-

Municipal IDs help marginalized groups, such as undocumented immigrants, open checking accounts and become credit union members but concerns over regulatory compliance linger.

March 15 -

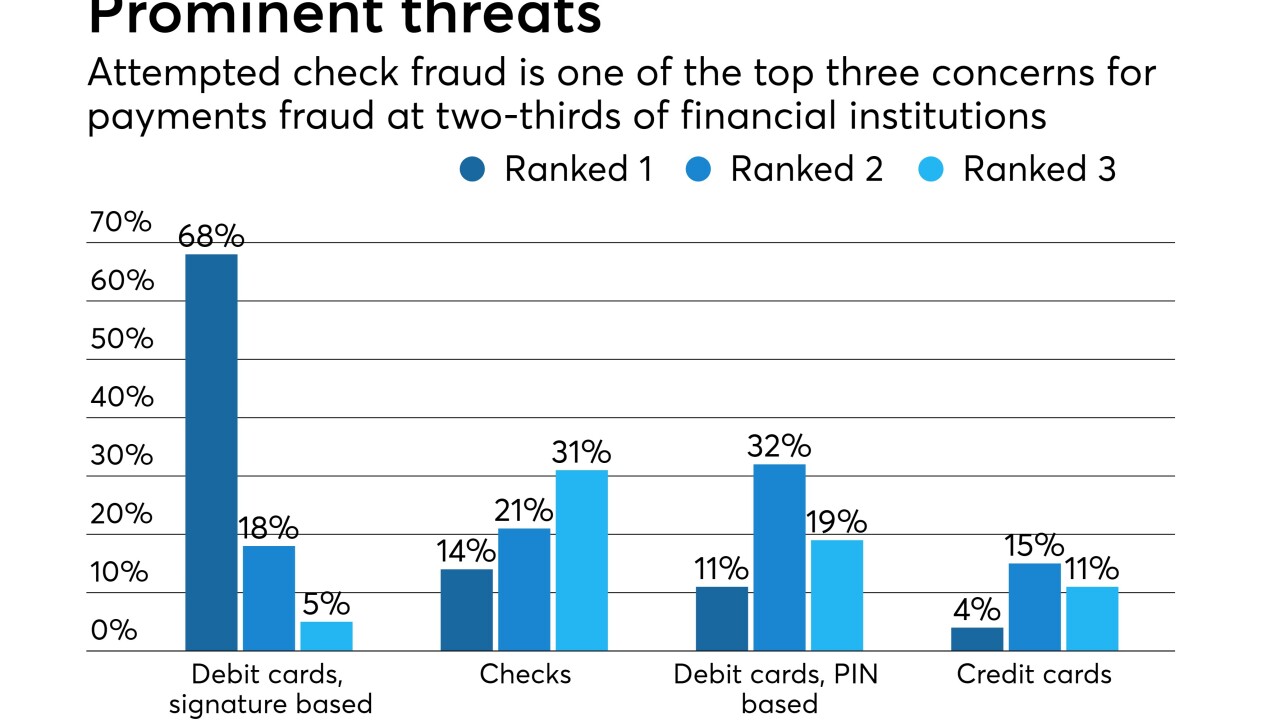

Merchants are often the last in the payments ecosystem to know when card fraud occurs, and their losses tend to escalate in the meantime.

March 13 -

Mastercard is bringing Ethoca—a fraud solution powered by collaboration between banks and merchants—in-house.

March 12 -

The past six years have been a whirlwind for King, who had no experience in the payments industry before becoming CEO of Featurespace, the fast-growing U.K. startup enabling banks to use machine-learning technology to block payment card fraud.

March 12 -

BrightWise is a joint venture among the Iowa CU League, its holding company and LMG Security. The initiative aims to teach credit union professionals how to better protect their institutions.

March 8 -

The California company could charge off $15 million because of allegedly fraudulent acts by an employee at one of its correspondent customers.

March 8 -

Criminals are inventing new ways to hide dirty money amid transactions for digital goods bought and sold on everything from Amazon to game-app sites. Banks need to wake up to the threat, says Ben Duranske, Facebook Payments' former compliance chief.

March 7 -

Criminals are inventing new ways to hide dirty money amid transactions for digital goods bought and sold on everything from Amazon to game-app sites. Banks need to wake up to the threat, says Ben Duranske, Facebook Payments' former compliance chief.

March 5 -

Credit unions must walk a fine line between making interactions for members as easy as possible while also providing robust protection against evolving cybersecurity threats.

