-

With the government functioning again, Congress may finally turn its attention to credit union priorities.

January 28 -

The New York company will also match donations made by its employees to Feeding America and United Way Worldwide.

January 25 -

In 2017, the National Credit Union Administration board approved provisions to make mergers more transparent. But one of those changes has become a casualty of the government closure.

January 25 -

With SBA lending at a standstill, many small businesses can't access the capital they need to create and retain jobs, Stephen Steinour says.

January 24 -

The question of what banks are doing to aid government workers shows how the industry is still struggling to rebuild its image following the crisis.

January 24 -

U.S. Commerce Secretary Wilbur Ross said unpaid federal workers could borrow to tide themselves over during the government shutdown rather than call in sick to earn a paycheck elsewhere.

January 24 -

Industry groups and lawmakers have joined bankers in insisting the agency develop a plan to resolve the paperwork problem before the partial government shutdown ends.

January 23 -

The shutdown is keeping the agency from approving about 300 loans per day, according to CBA President Richard Hunt.

January 22 -

For thousands of government employees, credit card bills are coming due for travel and other expenses they incurred before the shutdown.

January 22 -

CFPB to scrap key underwriting portion of payday rule; Fiserv-First Data — why small banks fear big fintech; banks, credit unions help federal workers hurt by shutdown; and more from this week's most-read stories.

January 18 -

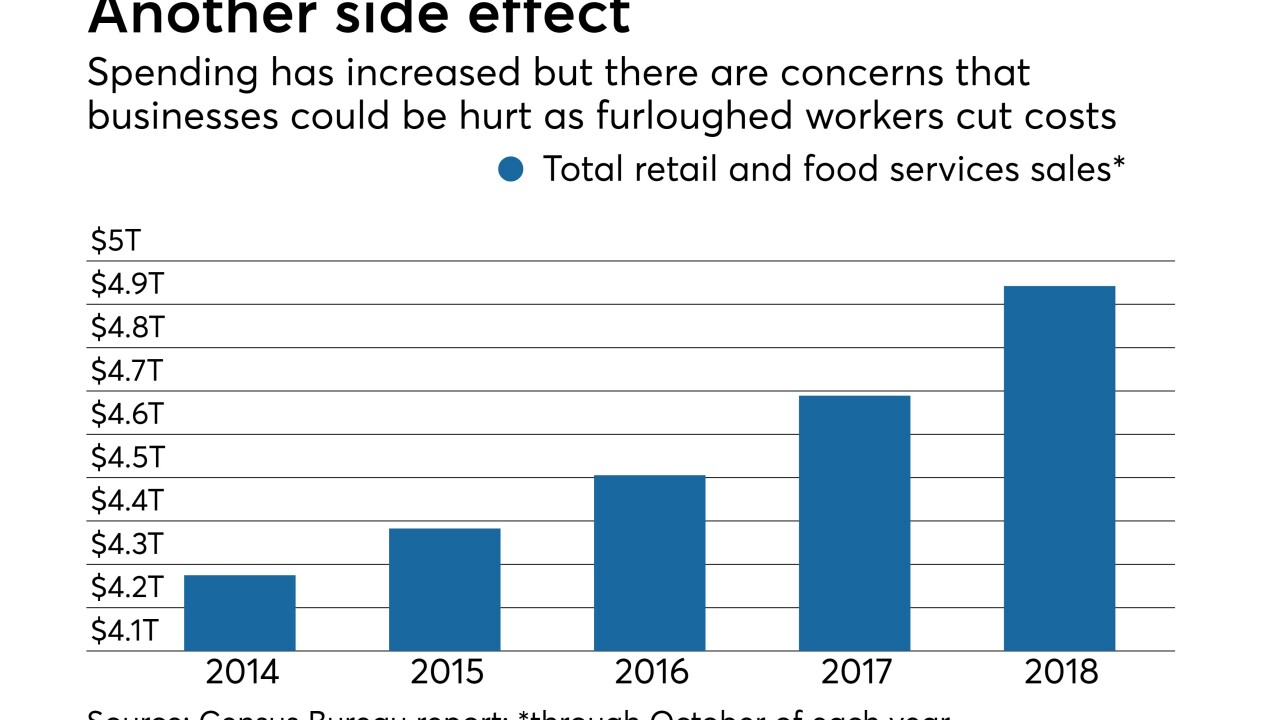

Credit union and bank executives say the federal work stoppage hasn’t hit business lines yet, but that could change if things drag on much longer.

January 18 -

Farm Service Agency staff will have three days to work on existing loan applications and provide tax documents for existing loans.

January 17 -

The impasse has halted grant and loan applications and frozen many farm subsidies just weeks ahead of planting season.

January 14 -

Many federal agencies have been closed for more than three weeks, making it the longest shutdown in U.S. history. With no end in sight, here's how it's affecting banks, credit unions and mortgage lenders.

January 13 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

The American Bankers Association has called for an end to the government shutdown, saying it has prevented customers from securing loans and threatens even more damage.

January 11 -

A lapse in rental-assistance funding, an understaffed FHA and other effects of the government shutdown are causing real harm to families, said the chair of the House Financial Services Committee.

January 11 -

The agency wants mortgage servicers to extend special forbearance plans to those affected by the partial government shutdown and evaluate borrowers for loss-mitigation options.

January 9 -

As the government shutdown enters its third week, mortgage servicers are activating the response plans they normally use during hurricanes and wildfires to assist federal workers who may have trouble paying their mortgages.

January 4 -

Borrowers and financial institutions may be feeling the strain from reduced operations at the FHA and IRS, which has suspended the release of certain income documentation during the budget impasse.

January 4