-

The competition has leading-edge technology, but consumers may be looking for more than just bells and whistles when choosing where to do their banking.

September 18 Agora Services

Agora Services -

A survey conducted by Harris Poll and commissioned by Plaid found that 60% of U.S. adults are using more apps to manage money since the onset of the pandemic.

September 15 -

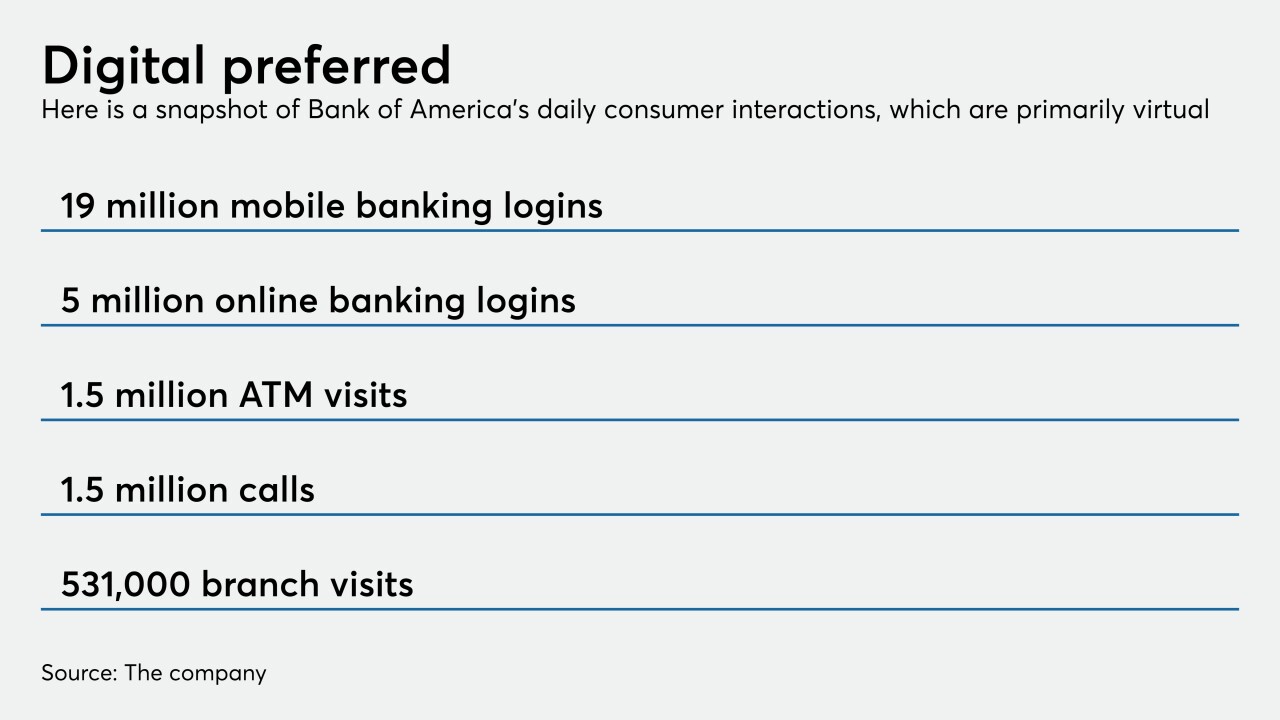

BofA, which has applied for or been granted thousands of patents, has been working recently on technologies that analyze spending patterns to give budgeting advice and use augmented reality to provide estate-planning services.

September 14 -

The fintech and the Minnesota bank it acquired last week, renamed Mid-Central National Bank, intend to pioneer a new method of storing and moving money for consumers.

September 8 -

Institutions considering new technologies must ask themselves what they're looking for not just from a product but from a partner.

September 4 PenFed

PenFed -

Texas Trust Credit Union boosted loan volumes with a marketing tool inspired by “Game of Thrones,” but gamification strategies can be risky in light of data privacy concerns.

September 4 -

The bank is making continuous improvements, including integrating Merrill Lynch accounts into its banking app and adding a security feature to Zelle.

August 31 -

T-Mobile Money is now being offered to the 150 million customers of the combined wireless carriers, which merged this spring.

August 24 -

T-Mobile Money is now being offered to the 150 million customers of the combined wireless carriers, which merged this spring.

August 24 -

s part of a global financial community, we must consider the long-term impact and see financial inclusion as a fundamental priority as we look to rebuild a fairer, more sustainable world, says Icon Solutions' Darren Caprehorn.

August 7 Icon Solutions

Icon Solutions -

Five banks, including BBVA USA and BMO Harris Bank, and one credit union will begin offering Google-branded bank accounts in 2021.

August 3 -

Heritage Bank and Dime Community Bank are among those financial services firms taking online and app-store reviews seriously. Here’s why all banks should pay attention.

July 31 -

Two credit unions' approaches to digital banking helped them provide superior member service as the coronavirus limited in-branch interactions.

July 24CU Rise -

Voice and text banking will be embedded in the Minneapolis bank's mobile app through a chatbot assistant that also caters to users with disabilities.

July 23 -

HSBC is planning to shift services away from its branches in a push to make more of its customers migrate to its digital and mobile channels as it embarks on a massive cost and jobs cutting program.

June 26 -

The company’s U.S. chief executive says the primary goal behind the app it rolled out Wednesday is to help customers improve their financial health and avoid overdrafts.

June 24 -

The pandemic has propelled digital banking to the forefront faster than expected and in ways that will have a lasting impact for credit unions.

June 24 Member Driven Technologies

Member Driven Technologies -

Mobile banking use has swelled since the pandemic hit, and law enforcement officials expect hackers to target the credentials of digital novices. The FBI stressed the importance of two-factor authentication and ensuring consumers know how to spot fake apps that carry malware.

June 15 -

The success of Isbank's Maxi service is a lesson for all banks: Chatbots, with the right training, can provide the kind of human touch customers need in times like these.

June 12 -

Mobile banking use has swelled since the pandemic hit, and law enforcement officials expect hackers to target the credentials of digital novices. The FBI stressed the importance of two-factor authentication and ensuring consumers know how to spot fake apps that carry malware.

June 11