Loans, assets and memberships are on the rise at credit unions even as the number of institutions continues to dwindle.

Those are some of the major takeaways from the latest Credit Union Trends Report from CUNA Mutual Group, which looks at major industry stats as of January 2019.

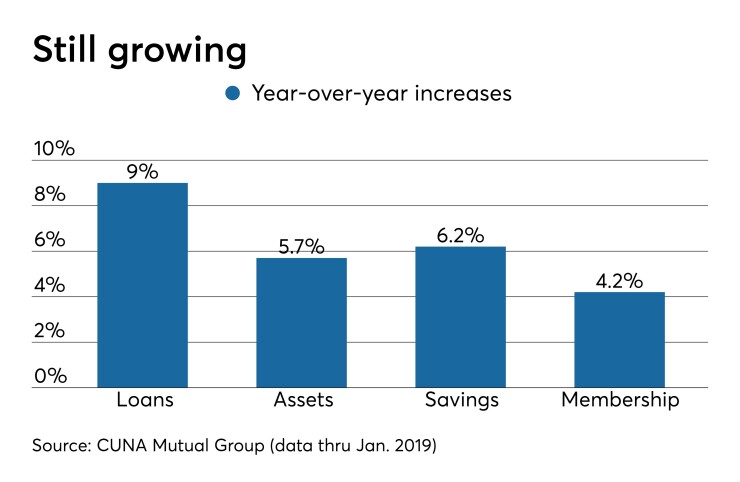

In the 12-month period ending Jan. 31, loan balances were up by 9 percent, though in the month of January alone loans were up 0.3 percent, down from the 0.4 percent seen in Jan. 2018.

The report noted that while credit union lending reached a peak in in the fourth quarter of 2016, the “credit boom” is expected to slow down over the next few years, due to rising interest rates and a projected slowdown in consumer spending.

Overall, loan growth is forecast to slip to 8 percent in 2019, down from 9.1 percent last year.

Other highlights from the report include:

- There were 5,613 credit unions in operation at the end of January, a reduction of 12 from December 2018, and down 177 from January 2018

- Credit union memberships were up 0.16 percent in January 2019, down from a 0.41 percent gain in January 2018. But memberships are up by 4.2 percent over the prior 12 months, due to “robust demand for credit, solid job growth and comparatively lower fees and loan interest rates.”

- Total credit union assets edged up by 0.1 percent in January 2018, versus the 0.1 percent drop recorded in January 2018. Assets climbed by 5.7 percent over the 12-month period ended January 2019, due to a 6.1 percent expansion in deposits, a 16.3 percent decline in borrowings and a 9.8 percent increase in capital

- First mortgage originations at credit unions amounted to $140.5 billion in 2018, a 0.9 percent fall from the $141.8 billion in originations recorded in 2017

- Delinquency rates on loans issued by credit unions amounted to 0.67 percent in January 2019, unchanged from December 2018, but down from the 0.81 percent figure of January 2018

- Auto loan balances rose by 0.6 percent in January 2019, below the 0.9 percent figure from January 2018; year-over-year auto loan balances were up by 9.2 percent

- CUNA Mutual commented that despite high used vehicle prices, “strong consumer fundamentals: are driving used auto loan growth, including an improving labor market, low oil prices, faster wage growth, low interest rates, expanding driving-age population, improving construction activity and better household balance sheets.”