-

The credit union saw a 50 percent increase in mortgage originations, which helped spur a significant spike in net income last year.

March 21 -

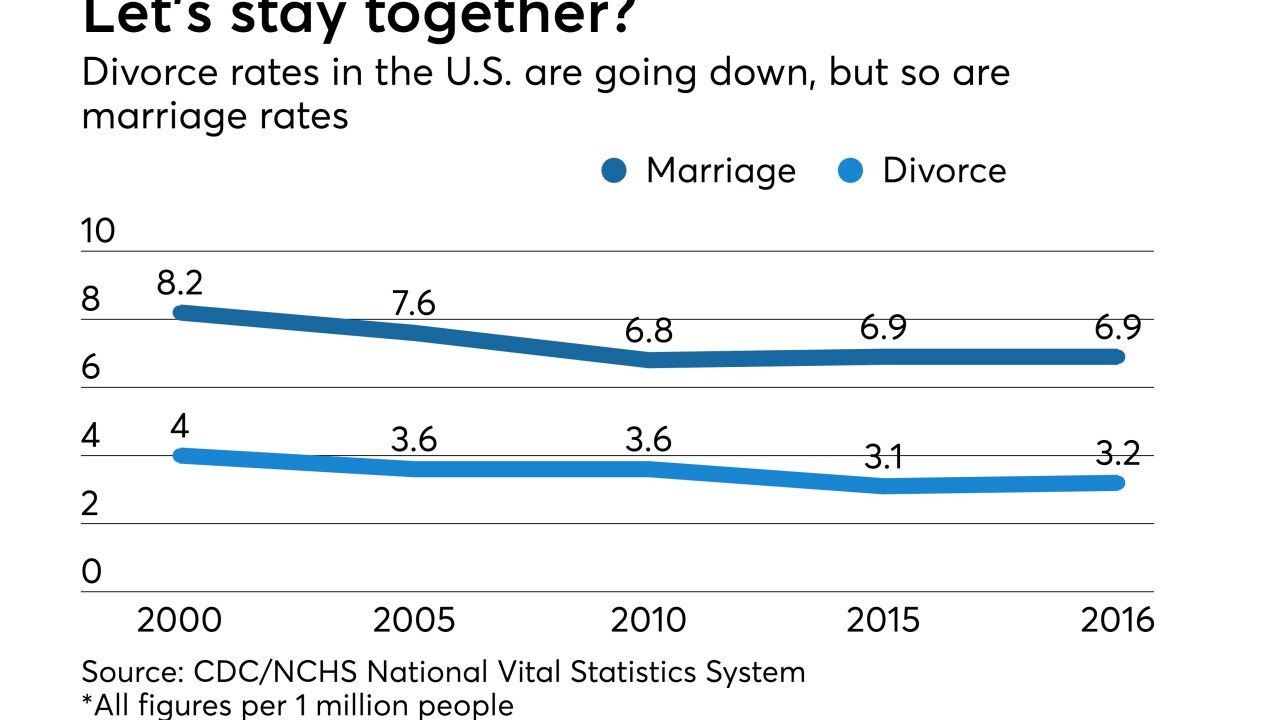

The latest Credit Union Trends Report from CUNA Mutual shows CUs serving more consumers even as the industry continues to contract.

March 20 -

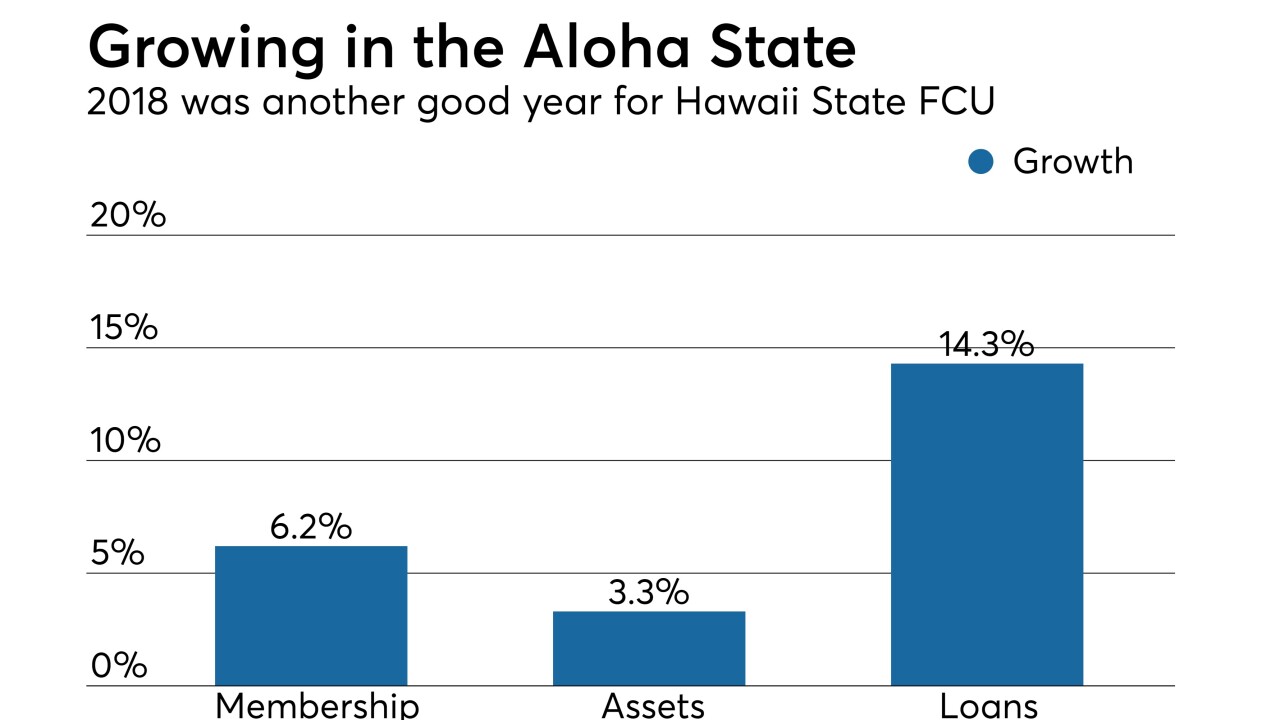

Credit unions in those two states also posted double-digit growth in total loans and recorded lower delinquency rates.

