-

Artificial intelligence is moving from science fiction to practical reality fast, and it's in banks' best interest to gear up now for the changes ahead. Here are some strategies to consider.

January 8 -

The jobs of chief investment officer departments and financial advisers are likely to change as banks and stand-alone wealth managers adopt artificial intelligence to inform the advice they give clients.

January 5 -

Banks are grappling with new challenges in trying to work with voice assistants like Alexa in Amazon's Echo to allow customers to check balances and perform other tasks. But with voice banking on the horizon, banks cannot afford to stall their efforts.

January 4 -

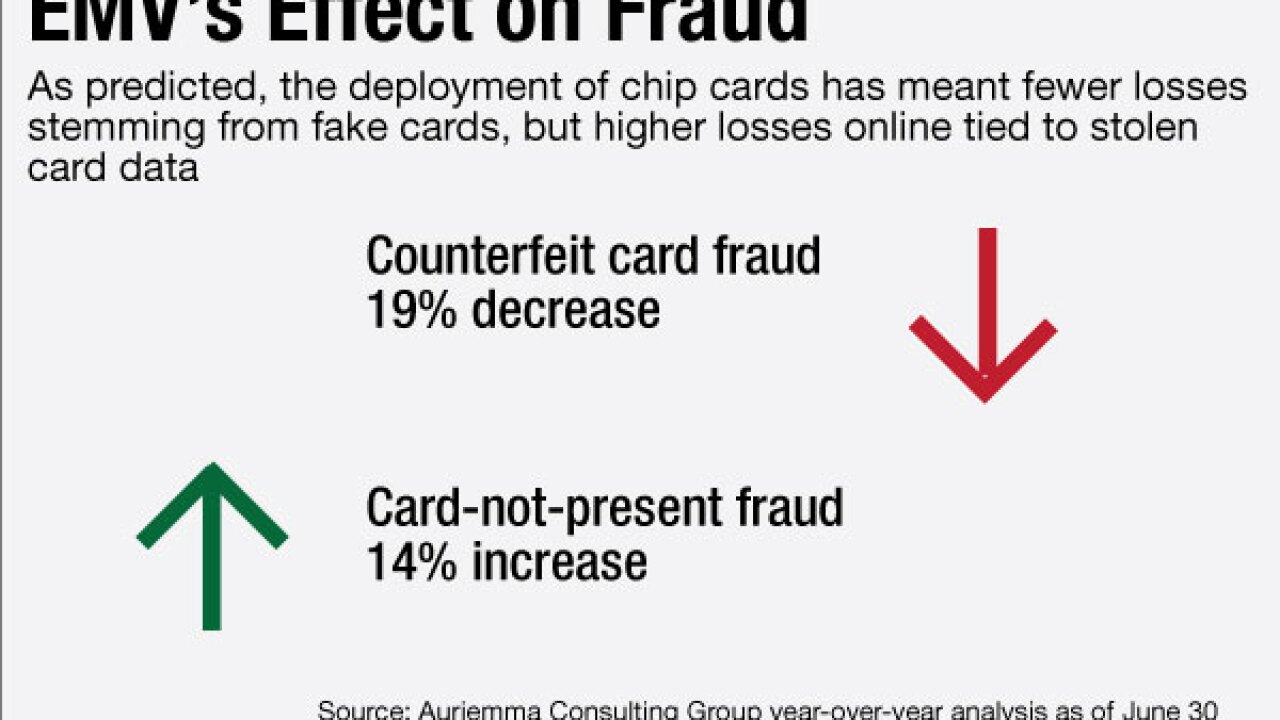

The EMV migration, online marketplaces and e-banking are giving crooks lots of places to commit fraud. Security strategy has to be more dynamic to keep up.

January 3 Simility

Simility -

The time banks have to investigate red-flagged credit payments has shrunk from several days to a few hours and fraudsters have already taken notice.

December 29 -

Banks have used biometrics for about a decade, but there are a number of hurdles that banks, device makers and customers need to overcome before passwords are history.

December 27 -

Fraud involving third parties and advance fees can be vexing for merchants. But doing lots of homework can mitigate the threat.

December 23 WePay

WePay -

At a time when individual accountability at corporations is mounting, here is how compliance officers can detect and prevent fraud occurrences within their own firms.

December 22 Intralinks

Intralinks -

The decision to rewrite the regulation came two days after a hearing in which New York bankers unleashed a litany of complaints about the regulation to Empire State lawmakers.

December 22 -

Scandal, business models gone awry, missing money and executive shake-ups — 2016 had it all. Here are the financial services executives or groups of them who took the heat and will be looking for better times in 2017.

December 21 -

The scourge of account takeover isn't lost on Citizens Union Bank, which is involving its business customers — or rather, their biometric traits — in improving the security of their accounts.

December 21 -

Ameris Bancorp in Georgia wanted to buy a premium-finance business but settled for a joint venture, blessed by its regulators, after being flagged for insufficient Bank Secrecy Act compliance.

December 20 -

Following the passage of the November ballot initiative, it is hugely important that cannabis businesses in the nation's largest state be able to secure bank accounts, at a minimum.

December 20 Harris Bricken LLP

Harris Bricken LLP -

The chip card migration is drawing more attention to card not present fraud. Account takeover risk is also on the rise.

December 16 LexisNexis

LexisNexis -

WASHINGTON Senate lawmakers are putting pressure on the Treasury Department's financial crimes unit to clarify to banks that businesses hired by marijuana growers and dispensers should not be treated like pot firms themselves.

December 14 -

As online shopping and card fraud increase, startups offering easy-to-use "burner" cards could see strong traction.

December 13 -

The core-tech vendor Fiserv has agreed to buy Online Banking Solutions in Atlanta.

December 12 -

Federal banking regulators are dismissing claims that they are pressuring banks to cut ties with payday lenders, arguing that the lenders' recent request for a court order against the agencies rests on erroneous speculation and bad legal arguments.

December 9 -

Despite gains for the legalization effort in the November election, the disconnect between federal and state law preserves uncertainty for banks catering to pot businesses.

December 9 K2 Intelligence LLC

K2 Intelligence LLC -

When BankMobile, the brainchild of Jay Sidhu and his daughter Luvleen, relaunches on a new platform in January, security especially for the onboarding process will be completely redesigned.

December 8