-

Fifth Third Bancorp is turning to a veteran of the consumer goods industry to help shape its approach to innovation.

April 28 -

Success rates vary wildly for innovation labs, but some basic principles increase a banks chances of the incubation process leading to viable product expansion.

April 28

-

Innovation in financial services faces a hurdle in the narrow, short-term profit motives of predatory patent trolls. Here is what startups can do to ward off attacks.

April 28

-

Wells Fargo will soon roll out eyeprint verification for its commercial customers using its mobile banking platform.

April 27 -

Two startups are working to educate millennials on the importance of credit and issue them small credit lines. Credit to young adults largely dried up following the CARD Act of 2009, which changed the way banks and others could market to the group.

April 27 -

Technology startups diving into mortgage lending are doing a lot of things well except servicing, warned a mortgage industry consultant who has advised them.

April 26 -

Hypur, a startup seeking to help banks serve businesses deemed high compliance risks (e.g. marijuana), has recruited a former Department of Justice lawyer to help build credibility. Its signature product: a payments platform to replace cash transactions.

April 25 -

JPMorgan Chase has added fingerprint authentication for customers on Android devices.

April 25 -

Community banks are grappling with a quickly changing operating environment, but they might have some practical advantages over large banks in building partnerships with fintech firms, and those relationships could give them the competitive edge they seek.

April 22 -

Traditional banks are not likely to match the nimbleness of a fintech startup for a whole variety of reasons. But that doesn't mean all is lost.

April 21

-

Ally Financial has launched a mobile app that uses geolocation to caution smartphone-carrying customers when they are arriving at stores where they overspend.

April 18 -

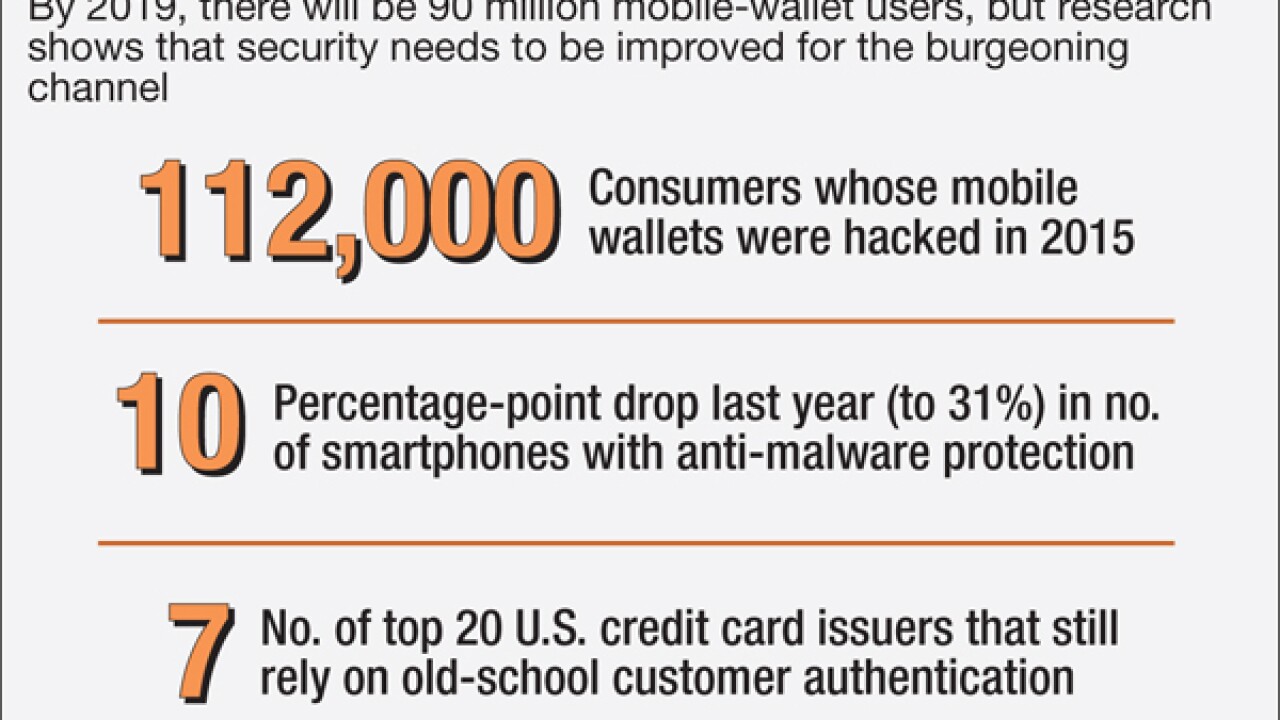

As mobile wallets become more popular they'll also become more popular targets for fraud. Banks ought to improve enrollment guidelines and other security tools in plotting their mobile-wallet strategy.

April 18 -

The Memphis, Tenn., company's forecast for the remainder of the year calls for cost saves from a branch-reduction effort that's gaining momentum as online and mobile banking grow and monthly visits to branches plummet.

April 15 -

It sounds like a bad idea to seat customers in front of a screen to open accounts or get other higher-level services from remote banking officers, but BluCurrent Credit Union in Springfield, Mo., turned to video banking to cure its branch traffic woes and its members seem to like it.

April 15 -

To get more Americans into the financial system, the industry must find ways to help more people get access to the Internet.

April 14

-

Banks are starting to use Facebook Messenger as a way to connect with customers. For now, such interactions will be limited and largely based on artificial intelligence. Down the road, the move could place Facebook deeper into the lives of its customers and could give it an entrée into financial services.

April 13 -

Retail banks must reinvent the way they charge consumers for their services at a time when institutions are struggling for profitability.

April 13 Sontiq

Sontiq -

Bank of America customers could soon interact with the bank via Facebook's Messenger app, the banking company said Tuesday.

April 13 -

Before banks are truly integrated into the digital landscape, they must break down data silos and implement steps to make data more accurate and actionable.

April 12 CCG Catalyst

CCG Catalyst -

Banks are slowly warming up to the idea of open APIs, essentially tools that allow banks to easily connect with others, but BBVA's Shamir Karkal says that they will likely also push banks to modernize their core systems.

April 11