M&A

M&A

-

The company, which operates private-label and cobranded credit card and loyalty programs, plans to spin off its loyalty operations this year to improve ADS' financial performance.

May 12 -

The Denver company, which has branches in El Paso, will gain more locations in cities such as Dallas and Austin with the pending purchase.

May 12 -

Both credit unions are based in Pittsfield, Massachusetts.

May 11 -

After more than 100 years of mostly in-person operations, the subprime installment lender is seeking to adapt to changing consumer preferences — launching an online loan platform just before the pandemic and recently striking a deal to acquire a financial wellness app.

May 10 -

American Express is trying to differentiate itself from other card networks by making loans through its bank and incorporating accounts payable services and lending technology it inherited with its acquisitions of Acompay and Kabbage.

May 10 -

American Express is trying to differentiate itself from other card networks by making loans through its bank and incorporating accounts payable services and lending technology it inherited with its acquisitions of Acompay and Kabbage.

May 10 -

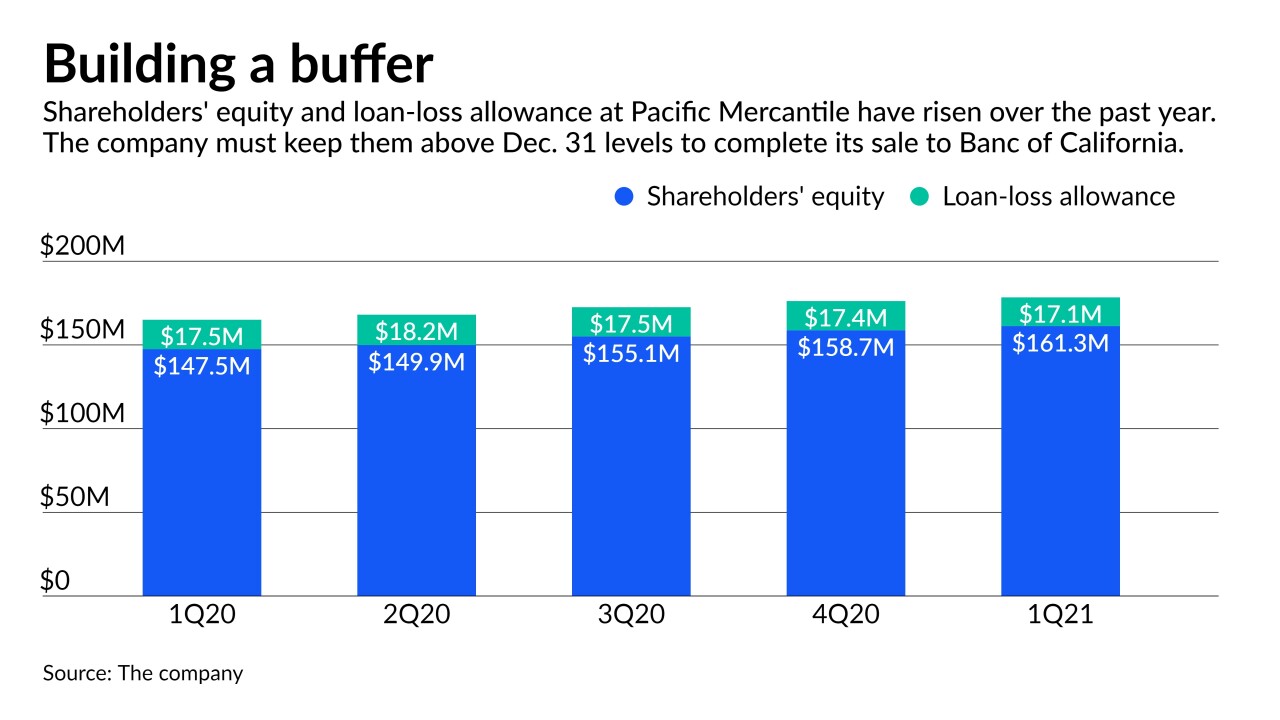

About 13% of Pacific Mercantile Bancorp's loans are tied to high-risk sectors such as entertainment and food services. The company must build shareholders' equity or its loan-loss allowance above last year's levels to make sure the sale goes through.

May 6 -

National Australia Bank and Australia & New Zealand Banking Group, the country’s third- and fourth-largest lenders by value, are in talks with Citigroup over the assets, according to people familiar with the matter.

May 5 -

The Arkansas company will gain branches around Nashville as part of the acquisition.

May 5 -

The company agreed to pay $104 million for a one-branch bank with $391 million of assets.

May 5