Yet Congress previously had the chance to enact such a measure and declined.

December 10 -

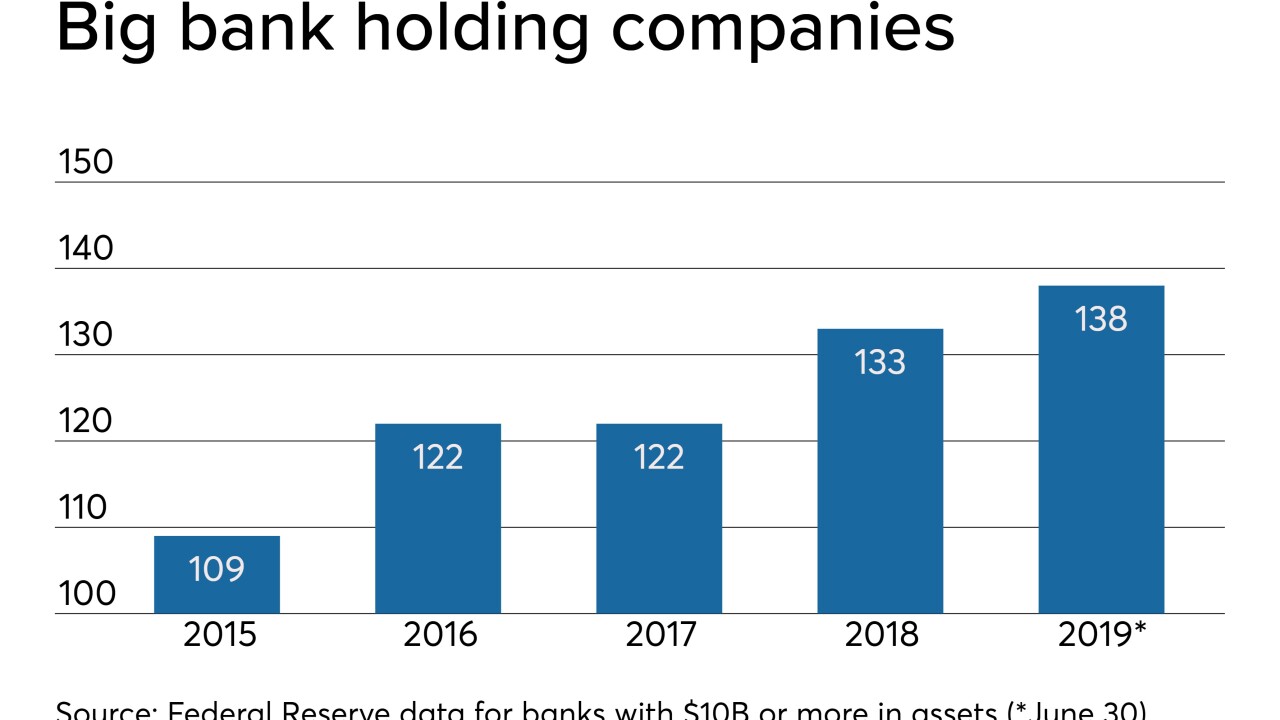

Several banks abandoned their BHCs two years ago to cut costs and reduce regulatory burden. But the strategy never really took hold as most bankers determined there were more benefits to having holding companies than eliminating them.

December 10 -

Brendan Coughlin will succeed Brad Conner as head of consumer banking, and Beth Johnson will be the bank's first chief experience officer.

December 10 -

BB&T and SunTrust showed that big-bank mergers are still possible, but top executives at other large regional banks say that a knee-jerk response would be a mistake.

December 10 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

The sale comes just three years after the San Francisco bank bought the platform.

December 9 -

Credit unions today regularly receive monies from the CDFI Fund, but it wasn't always that way. Here's a look back at the last quarter-century and the progres that still needs to be made.

December 9 Archer+Rosenthal

Archer+Rosenthal -

Cost cutting and systems integrations are short-term priorities, but over time CEO Kelly King and his heir apparent, Bill Rogers, will have to exploit the combined BB&T-SunTrust's revenue potential and prove the biggest post-crisis merger was a good idea.

December 9 -

The company will merge Fidelity Savings and Loan and Washington Savings Bank into its own bank.

December 7 -

A day after House Democrats urged the banking agencies to unite behind a joint plan to update the Community Reinvestment Act, Senate Democrats worried that an impending proposal from the OCC and FDIC will reduce access to credit.

December 5 -

A report from the Financial Stability Oversight Council cited a bigger share of originations and servicing by nonbanks as a potential vulnerability in the financial system.

December 4 -

Her comments signaled cooperation between the two agencies on a coming proposal to revamp the Community Reinvestment Act, but she raised questions about CRA assessment areas and developing a single compliance metric.

December 3 -

BB&T has said the outage, which blocked customers' account access for hours, cost it about $20 million.

December 3 -

These community development-focused banks need tailored regulations to expand their purpose in helping underserved areas.

December 3 Ludwig Advisors

Ludwig Advisors -

The company will enter three counties in its home state after it buys Roselle.

December 3 -

PiNG Bank, which would be based in Jersey City, is being proposed by former bankers at Cross River Bank, Citigroup and Bogota Savings Bank.

December 2 -

Once struggling to remain relevant, the Providence, R.I., bank is now an industry standout. Inside the story of its resurgence.

-

USAA won $200M from Wells Fargo in patent fight — will others be on the hook?; three takeaways from regulators' approval of the BB&T-SunTrust merger; don't believe the doom and gloom on Fannie, Freddie; and more from this week's most-read stories.

November 27