Fraud

Fraud

-

A report reveals Heartland Tri-State Bank's failure last year was due to its CEO being ensnared in a sophisticated investment scam that is taking more victims.

February 19 -

-

When customers are targeted directly with fake text messages that lead to account takeover, artificial intelligence, and in some cases generative AI, can play a role in fighting the fraud, experts say.

February 5 -

-

The megabank failed to adequately protect and reimburse customers who were victims of wire-transfer fraud, according to a lawsuit by the New York Attorney General. Citi said that it follows all relevant laws and regulations.

January 30 -

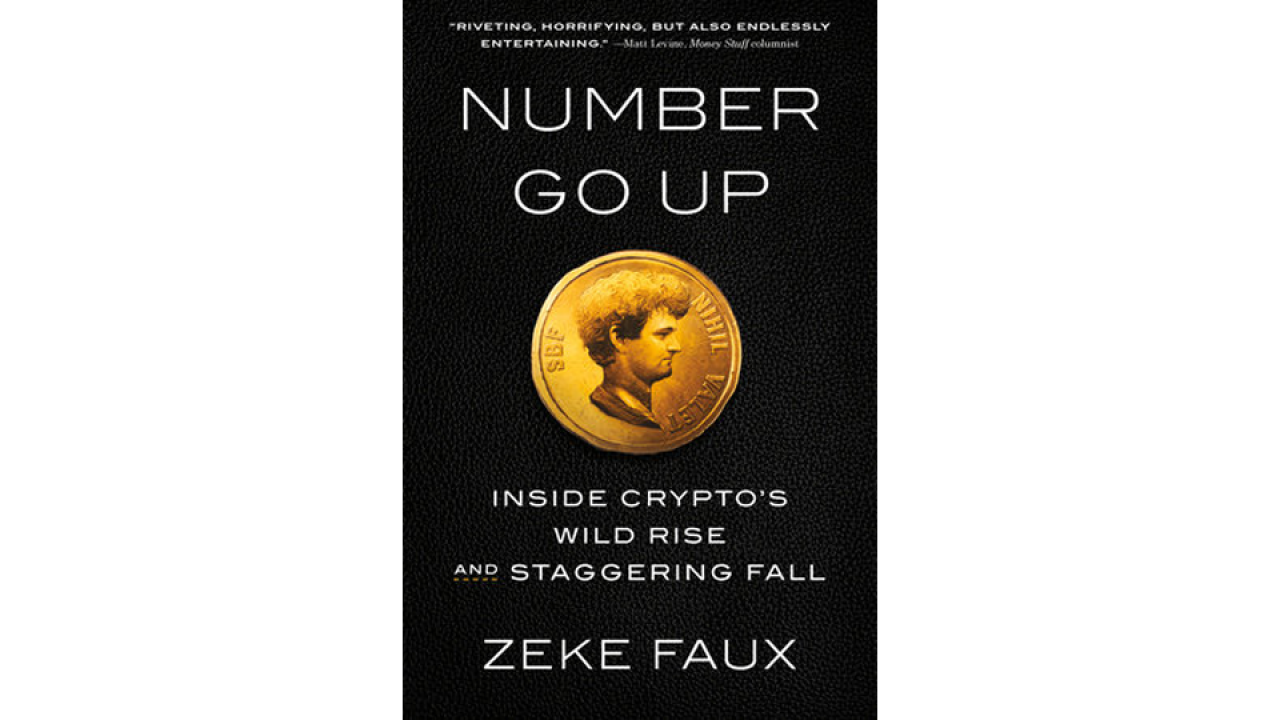

Zeke Faux, a Bloomberg journalist, describes his two-year odyssey to better understand cryptocurrencies in his book "Number Go Up." His work proves to be an entertaining deep dive into an industry riddled with scams.

January 30 -

Payments fraud is the most expensive kind, at $450B; anti-financial-crime execs are the most worried about real-time payments, a survey from Nasdaq and Oliver Wyman found.

January 16 -

The agency plans to restrict access to a system that provides borrower tax returns to mortgage lenders beginning June 30. Left out of the loop, small-business lenders say getting credit to borrowers will become more difficult as a result.

January 10 -

SEC Chairman Gary Gensler clarified Tuesday that a post on X from the official SEC account that the commission had approved bitcoin ETFs was the result of a hack. X said the SEC did not have multifactor authentication enabled on its account.

January 10 -

The Alabama-based bank, which reported $135 million in check fraud losses during a six-month period, says that it had changed the period of time it holds a deposit in an effort to become more customer-friendly. "We opened the door too wide, bad people came rushing in, and we didn't close the door timely enough," said CFO David Turner.

January 2