Fraud

Fraud

-

Credit unions are well positioned to serve small businesses, but they'll lose that opportunity if they're not adequately protecting those members' cash flow.

November 16 -

California-based America's Christian Credit Union's efforts earned it a 2018 Best Practices Award.

November 16 -

With fraud rising alongside mobile deposit usage, credit union executives needed a way to solve the problem without making the process burdensome to employees and members.

November 13 -

PNC is piloting IDEMIA’s motion code card which offers a dynamic CVV2 security code for its commercial clients in an effort to combat card not present fraud.

November 9 -

A new group aims to foster collaboration between fintechs and state and federal officials in the fight against crime — without hindering legitimate business innovation.

November 9 -

UBS Group sold tens of billions of dollars' worth of residential mortgage-backed securities by "knowingly and repeatedly" making false and fraudulent statements to investors about the loans backing those trusts, the U.S. Justice Department said in a civil suit filed Thursday.

November 8 -

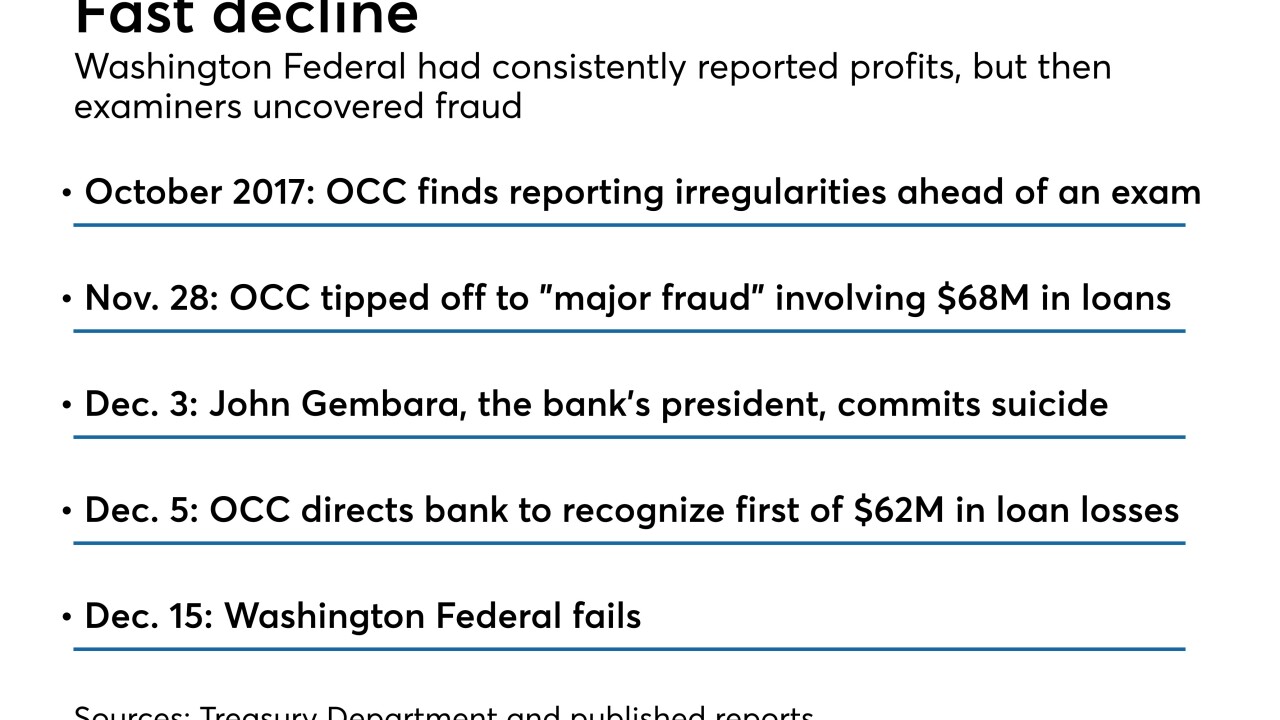

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -

Richard Bowe is alleged to have made false statements on loan applications totaling more than $96,000.

November 8 -

Fred Daibes and an associate allegedly conspired to fraudulently obtain loans from Mariner's Bank, a New Jersey institution he helped found.

October 31 -

The quartet of former credit union staffers all pleaded guilty, were sentenced to prison time and forced to pay a total of more than $1.5 million in restitution.

October 31