-

After launching a video-banking platform in 2016, Vibrant Credit Union has now rolled the program out across its entire branch network, citing high member satisfaction rates, a boost in lending and decreased wait times.

February 9 -

The Massachusetts bank — and former credit union — bought Cumberland County Mortgage in Maine.

January 31 -

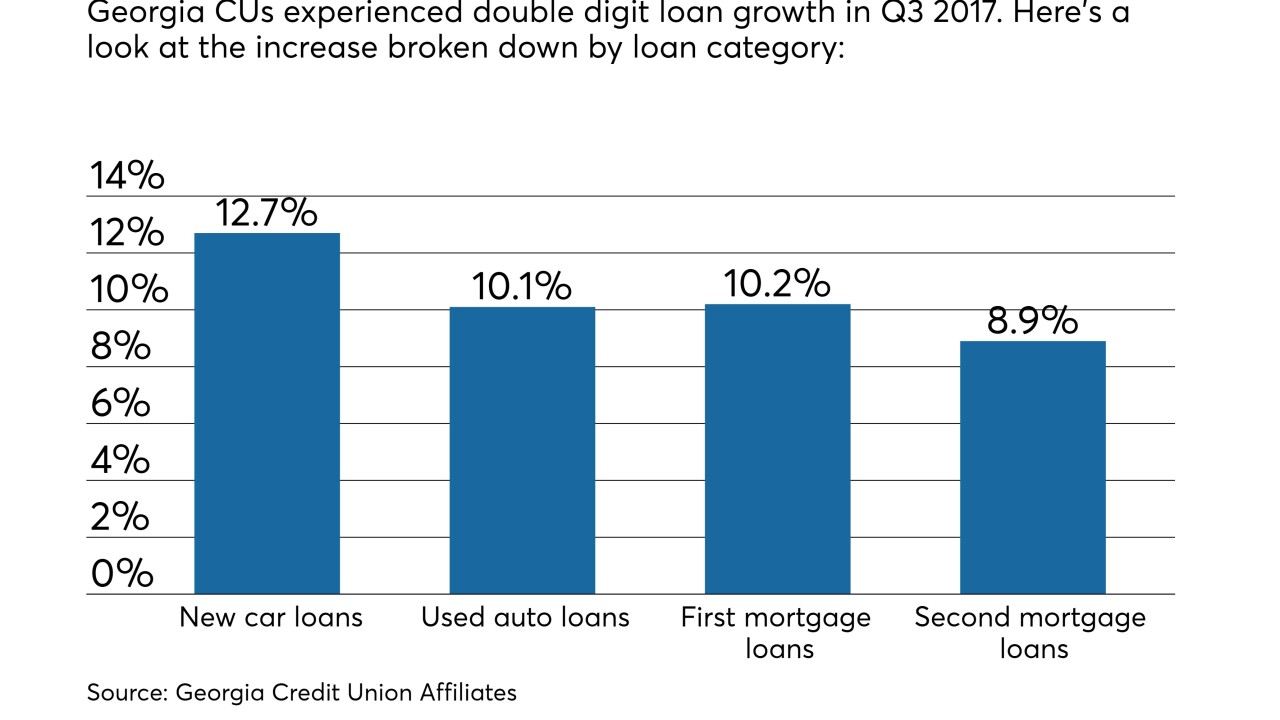

The increase was led by new car loans, which rose by 12.7 percent. Approximately 20 percent of the state's population are now credit union members.

January 31 -

Meta Financial expects to originate $500 million to $1 billion in personal loans as part of a three-year partnership with Liberty Lending in New York.

January 26 -

In a move rare for the industry, the bank bought a team of data scientists to bolster its artificial intelligence efforts in areas including product recommendations and fraud prevention.

January 16 -

Weak loan growth, a $3.25 billion litigation accrual and other costs tied to the phony-accounts saga all added up to a messy fourth quarter for the San Francisco bank.

January 12 -

Credit unions in the Gem State had a $638 million economic impact, according to a newly released study.

January 10 -

The Carson City-based credit union now has three wholly owned subsidiaries.

January 9 -

Auto lending, mortgages and MBLs are on a tear, and more than half the state's population are now credit union members.

January 5 -

The New York company, which offers loans and provides personal finance advice, plans to expand its product line and invest in new technology with the funds.

January 4