-

Blend Labs, a lending platform for financial companies, raised $360 million in an initial public offering price at the top of a marketed range.

July 16 -

Wells Fargo’s average loans tumbled in the second quarter as consumers and businesses, buoyed by pandemic stimulus programs, refrained from more borrowing.

July 14 -

Apple Inc. is working on a new service that will let consumers pay for any Apple Pay purchase in installments over time, rivaling the buy now/pay later offerings popularized by services from Affirm Holdings Inc. and PayPal Holdings Inc.

July 13 -

The Fed’s decision to extend a key liquidity program keeps the prospect of additional Paycheck Protection Program loans alive through July 31.

July 1 -

Banks such as Santa Cruz County Bank are now trading shares over the counter to capitalize on investors' bullish outlook for small lenders.

July 1 -

Even as lockdowns ease, the trend toward remote work poses challenges for building owners and the banks that lend to them.

June 30 -

A growing number of companies like Klarna, Sezzle and Circle let consumers split large purchases into smaller transactions paid over time. But they say they need to offer more than one product to set themselves apart and build customer loyalty.

June 18 -

Unchained Capital, a Bitcoin-based custody-service provider and lender, has raised $25 million in funding, valuing the company at $125 million.

June 4 -

Bank of Montreal’s fiscal second-quarter earnings beat estimates as the waning COVID-19 crisis allowed the lender to set aside less for souring loans and gave a lift to the company’s personal and commercial banking businesses.

May 26 -

The private-label card issuer says that, as merchants reopen, now is the time to realize the benefits of its 2020 acquisition of the buy now/pay later company Bread.

May 26 -

A group of fintech venture capital firms have made a fresh investment in Resolve, a firm that offers alternative supply chain finance.

May 25 -

Year to date Dec. 31, 2020. Dollars in thousands (Dec. 31, 2020)

May 17 -

Applications for small business and commercial real estate loans are rising, creating some optimism among lenders — and more temptation to loosen standards to land those borrowers.

May 13 -

Small-bank executives are more optimistic about future loan demand than at any point since 2017, but they have mixed feelings about how to fund upgrades to the nation's roads, bridges and other infrastructure — if at all — according to a new survey by IntraFi Network.

May 11 -

Many younger people are looking for financing and are averse to traditional credit cards, says Four's Chaim Lever.

May 6 Four

Four -

Citizens Bank and Barclays US are among the lenders expanding in this market — with or without fintechs on board.

April 30 -

Citizens Bank and Barclays US are among the lenders expanding in this market — with or without fintechs on board.

April 30 -

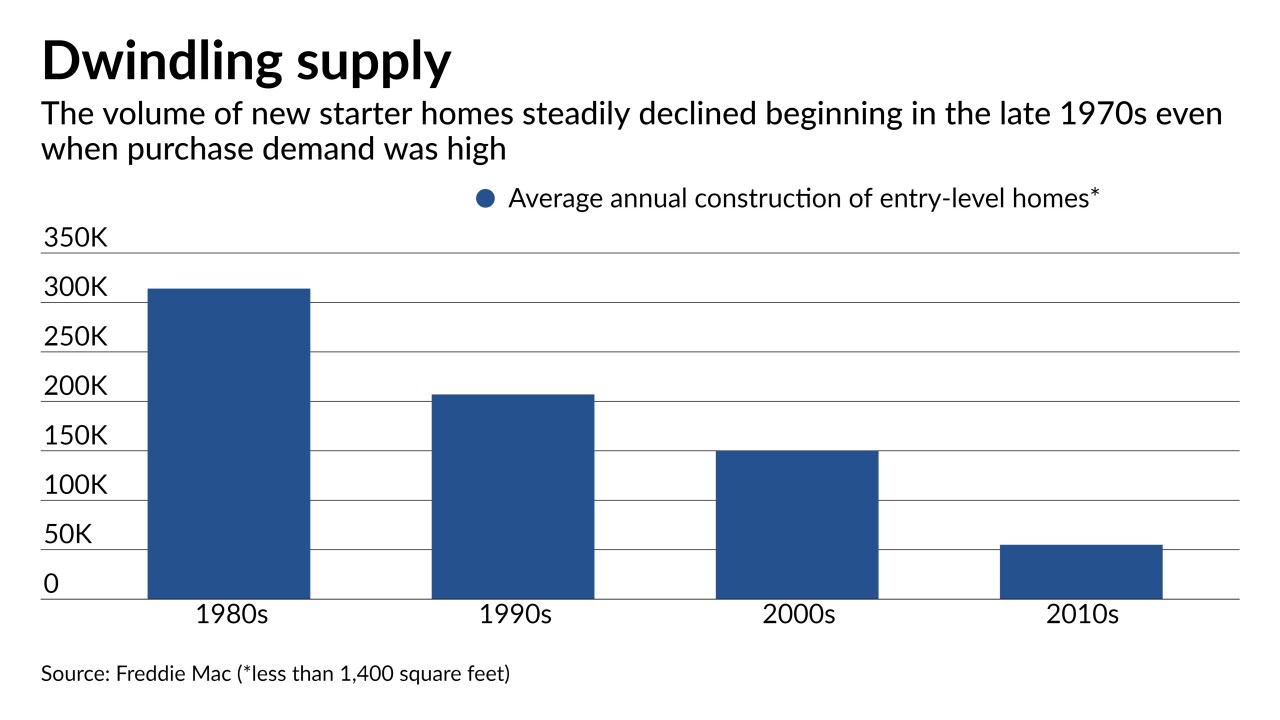

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

April 27 -

On Dec. 31, 2020. Dollars in thousands.

April 26 -

The New York bank, which holds deposits for the stablecoin firm Circle and enables payments for the smart contract provider GreenBox, wants to provide loans to crypto firms as well.

April 22