March 19 -

AI can help reduce risk, make more loans and find ideal members for credit unions.

March 19 2River Consulting Group

2River Consulting Group -

A handful of institutions are dipping a toe into a niche lending market that saw sales level off precipitously in the wake of the Great Recession.

March 19 -

Recent data from the National Credit Union Administration breaks down which states surged and which states struggled in 2018.

March 18 -

The National Credit Union Administration board held its monthly open board meeting Thursday – likely board member Rick Metsger's last hearing with the panel before two new members join.

March 14 -

Credit unions need to be thinking about pressure on net interest margins and declining revenues.

March 12 Credit Union National Association

Credit Union National Association -

The CUSO and tech giant have joined forces to help expand blockchian services to credit unions.

March 11 -

The proposed legislation would ease restraints on loan maturity limits.

March 8 -

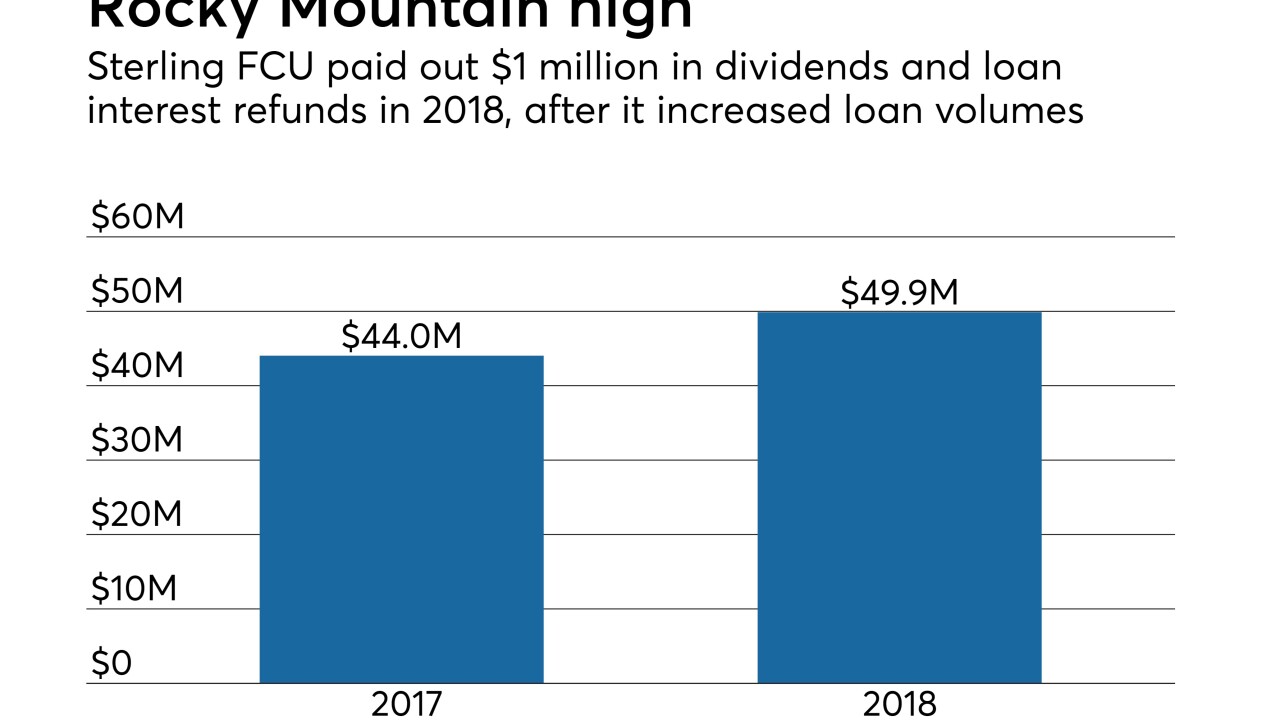

The Kansas-based institution saw growth in a number of areas last year, though increased staffing costs.

March 5 -

The payout included bonus dividends and a 7 percent refund of loan interest paid by members.

March 5 -

Credit unions are getting better at using data analytics to pitch loan refinancing options to members, though there are still some pitfalls with the strategy.

March 4 -

The latest Credit Union Trends Report from CUNA Mutual Group shows strong performance in membership growth and delinquencies, but lending is beginning to slow and could slow further by next year.

March 1 -

Year to date Sep. 30, 2018. Dollars in thousands.

February 19 -

Credit unions tout their readiness to assist with a variety of life stages, but a loan product for one of the most difficult potential life experiences is virtually nowhere to be found.

February 15 -

Among the 2018 highlights for the Honolulu-based credit union were a 108% rise in net income.

February 11 -

Banks that gather deposits through branches generally pay lower deposit premiums than those that solicit deposits online. So what happens if long-standing restrictions on brokered deposits are relaxed?

January 30 -

After struggling during the Great Recession, the Las Vegas-based credit union has now posted 27 consecutive quarters of positive results.

January 29 -

On Sep. 30, 2018. Dollars in thousands.

January 28