-

Credit unions enjoyed a boost to membership as consumers fled the big banks in the wake of the financial crisis. But they can't wait for the next global disaster to drive younger members into their arms.

October 30 FIS

FIS -

Trade associations and other industry groups are partnering with universities and colleges to create more degree programs and special courses that prepare young people to work for banks — especially small ones.

October 29 -

Financial institutions need to adapt their offerings to meet the preferences of these young consumers or they risk losing ground to fintechs and other nontraditional players.

October 18 CCG Catalyst

CCG Catalyst -

Banks and credit unions will have to re-engineer a number of systems to meet the eclectic demands of the generation born roughly in the last 10 to 20 years.

October 11 -

Banks will have to re-engineer a number of systems to meet the eclectic demands of the generation born roughly in the last 10 to 20 years.

October 11 -

Gen Z recruits add a fresh perspective and provide a talent pipeline for the future, bankers say.

September 25 -

Young consumers do not trust centralized authorities, making the distributed ledger attractive, according to Donika Kraeva, strategic communications manager for Dentacoin.

August 30 Dentacoin

Dentacoin -

After the 2008 banking crisis, centralized payment systems and financial services don’t have as much appeal to the younger set as a more transparent decentralized system, argues Csaba Csabai, founder and CEO of Inlock.

August 24 Inlock

Inlock -

These teens and early 20-somethings are hardworking, frugal, prudent, debt averse and fiercely opposed to fees — much like their great-grandparents who grew up during the Depression.

July 9 -

These teens and early 20-somethings are hardworking, frugal, prudent, debt averse and fiercely opposed to fees — much like their great-grandparents who grew up during the Depression.

July 6 -

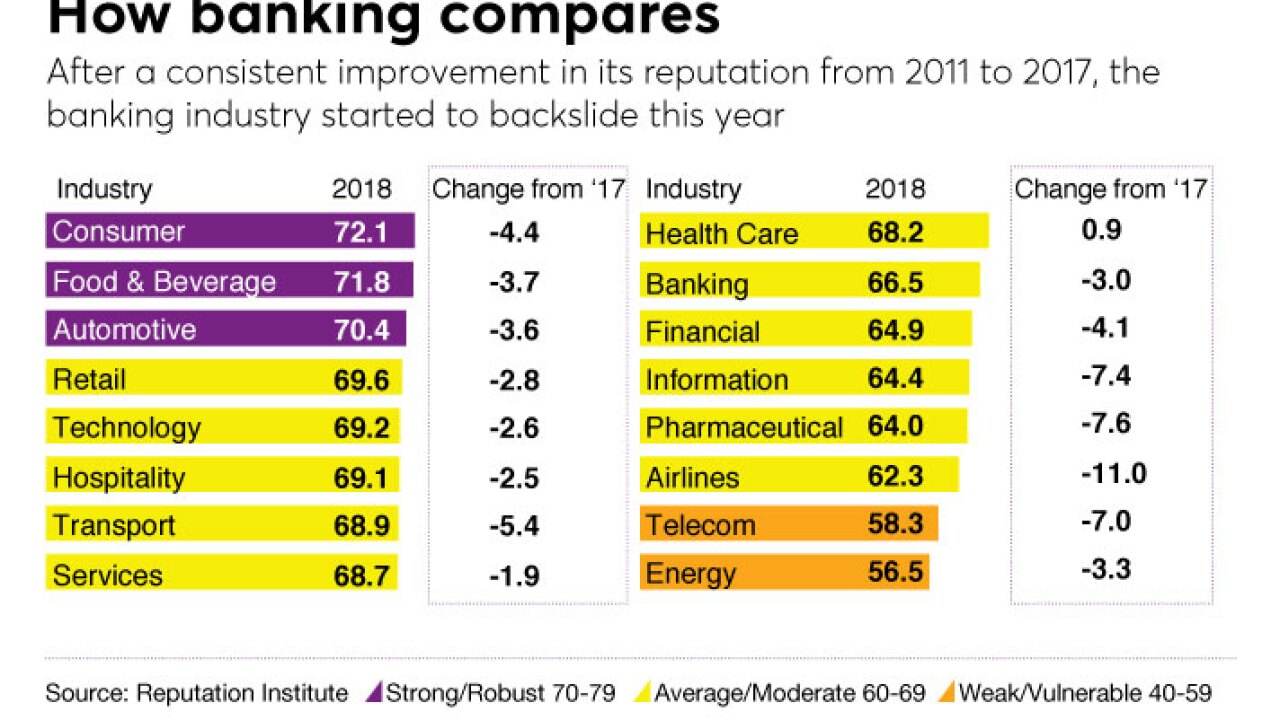

USAA reigns, Wells Fargo, well, doesn't. Here's a look at the highs and lows in this year's survey, as well as the trends that drove the results.

July 1 -

The sharing economy, declining cash usage, mobile banking and more will all have a major impact on how credit unions do business less than a decade from now, according to one analyst.

June 21 -

Most of Generation Z desires more robust and holistic payments management experience, making it a requirement that the financial services industry create new solutions with these preferences in mind. Technology partners and open development can help meet these needs, writes Zavida Mangaru, executive vice president of product strategy and innovation at North American Bancard.

May 22 North American Bancard

North American Bancard -

A generation that has never known a world without cell phones or the internet – in other words, those born in the year 2000 or later – is driving credit unions to redefine traditional approaches to banking, technology, communication and more.

April 4 -

Amazon.com has millennial shoppers nailed down. And their parents. And most of their grandparents. But one group of potential customers has eluded the world's biggest internet retailer: teenagers.

March 29 -

Banks continue to struggle in wooing millennials, but their customer acquisition challenge is about to get even more complicated as Generation Z comes of age.

June 22 Firstborn

Firstborn -

Here are some major ways that mobile banking, P-to-P payments and fintech are changing banking.

June 1 -

One millennial's take on how credit unions can woo the next generation of members.

April 28 BluCurrent CU

BluCurrent CU