-

The addition of the conservative pundit could signal the Trump administration's intent to have a more direct hand in central bank policies, yet Moore could experience his own transformation as a Fed governor.

March 28 -

The latest Credit Union Trends Report from CUNA Mutual shows CUs serving more consumers even as the industry continues to contract.

March 20 -

The state's financial regulator says Fast Money Loan charged consumers interest rates and fees above the state's usury cap, and operated unlicensed storefronts.

March 19 -

Aspiration, Wealthfront and SoFi have all begun offering high-yield savings accounts during the past few weeks.

February 28 -

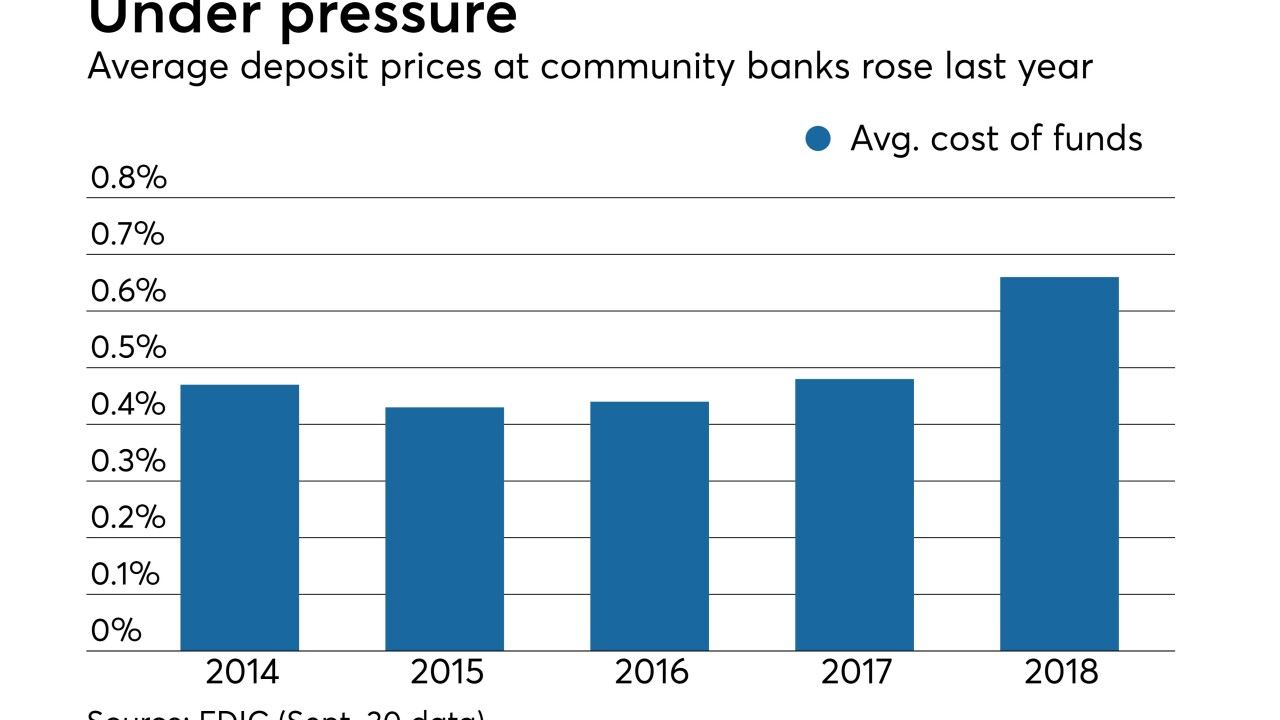

Banks and credit unions are experimenting with ways to maximize margins in an environment where the yield curve is flat, depositors want them to pay up and they fear the Fed could actually cut rates.

February 13 -

Wells says it's made progress but needs to do more to rebuild trust with customers and regulators; despite rate hikes by the Fed, big banks continue to effectively pay nothing in interest to savings customers.

January 31 -

A new report from Cornerstone Advisors finds credit union executives aren't all that bullish on the year ahead, while banker optimism is back on the rise.

January 28 -

The consent order against California Check Cashing Stores is part of a broader crackdown by the Department of Business Oversight on small-dollar lenders trying to skirt interest rate limits.

January 22 -

The central bank’s investments under its quantitative easing program have put its balance sheet in the red under mark-to-market accounting, another potential risk for an agency already under political fire.

January 10

-

The accounts — which eschew paper checks and overdraft protection — appeal beyond the low-income customers they were intended for; lenders are embracing artificial intelligence systems to analyze more data to determine creditworthiness.

January 4