-

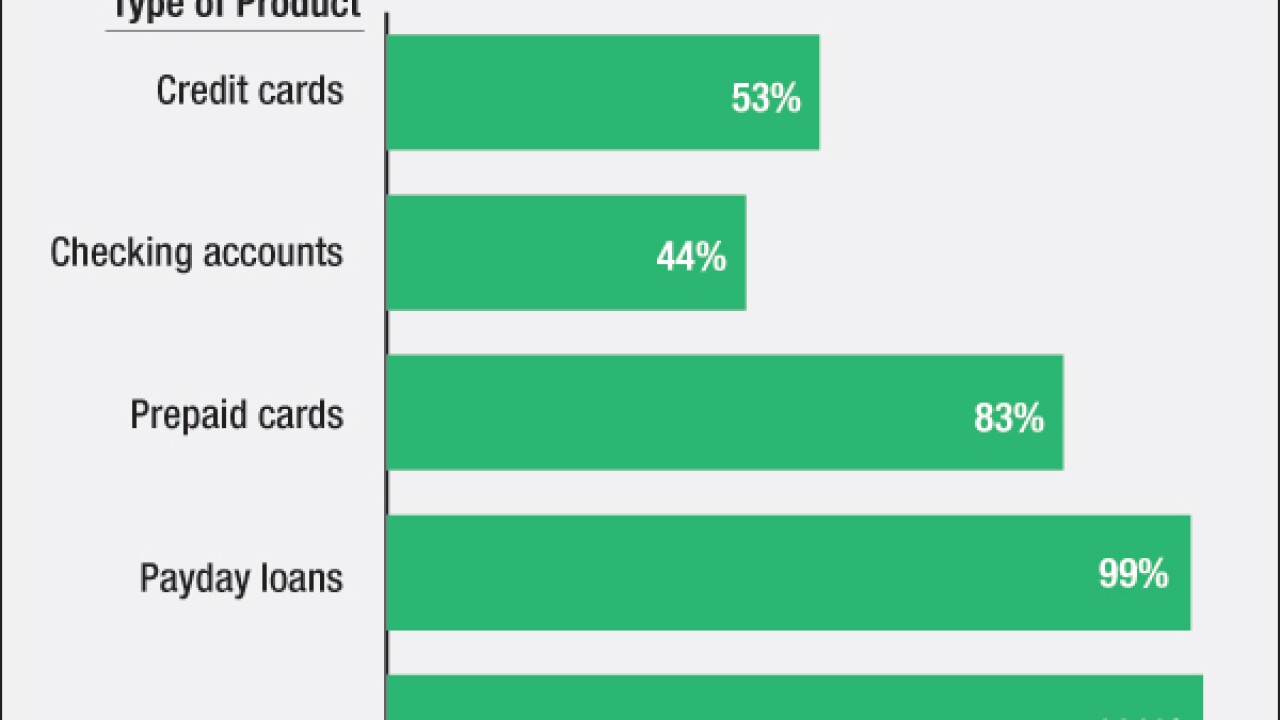

The Consumer Financial Protection Bureau's impending proposal, to be reviewed by a small business advisory panel, would block companies from using arbitration clauses to avoid class actions but allow them for individuals.

October 7 -

The clash between the Department of Housing and Urban Development and its inspector general over down payment assistance programs run by state or local housing finance agencies continues to heat up.

October 6 -

Despite their major push to overhaul the housing finance market last Congress, Sens. Bob Corker, R-Tenn., and Mark Warner, D-Va., offered little optimism Tuesday that structural reform is on its way anytime soon.

October 6 -

What happens when big banks move into a market? Is it a good idea to partner with online lenders? How much of a problem are ag loans? Those questions were among the many addressed by researchers at the recent community banking conference in St. Louis hosted by the Federal Reserve and Conference of State Bank Supervisors.

October 6 -

The Federal Reserve Board said Monday that it would reopen its public comment period on Goldman Sachs' pending acquisition of roughly $16 billion in online deposits from GE Capital, citing a need for greater public examination of the deal.

October 5 -

The New York State Department of Financial Services on Monday gave a third virtual currency company the green light to begin operations in the state.

