-

Guy Gentile ran a stock brokerage. He spent years running sting operations as an FBI informant. Then, after he was arrested anyway, he beat the charges. Now his plan for his next act — opening a bank in Puerto Rico — is hitting a snag.

July 5 -

American Express prevailed Monday in an eight-year antitrust battle with the government. Here’s a look at how other card networks, banks, retailers and consumers will be affected.

June 25 -

How the big banks fared in the Fed's latest round of stress testing; what's on new FDIC chair Jelena McWilliams' plate; why banks' biggest risk factor may be employees who don't speak up; and more from this week's most-read stories.

June 22 -

Wells Fargo on the receiving end of USAA's long-standing intellectual property threat; millions are mad about Erica, Bank of America's virtual assistant; relief may be in reach for bankers fed up with SARs; and more from this week's most-read stories.

June 15 -

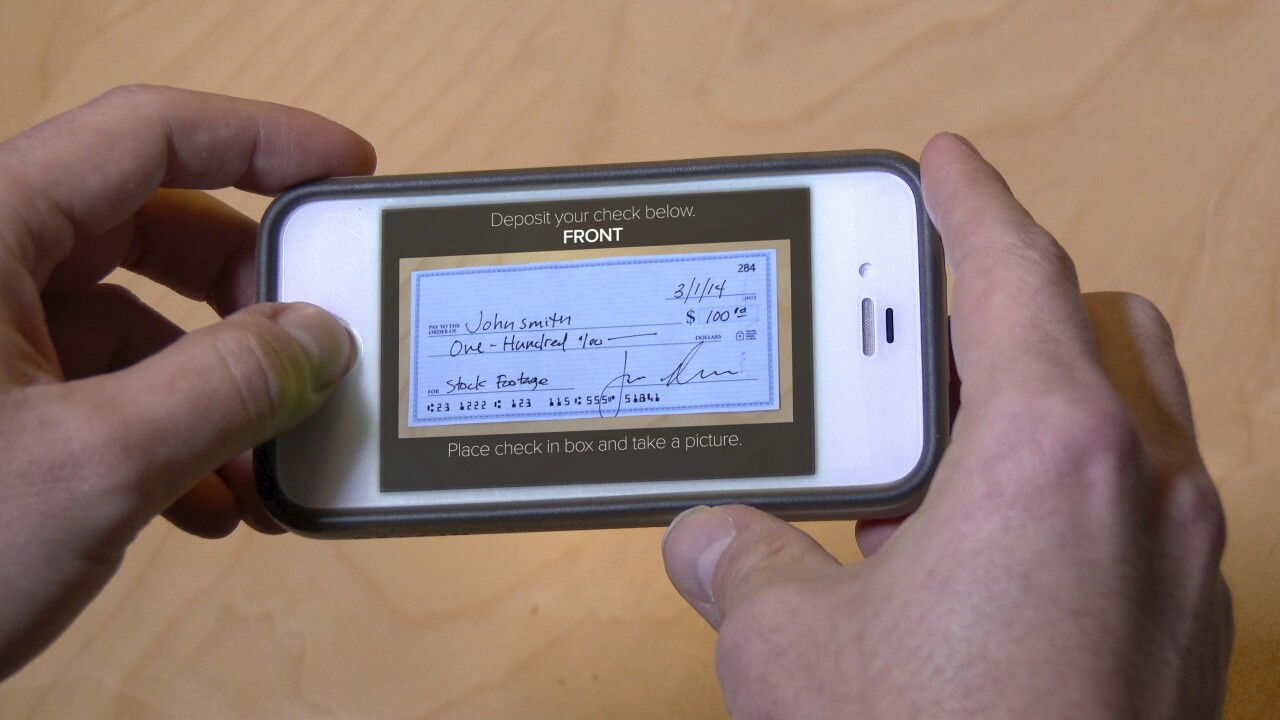

USAA's lawsuit accusing Wells of infringing on its remote-deposit patents is new territory: bank-on-bank fights over intellectual property.

June 11 -

When asked if other banks were being sued, USAA said the lawsuit names only Wells Fargo because the bank is one of the biggest adopters of remote mobile deposit capture and has failed to license the technology.

June 8 -

Acting CFPB Director Mick Mulvaney wrote in a two-paragraph filing that the Mount Laurel, N.J., company did not violate the Real Estate Settlement Procedures Act.

June 7 -

Bankers hope to claw back even more of the agency's rule rather than merely defend their partial victory in the judge's original split decision.

June 5 -

A number of credit unions and banks have been accused of operating websites that violate the Americans with Disabilities Act. Here’s why trial lawyers are targeting them and are expected to sue more.

May 21 -

Several dozen banks have been accused of operating websites that violate the Americans with Disabilities Act. Here’s why trial lawyers are targeting them and are expected to sue more.

May 21 -

The Federal Trade Commission alleges in a lawsuit that the company's "no-hidden-fee" pledge is deceptive. LendingClub says the claims are unwarranted.

April 25 -

A class action filed last week alleges that Renovate America and Renew Financial failed to provide consumer protections promised to L.A. County, that this constitutes elder abuse, and the county is complicit.

April 16 -

A panel of judges remained skeptical of claims by Leandra English, deputy director of the Consumer Financial Protection Bureau, that she is the rightful head of the agency. But they didn’t sound convinced that current acting Director Mick Mulvaney is, either.

April 12 -

JPMorgan Chase was sued for charging "sky-high" interest rates and fees to customers who used their credit cards to buy cryptocurrencies such as bitcoin.

April 11 -

The lawsuit, filed in the U.S. District Court for the Western District of Texas, alleges that the CFPB rule is "arbitrary, capricious, and unsupported by substantial evidence."

April 9 -

National Credit Union Administration board member Rick Metsger says a federal judge overstepped the court's bounds when striking down portions of the agency's field-of-membership rule, but stopped short of saying the regulator planned to appeal the decision.

April 5 -

Banks have not yet finished with the wave of lawsuits stemming from the financial crisis. There are ways they can better ward off those threats next time around.

April 4 Bilzin Sumberg

Bilzin Sumberg -

If the National Credit Union Administration appeals a judge's decision against part of its rule, it could help the ABA potentially upend other provisions.

April 2 -

A federal judge struck down two provisions of the National Credit Union Administration's embattled field of membership regulation as "manifestly contrary to statute," while upholding two others.

March 29 -

A federal judge has upheld two provisions from NCUA's revised field-of-membership rule but struck down two other measures related to population centers.

March 29