-

Capital One Financial Corp. introduced a tap-to-pay mobile-payments service, becoming the first major U.S. bank to offer such functionality in competition with Google Inc.'s Android Pay.

October 14 -

Bank of America's long effort to become a slimmer, more profitable retail bank could be starting to pay off. In a tough quarter for revenue growth, its consumer banking division gained traction thanks to branch consolidation, investments in mobile banking and other factors.

October 14 -

IDology, an Atlanta provider of fraud-prevention and identity verification, has made an equity investment in the mobile identity authentication provider Payfone.

October 13 -

In a Q&A, Hari Gopalkrishnan, who oversees mobile banking for Bank of America's consumer and wealth management operations, discusses the mobile trends of the past year, including the difference between what its technology is capable of doing and what consumers are willing to adopt.

October 8 -

The central bank originally established a 10-year time horizon for completing upgrades to the nation's aging electronic payment system. But a task force convened by the Fed thinks that's not ambitious enough.

October 6 -

Independence Bancshares in South Carolina last week fired its CEO and gave up its dreams of shaking up the payments world after losing nearly $9 million on the effort. Many details are still unknown, but it looks like a case study for what can go wrong when community banks invest in technology.

October 6 -

Banks worldwide are in danger of losing significant profits in several lending areas to nonbank alternative lenders, according to a McKinsey study.

October 1 -

BB&T has rolled out a digital banking platform that lets customers customize which features appear once they log in. It saves the bank having to decide what to show and what to hide on devices with different screen sizes.

September 30 -

The collaboration between financial institutions and technology firms runs deep, but banks' recent criticism of lax regulatory oversight for nonbanks reveals fissures.

September 25 -

A Nevada firm is trying to make debt collections easier, friendlier and more interesting on a smartphone app designed for the underbanked. The new app, called PaySwag, is being marketed to banks and other companies to foster a more proactive approach to collections.

September 24 -

The quest for secure, yet really quick and easy enrollment and login for bank accounts, has evaded banks for years, and its become more important than ever.

September 17 -

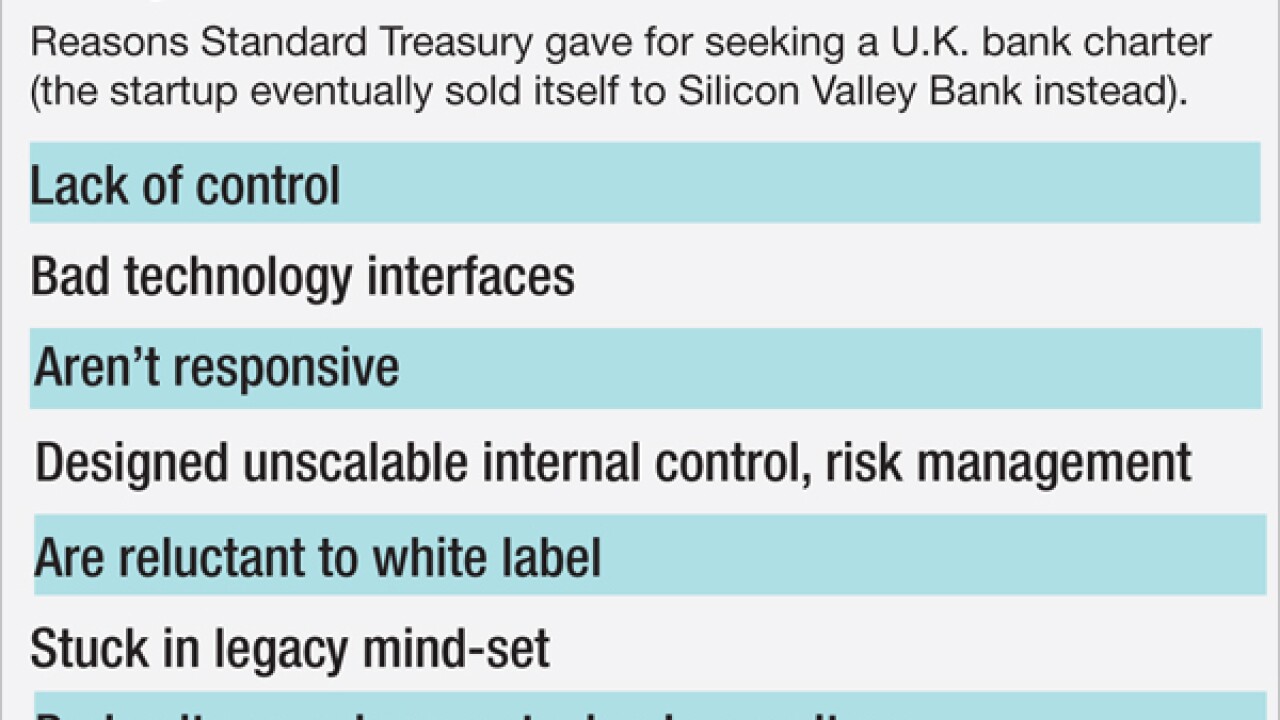

Among other reasons for seeking their own charters, the U.K.'s so-called challenger banks say they need to avoid being beholden to older institutions that can slow down the creative process.

September 16 -

The rest of the credit card industry continues to be dogged by slow loan growth, but retail-branded cards are bouncing back, thanks largely to a big push by merchants.

September 14 -

Apps that help people manage their money on a day-to-day basis are all the rage among millennials. Here are the most effective of the bunch.

September 10 -

Bankers are already planning app improvements after seeing the new features of the Apple Watch, iPhone 6S, iPad Pro and Apple TV that were revealed this week.

September 10 -

Citizens Financial Group in Providence, R.I., has been picked by Apple to provide financing to customers who want to upgrade to a newer model iPhone.

September 10 -

BBVA Compass' Simple said it has removed fees for its checking accounts and other banking transactions.

September 10 -

Graduate business students some of whom previously worked at traditional financial services companies have been organizing fintech clubs at universities to explore the dramatic changes in banking and to find potential employers.

September 8 -

Ally Financial has extended the cutoff time for accepting check deposits that are credited the next day.

September 4 -

First Internet Bank is pioneering eye-vein recognition to let customers log in to its mobile app, hoping consumers' distinct concerns about this form of biometric authentication fade away.

September 4