October 5 -

Republicans and the banking industry face long odds in making structural changes to the Consumer Financial Protection Bureau this year, but the ultimate outcome of the battle is still far from certain.

October 5 -

Borrowers are faced with two terrible choices: take out another exploitative loan because of the shortfall created by the first, or face a range of catastrophic consequences associated with defaulting.

October 5

-

If we can't identify adequate capital to bear mortgage credit losses when they are incurred, aren't we setting ourselves up for another series of bailouts in the next housing downturn?

October 5

-

A bank failure in Georgia and then another in Washington state late Friday were estimated to cost the Federal Deposit Insurance Corp. nearly $25 million.

October 2 -

-

Consumer advocacy groups are urging regulators to take a closer look at how alternative lenders are using the stockpiles of personal information they collect.

October 2 -

The Mortgage Bankers Association is disappointed that the Consumer Financial Protection Bureau has not provided an explicit temporary safe harbor for lenders who have made a good-faith effort to implement new disclosures.

October 2 -

Trinity Capital in Los Alamos, New Mexico, and its subsidiary Los Alamos National Bank will pay a $1.5 million penalty to the Securities and Exchange Commission following charges of accounting fraud.

October 2 -

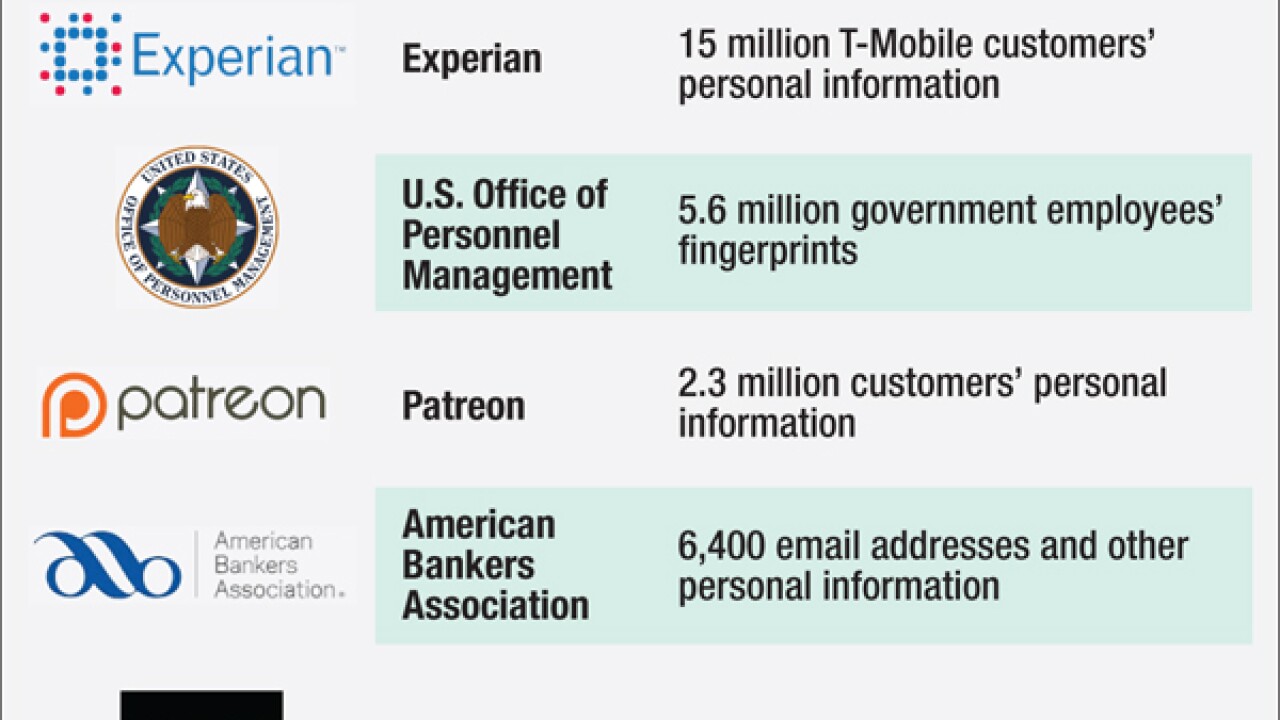

Compared with other recent breaches, the theft of 6,400 user email addresses and passwords on the American Bankers Association's website might seem like small potatoes. But experts said the attack the first in the association's history was still significant and could have implications for banks.

