-

Banks make emergency preparations as HSBC deals with confirmed case; the changes simplify regulations without posing additional systemic risks, the Fed says.

March 5 -

In spite of MGM’s quickly notifying hotel guests impacted by the breach in accordance with applicable state laws, it’s a clear concern that many of the contact details were still valid, particularly the phone numbers, says Shared Assessments' Tom Garrabba.

March 5 Shared Assessments

Shared Assessments -

Operational efficiency has long been the key to selling AP automation, but a growing payment fraud problem and new risk exposures are giving businesses new reasons to digitize payments.

March 3 -

The disease could lead to less lending business and more loan defaults; Sergio Ermotti will join the insurance company as chairman in 2021.

March 3 -

Wells Fargo and JPMorgan Chase recently avoided shareholder votes tied to their use of arbitration clauses in sexual harassment cases. But socially conscious investors say the issue is likely to flare up again elsewhere and that banks would do well to address a wide range of gender equity matters head on.

March 2 -

The Consumer Financial Protection Bureau heads to the Supreme Court on the same day as 95 credit union-supported candidates take part in the year's first congressional primary races.

March 2 -

The Treasury secretary’s recent Senate testimony coming down on cryptocurrencies is misguided. Regulations should require building better blockchain technology at the banks.

March 2 Polyient Labs

Polyient Labs -

The Supreme Court will hear arguments on the agency’s structure; the company, desperate after losing Costco’s business, allegedly pressured and misled applicants.

March 2 -

Some institutions have taken steps to ensure their websites meet accessibility standards, but experts say many credit unions could still be doing more.

March 2 -

The regulator barred nearly a dozen former credit union employees from working with any financial instiutiotn following charges of theft, embezzlement and more.

February 28 -

How New York became Wells Fargo's new center of power; banks walk fine line in preparing for a coronavirus outbreak in U.S.; bankers on Bernie's electoral chances and whether a Sanders presidency would pose a threat; and more from this week's most-read stories.

February 28 -

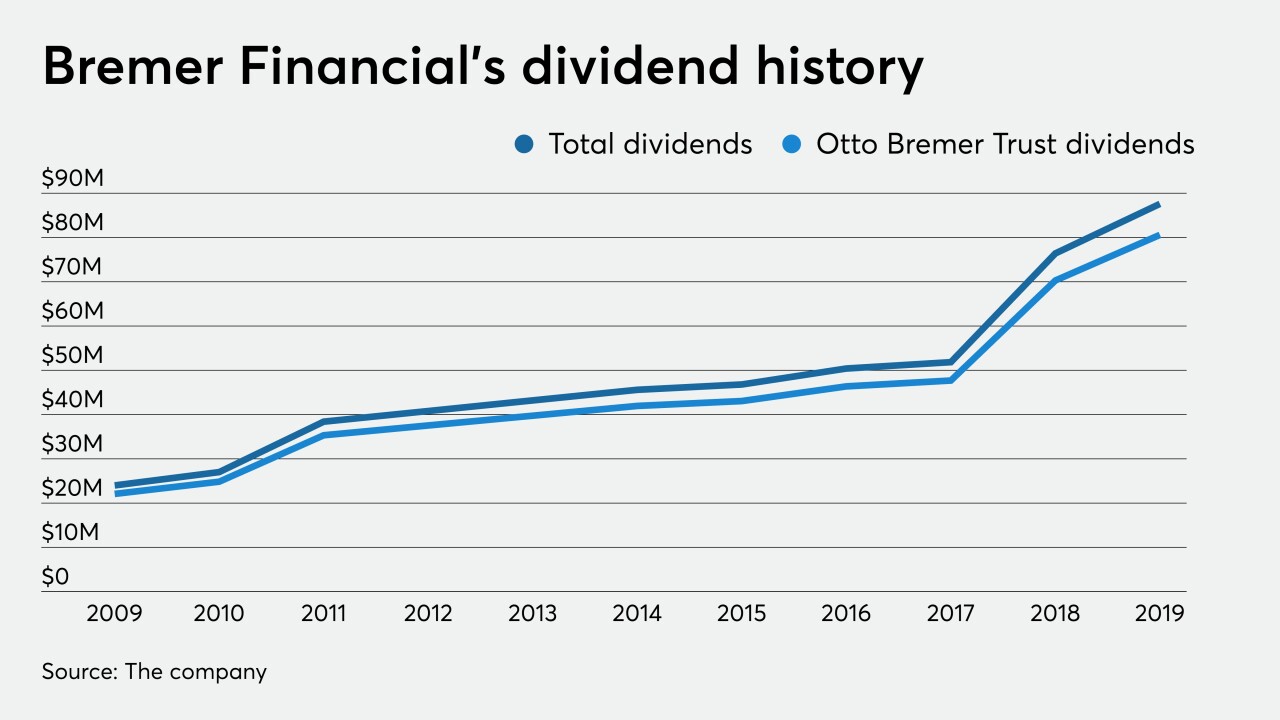

The Minnesota bank is locked in a bitter legal battle to preserve its independence. Its foe? The charitable organization set up by its founder.

February 28 -

The bank agreed to pay $35 million to settle SEC charges it recommended high-risk ETFs to some customers; coronavirus fears continue to batter financial shares.

February 28 -

-

Wall Street banks make plans to keep workers in Tokyo safe; the employees are bringing their grievances against the bank to Capitol Hill.

February 27 -

Under CEO Charlie Scharf, the bank that has historically viewed itself as more Main Street than Wall Street is becoming deeply embedded in the nation’s financial capital and its hard-charging culture.

February 26 -

The Payment Card Industry data security standard applies to organizations of all sizes, but has often been seen as an intro to data security for small-business owners who know more about cooking burgers than securing data.

February 25 -

The 10-digit penalty marks an important milestone for the bank, but individual ex-bankers may still be at risk and grueling hearings lie ahead for current leadership.

February 21 -

A deferred-prosecution agreement with the Justice Department spares the bank a potential criminal conviction — provided it cooperates with continuing probes and abides by other conditions.

February 21 -

Debt collectors would have to tell consumers upfront that they cannot sue to recover "time-barred" debt under a proposal issued Friday by the Consumer Financial Protection Bureau.

February 21