February 28 IDology

IDology -

As large banks put stronger fraud monitoring and authentication technology in place, fraudsters have been turning to small banks, like Kennebunk Bank on the coast of Maine. Here's how it fought back.

February 21 -

Featurespace wants to expand its fraud-fighting tool beyond its core audience of banks and payment processors to cover transactions across a broader industry spectrum including retail, gaming and insurance.

January 31 -

Banks use anti-money-laundering and fraud systems to try to catch scams that prey on senior citizens. A few, including Wells Fargo, are working on artificial intelligence that could spot them even earlier.

January 30 -

The senator wants Treasury to enhance fraud protection in the Direct Express prepaid program — now a partnership with Comerica Bank — when its contract is rebid in 2020.

January 10 -

The software, which was developed by Feedzai, will eventually block payments that appear to be fraudulent or mistaken.

December 21 -

Time and again, two former associates of President Trump deceived banks in connection with loan applications. Their wealth, proximity to power and willingness to tell big lies all appear to have helped them get away with brazen schemes.

December 12 -

While fraud is a year-round concern, credit unions need to be extra vigilant during the holiday season.

December 11 Advanced Fraud Solutions

Advanced Fraud Solutions -

As U.S. banks move toward faster payments, they should heed the lessons U.K. banks learned about criminals after launching their real-time transaction system, says Varo Money's fraud strategy leader.

November 27 -

With fraud rising alongside mobile deposit usage, credit union executives needed a way to solve the problem without making the process burdensome to employees and members.

November 13 -

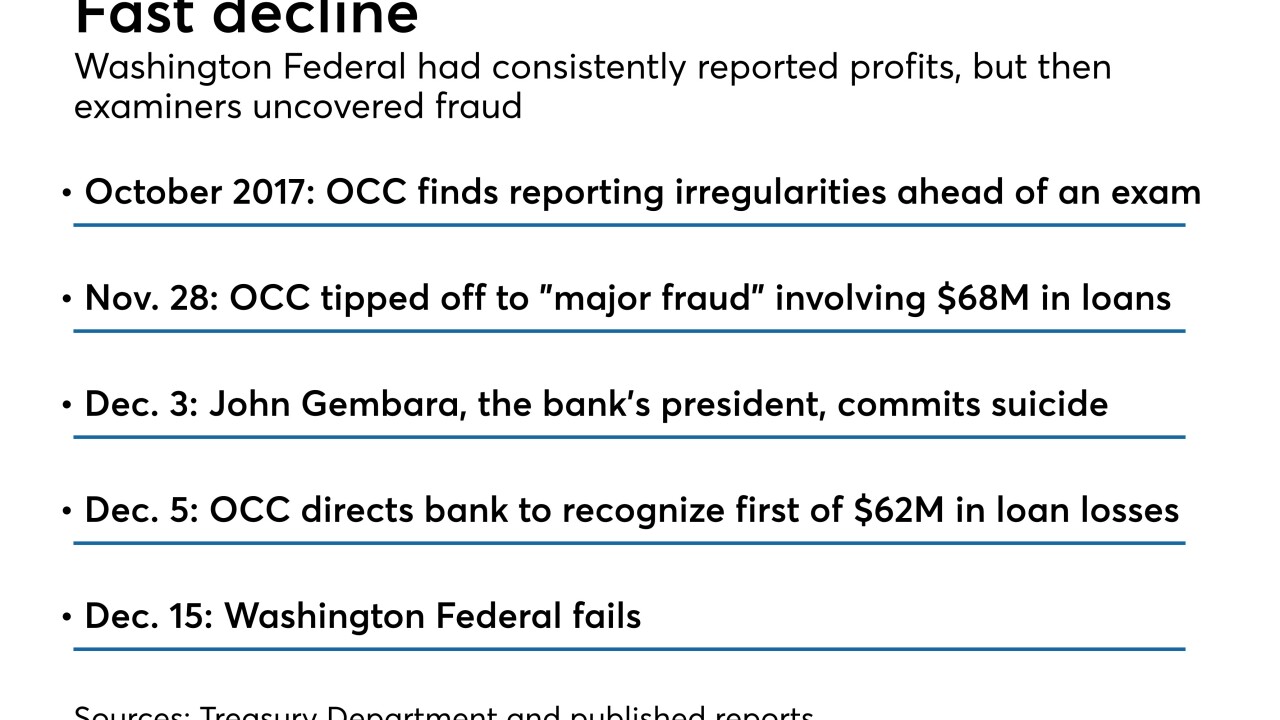

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -