-

First Citizens, which wants to buy KS Bancorp, has filed a lawsuit to challenge a so-called poison pill provision that the much smaller bank's board recently passed.

February 21 -

The Trump administration on Wednesday refrained from proposing the elimination of authority to clean up failed financial behemoths, but the Treasury Department still wants substantial reforms to the resolution powers.

February 21 -

The subprime auto lender paid $2.9 million to Connecticut consumers and a $100,000 fine for miscalculating balances owed on repossessed cars and for charging improper fees. It says the settlement is part of an effort to clean up "legacy issues."

February 20 -

The online lender continues to contend with the fallout of a 2016 scandal that led to the ouster of its founder and CEO.

February 20 -

Foreign operatives' alleged use of fraudulent financial accounts to try to influence the U.S. political system shows again how difficult it is for banks to truly know their customers.

February 20 -

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

The CFTC will pay the award for tips received from one person in the case, in which the bank didn’t properly disclose that it was steering asset management customers into investments that would be profitable for the bank.

February 16 -

A bipartisan bill to establish a federal security framework follows a string of efforts beset by congressional turf battles.

February 16 -

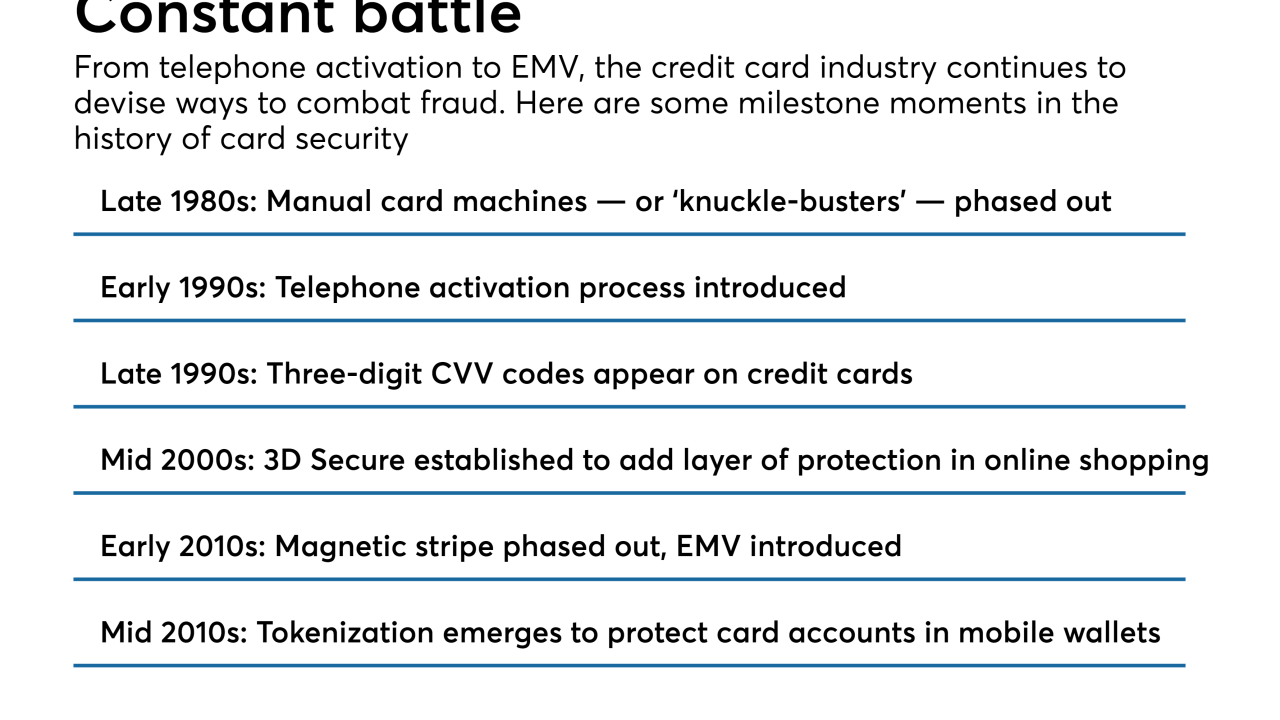

The card activation process is relatively low-tech, but since its introduction nearly three decades ago it has been hugely effective in preventing credit cards from falling into the wrong hands. Among its pioneers was Ash Gupta, American Express’ president of global credit risk, who is retiring next month.

February 16 -

U.S. Bank's $600 million fine for AML lapses quickly drew readers attention, while acting CFPB Director Mick Mulvaney got the Cordray treatment on Capitol Hill and big banks made moves to speed real-time payments.

February 16 -

A sophisticated campaign by Russian actors seeking to manipulate the 2016 U.S. presidential election through social media included stealing the identities of Americans and using accounts at PayPal to aid their effort.

February 16 -

The finance sector had the highest number of breaches of all industries, with 471 in 2016, according to a report issued Friday by the White House's Council of Economic Advisers.

February 16 -

Bank’s alleged lax controls enabled a former customer to launder money in a payday lending scheme; digital currency has made back a chunk of its recent decline.

February 16 -

The bank’s unsullied image took a hit when it admitted to misleading regulators regarding its efforts to combat money laundering.

February 15 -

U.S. Bancorp has agreed to pay $613 million in penalties to state and federal authorities for violations of the Bank Secrecy Act and a faulty anti-money-laundering program.

February 15 -

More than 700 million global cyberattacks and 1.7 billion bot attacks took place in 2017, a 44% increase in the attack rate over 2016.

February 15 -

From giveaways to budgeting tips and more, here's how credit unions are helping members have a romantic Valentine's Day, no matter how big or small their price point.

February 14 -

A small legal case in California brings a warning to banks: Be careful who you report for fraud.

February 14 -

There’s a widely held belief that clamping down on fraud in one area will lead to it popping up somewhere else. There is some truth to this — fraudsters favor the points of least resistance. But there are also major exceptions.

February 14 -

By taking advantage of the peak sales periods with higher-than-usual transaction volumes such as Valentine’s Day, criminals can use legitimate payment and shipping platforms without raising fraud alerts, writes Ron Teicher, CEO of EverCompliant.

February 13 EverCompliant

EverCompliant