October 2 -

The Federal Reserve Bank of Philadelphia has lifted a cease-and-desist order for Carver Bancorp that was issued in February 2011.

October 2 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

October 2 -

WASHINGTON Federal examiners will expect institutions to show that they made a "good faith" effort in preparing for the implementation of the new integrated mortgage disclosures that go into effect on Oct. 3, regulators said in letters sent to industry groups on Thursday.

October 1 -

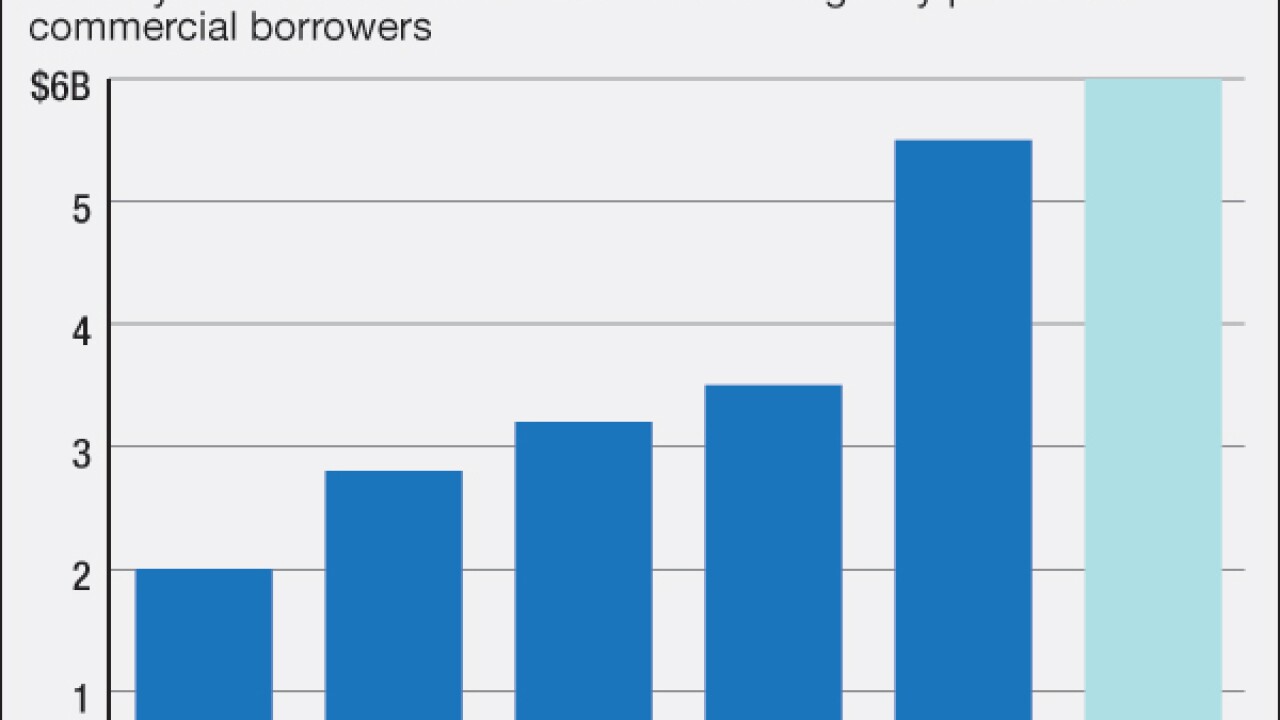

The Small Business Investment Company program may be less famous among banks than some of the SBA's other programs, but it enjoyed a record in fiscal 2015 that wrapped up this week. Stories like that of Opus Bank in California shed light on why.

October 1 -

The Consumer Financial Protection Bureau hit an indirect auto lender and a subsidiary with $48.3 million in fines and restitution on Thursday, accusing it of deceptive collection tactics.

October 1