-

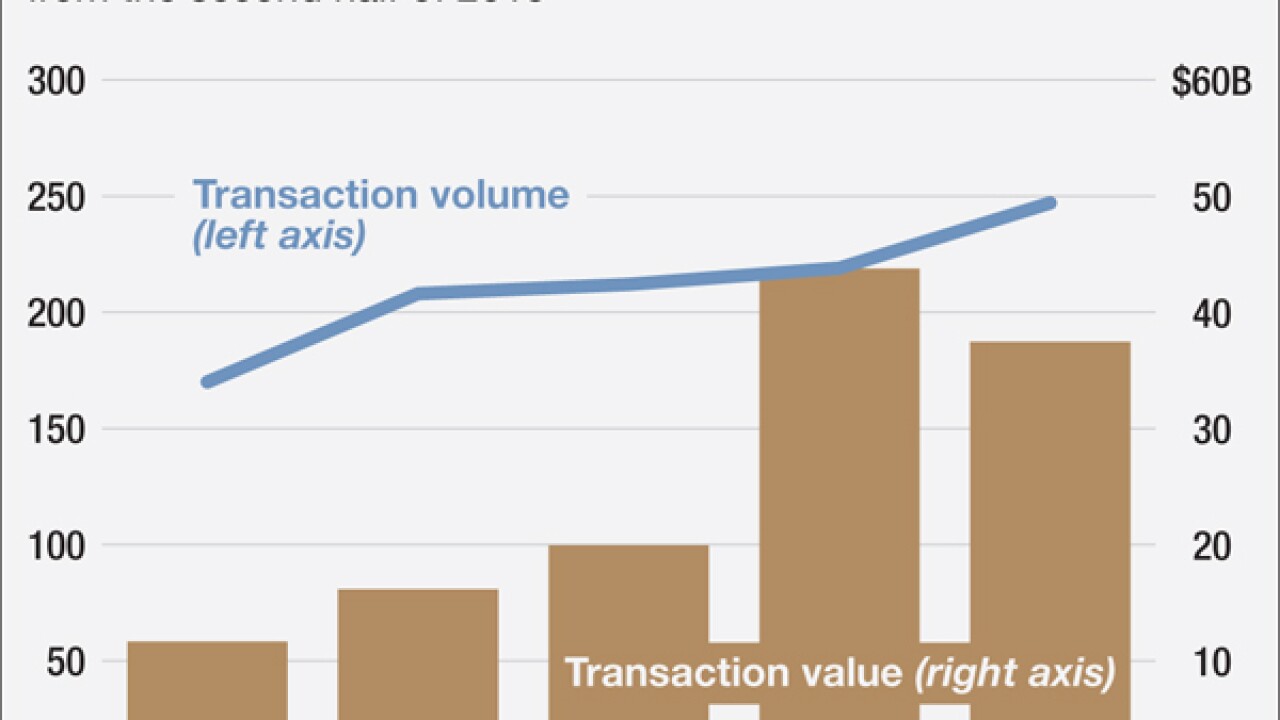

Banks have found a novel way to fend off fintechs plans to take them down: they are funding it. A new report shows corporate venture capital investors, such as those backed by banks, made up nearly a third of funding in the second quarter.

August 17 -

Citigroup lost a big technology executive last week and hired another from JPMorgan Chase. Then word surfaced that JPMorgan had decided to replace that exec anyway and a successor was ready to go. It all shows scoring top digital talent has become vital to the largest banks as mobile becomes their future.

August 16 -

Longtime JPMorgan Chase veteran Bill Wallace is set to become digital chief for its consumer bank.

August 16 -

Gavin Michael, head of digital banking for JPMorgan Chase's retail unit, is moving to Citigroup.

August 16 -

PNC Financial Services Group has expanded its support of mobile wallets to Microsoft devices.

August 15 -

The federal government recently began to discourage companies from using SMS-based authentication in their two-factor authentication schemes. So do banks need to completely eliminate authentication via text message? Not entirely.

August 12 -

In 2008, the smartphone revolution had begun but there were no mobile-first banks and brick-and-mortar institutions were still watching whether mobile banking would actually catch on with consumers.

August 12

-

Application programming interfaces are the connective tissue of the digital transformation at banks. Their role is getting more important as consumers look for more ways to connect.

August 10 -

Banks need to embrace technology that can deliver the speed and personalization millennials have come to expect or risk losing this customer segment to fintech companies for good.

August 10 CCG Catalyst

CCG Catalyst -

The U.S. is steadily building the foundation of a nationwide faster payments system, but not all of the pieces are connected. Many of the elements developed independently, with influence from across the globe.

August 9 -

Bank of America, which spends about $1 billion a year handling cash, will save money and require fewer employees as more customers make payments electronically, Chief Executive Officer Brian Moynihan said.

August 4 -

The startup firm Paymency is seeking to offer an API-driven "banking-as-a-platform" service to the U.S. financial services industry.

August 3 -

Bots have slowly begun to creep onto the online payments scene, and they could offer a whole new, simpler way to part with our cash.

August 3 SecurionPay.com

SecurionPay.com -

What was true in the late 1700s, the 1970s and the 1980s is still true today: bank customers want to interact with real-life people when managing finances.

August 2 K.H. Thomas Associates

K.H. Thomas Associates -

A handful of banks and fintech companies are letting bank customers connect via chat bots on platforms like Slack of Facebook messenger. Some say this is the next big thing, while others say the technology still has a ways to go.

August 1 -

The private equity firm GTCR is interested in fintech companies looking to disrupt the status quo, so long as they have proved themselves and are paired with managers who have a long track record of success.

July 29 -

Pokémon Go has taken the U.S. by storm, to put it mildly. For an app that was released very recently, it already has more users than Twitter and is beating Facebook on daily engagement.

July 29 Cardlinx

Cardlinx -

The popular German digital startup Fidor Bank has agreed to be acquired by Groupe BPCE, the second-largest French bank.

July 28 -

Banks need to improve their use of technology designed for small-business customers soon, or risk losing them.

July 28 -

A less discussed but arguably more important application of the blockchain is to help serve the unbanked masses, including refugees.

July 28 PricewaterhouseCoopers

PricewaterhouseCoopers