-

Several megabanks have sued the National Credit Union Administration claiming breach of settlement in a previous case related to mortgage-backed securities, but trends may favor the agency.

March 6 -

The settlement would mark a rare instance where the bank stands to benefit monetarily from a scandal that has severely damaged its reputation and cost it hundreds of millions in penalties.

March 1 -

A federal judge has offered a split decision in a suit regarding Marriott Employees Federal Credit Union, denying plaintiffs' request for damages but refusing to throw the case out entirely.

March 1 -

At least five banks have warned about the potential loss of tax benefits if it is proven that DC Solar operated an investor scheme.

March 1 -

The effort comes more than a year after Republicans successfully blocked a CFPB rule that would have banned mandatory arbitration clauses in financial contracts.

February 28 -

Lawmakers should step in to address the proper status of loans made by banks that have partnered with fintechs, rather than letting the courts decide.

February 12 Auriemma Consulting Group

Auriemma Consulting Group -

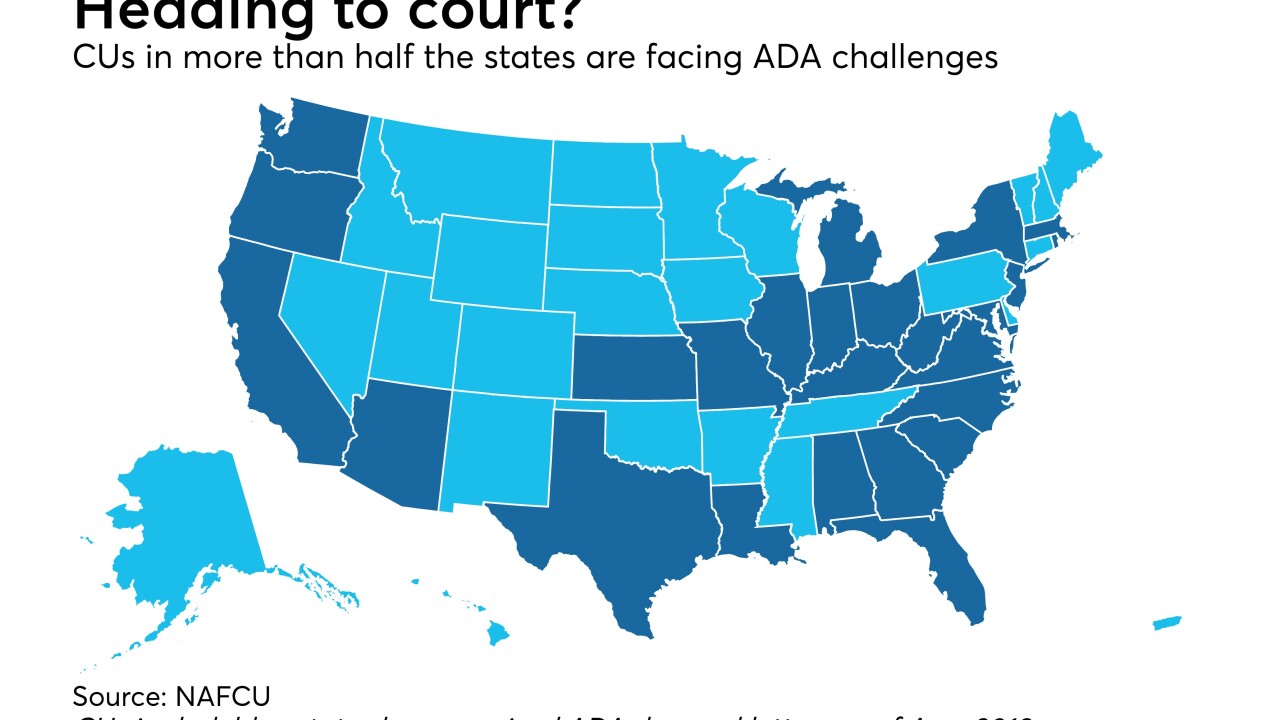

At least 14 suits have been filed this year alone accusing banks of operating websites that violate the Americans with Disabilities Act. Some banks prefer settlements to investments in technological overhauls, but experts say that strategy could be costlier in the long run.

February 10 -

A federal judge in Texas has ruled a website is not a physical place and is not subject to the Americans with Disabilities Act.

January 28 -

Trade groups have filed paperwork supporting two Michigan credit unions facing ADA suits, but a similar suit against Domino's Pizza could cloud the issue.

January 24 -

Federal regulators should consider applying guidance that is nearly two decades old to end uncertainty about the legality of particular bank partnerships.

January 17 Pepper Hamilton

Pepper Hamilton -

Industry trade groups, which have been active in fighting lawsuits that allege violations of the Americans with Disabilities Act, hailed the decision.

January 3 -

Linda Levy, CEO of Lower East Side People's Federal Credit Union, has no regrets about suing President Trump when he appointed Mick Mulvaney to run the CFPB, despite some negative reactions from her credit union colleagues.

December 28 -

CUNA and the credit union leagues of Illinois and Wisconsin filed a brief in support of an institution that is embroiled in litigation over whether its website meets the requirements of the Americans with Disabilities Act.

December 21 -

The Maryland-based credit union sued the nation's largest CUSO over call center services, but the two sides didn't take long to come to an agreement.

December 20 -

The industry spent a good portion of 2018 fighting ADA and overdraft lawsuits, and experts say despite some progress, next year could hold more of the same.

December 20 -

A number of credit unions have been hit with lawsuits that claim they have charged members overdraft fees despite there being sufficient funds in checking accounts.

December 11 -

An institution in California calling itself Indian Federal Credit Union purports to be operational but does not have all the required regulatory approvals.

December 10 -

The Massachusetts senator said the government’s findings bolster allegations that the servicer steered borrowers into expensive student loan forbearance plans.

November 20 -

The bank recently notified an upstate New York man that he was wrongly denied a mortgage modification, and enclosed a $25,000 check. But details of what went wrong have been hard to come by.

November 13 -

A judge dismissed two of the six counts against the Mass.-based credit union, meaning DFCU will join several other CUs nationwide facing similar suits.

November 12