-

Former Texas Gov. Rick Perry laid out a sweeping financial reform agenda on Wednesday, suggesting he would force the biggest banks to hold even more capital or reinstitute elements of the Glass-Steagall Act.

July 29 -

The Federal Housing Finance Agency is still not producing enough adequately-trained examiners necessary to monitor Fannie Mae and Freddie Mac, according to an inspector general report.

July 29 -

The House Financial Services Committee tackled several key bills including ones targeting Operation Choke Point, executive compensation at Fannie Mae and Freddie Mac, small banks' exam cycle, and changes or delays to several actions by the Consumer Financial Protection Bureau.

July 28 -

Just a day after the Dodd-Frank Act's fifth anniversary, Senate Banking Committee Chairman Richard Shelby launched a new attempt to make significant changes to the law, attaching his regulatory relief bill to legislation that would provide funding for financial services agencies.

July 22 -

WASHINGTON The Senate Finance Committee voted Tuesday for a measure that would extend a temporary 10-basis point hike in Fannie Mae and Freddie Mac guarantee fees for an additional four years.

July 22 -

The new MBS program gives FHLB members direct access to the secondary market.

July 21 -

WASHINGTON The efforts of Fannie Mae and Freddie Mac shareholders to claw back the value of their investments by suing the U.S. Treasury have not elicited much support on Capitol Hill.

July 16 -

FHFA report shows FHLBs are well capitalized while Fannie and Freddie continue to see improving loan performance.

June 29 -

Fannie Mae will no longer charge mortgage lenders to submit loans to its Desktop Underwriter automated underwriting system, a decision that follows a similar move by Freddie Mac earlier this month.

June 23 -

Some argue that nonbank mortgage lenders' rising market share poses a risk to the financial system. But this belief arises from an inaccurate understanding of what is in fact a well-regulated sector.

June 16

-

The decline in foreclosures and short sales is contributing to the dearth of housing inventory, complicating the prospects for home buyers feeling the pinch of tight credit and lenders that need purchase mortgages to supplant refinancing once interest rates rise.

June 15 -

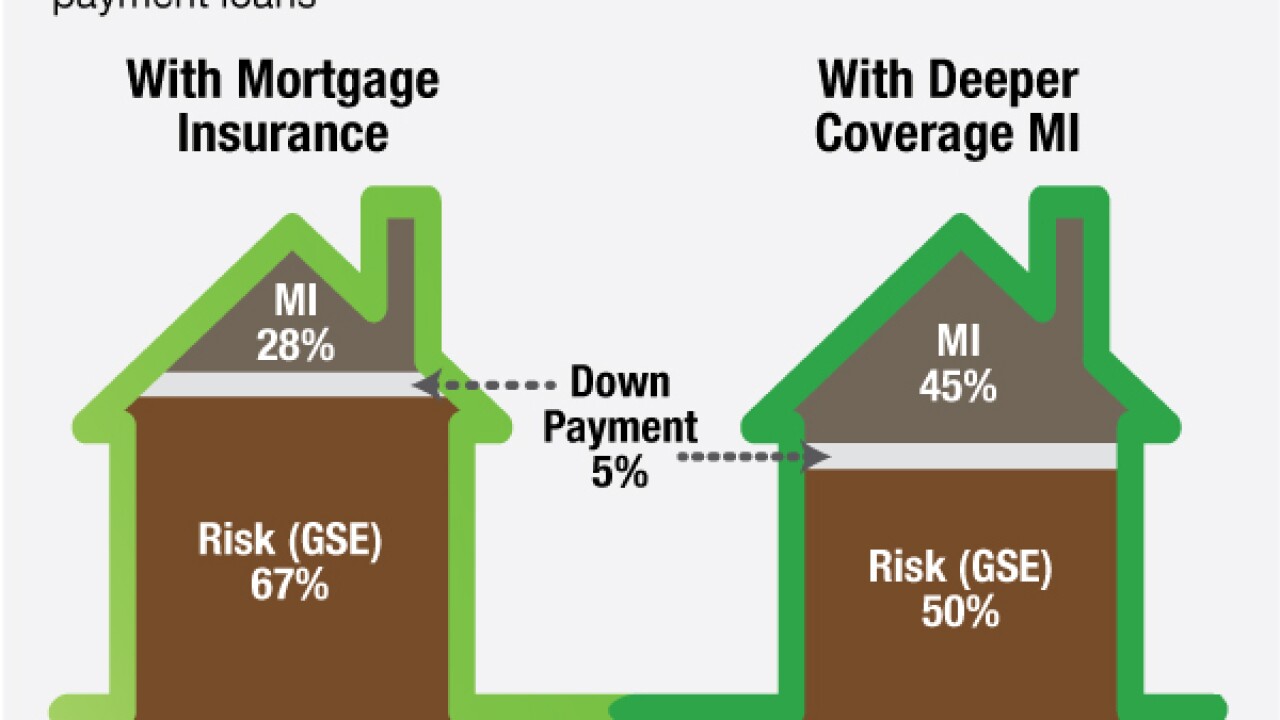

Private mortgage insurers see deeper coverage of GSE loans as a way to expand business, while lenders hope it could lead to a reduction to guarantee fees.

June 12 -

A bipartisan group of Senate Banking Committee members is urging the Federal Housing Finance Agency to make risk-sharing a higher priority for Fannie Mae and Freddie Mac.

June 10 -

Fannie and Freddie should offer upfront risk-sharing options in order to give lenders an opportunity to lower their guarantee fees while encouraging more private capital and competition to flow into the secondary mortgage market.

June 10

-

The details of the final Des-Moines-Seattle Home Loan Bank deal made it clear why this merger worked when past attempts had not and gave clues as to whether other institutions could one day follow suit. Following are three items that jumped out.

June 9 -

Rep. Edward Royce, R-Calif., urged fellow House members Wednesday to support a Senate proposal that would make significant reforms to Fannie Mae and Freddie Mac.

June 3 -

The merger of the Federal Home Loan Banks in Des Moines and Seattle became official on Monday, shrinking the overall number of banks in the system to 11.

June 1 -

New servicing standards issued by the government-sponsored enterprises are unlikely to pose a hurdle for the biggest nonbank players in the market, but small servicers could find it more challenging.

May 28 -

In a sign that the GSEs may once again be trying to compete with each other, Freddie Mac will no longer charge lenders to use its Loan Prospector automated underwriting system.

May 27 -

Fannie and Freddie's profits depend on having their obligations backed by the U.S. Treasury. Therefore they should have to pay a sensible price for this backstop just like big banks.

May 22