-

With Cybersecurity Awareness Month drawing to a close, CU Journal asked experts a simple question with no easy answers.

October 30 -

The bank, one of the few that do business with digital currency exchanges like Coinbase, has developed methods for monitoring all customers’ digital currency purchases.

October 29 -

The idea of digitizing cashier's checks is likely to meet resistance, but the Swiss startup says at least two U.S. banks are already showing interest.

October 29 -

Christian Sewing calls out the German bank's senior managers for using rumors of a merger with Commerzbank to excuse poor performance; banks in China begin using smartphones to pick up on lie-detecting facial tics.

October 29 -

Accounts payables automation is a tough sell for companies that don't want to abandon a process they have clung to for decades. But this old process is a big target for fraudsters — and growing.

October 29 -

Wells Fargo puts two top execs on leave as scandal's reach grows; regional banks freed from SIFI label lobbying regulators hard for more relief; FDIC to launch innovation office to help banks compete with fintechs; and more from this week's most-read stories.

October 26 -

Growing home prices plus rising interest rates are putting a damper on mortgage lending, which pushes the market to seek out less qualified borrowers and increases the risk of fraud.

October 26 Mark Migdal & Hayden

Mark Migdal & Hayden -

The assessment is designed to get banks on the same page in combating cybersecurity and make it easier for institutions and regulators to assess their performance.

October 25 -

Executives offer support to lift investment bankers’ morale; retailer’s move from Synchrony Financial could force card issuers to make concessions.

October 25 -

Building a blockchain solution that adds greater transparency in transactions has the potential to make KYC and KYT processes for crypto transactions much more efficient than the system in place, writes Ash Shilkin, president of Ivy.

October 25 Ivy

Ivy -

Cash Express LLC allegedly sent customers threats of legal action even though the time for taking legal action had expired.

October 24 -

The hacks keep coming — most recently to Facebook and the federal government’s health insurance sites — and consumer trust in online security systems disintegrates along with them, according to a number of recent surveys.

October 24 -

The 25-year JPM veteran will pursue an opportunity elsewhere; private equity firms have a record $57 billion to loan for real estate.

October 24 -

A smaller provision for loan losses helped counteract declining loan volume and higher expenses during the third quarter.

October 23 -

The civil money penalty from the Office of the Comptroller of the Currency follows a 2015 consent order against the bank, which became a subject of federal questioning after it suspended its business with check cashers.

October 23 -

Consumer finance portal will be able to tell customers which loans they’ll qualify for; Marcus unit will soon offer investment services.

October 23 -

New York's new AML rules clarify how institutions should monitor transactions and screen sanctions lists issued by the US Office of Foreign Assets Control (OFAC). But critically, it goes a lot further, writes Sophie Lagouanelle, Head of Solutions at Accuity.

October 23 Accuity

Accuity -

Kam Wong has been accused of submitting requests for fake expense reimbursements when he ran Municipal Credit Union.

October 19 -

Crowdsourced cybersecurity is making inroads into the world of big banks, even though there is a risk bad actors will exploit the opportunity.

October 18 -

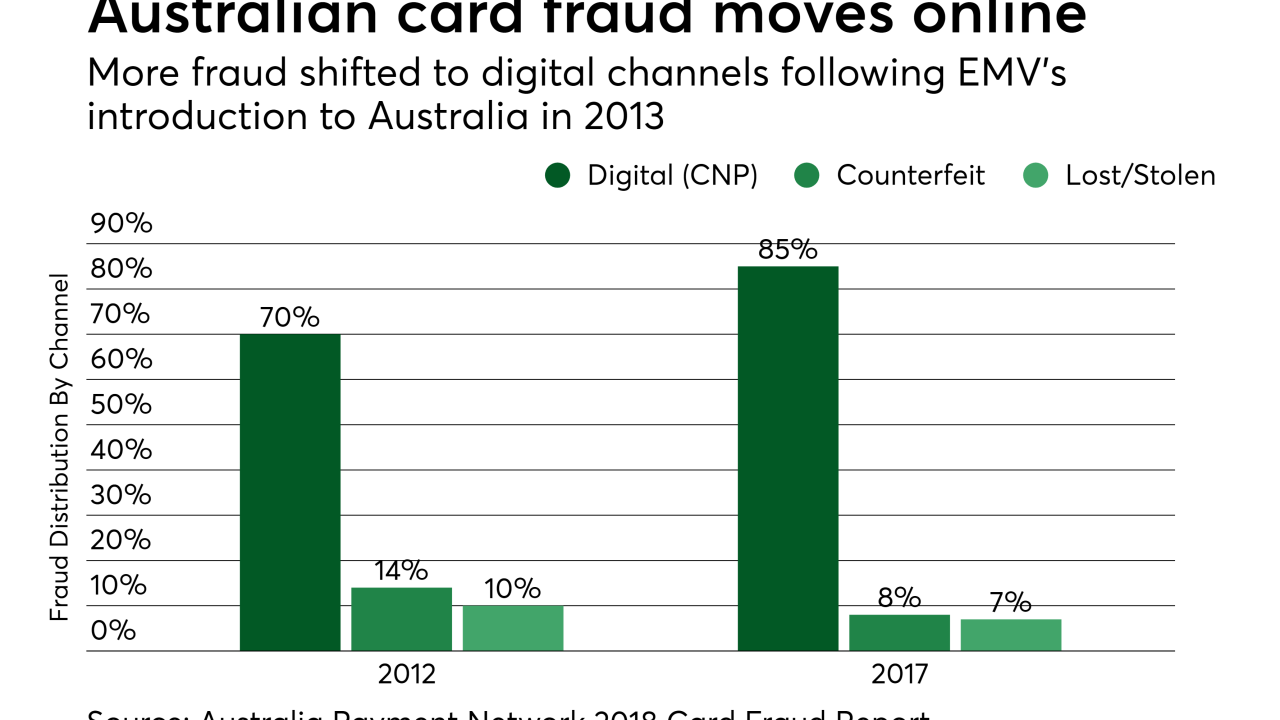

The vast majority of card fraud in post-EMV Australia affects digital payments, a trend that has prompted government action, expedited security projects, and financial pressure on banks from retailers.

October 18