-

Banks need to stake out a presence on platforms that have nothing to do with banking.

January 2 -

The banking industry has long been critical of the government-sponsored enterprise, but the system could provide valuable banking services to large swaths of the country currently lacking access to them.

January 2 Duke Financial Economics Center

Duke Financial Economics Center -

The cost of Wells Fargo's scandals continues to rise as regulators from all 50 states forced the institution to pay hundreds of millions in penalties for the creation of fake accounts, improper enrollment in life insurance, force-placed auto insurance policies and other activities.

December 28 -

After 10 years of conservatorship, the new year could finally usher in big steps toward housing finance reform.

December 27 -

Rushing to copy the Amazon experience, banks and fintechs are focused on simplifying financial services online. A Georgia Tech researcher says that approach is risky.

December 27 -

Investors are spooked by banks' exposure to oil and other sectors threatened by a global slowdown as well as by policy uncertainties, but banks argue credit quality is strong and recession fears are exaggerated.

December 26 -

The mortgage industry heads into 2019 with little relief from the market strains of the past three years. To succeed — or at least survive — lenders must confront major questions about demand, affordability and market consolidation.

December 26 -

The industry could see a boost in mortgage lending from regulatory changes, but other factors may slow growth.

December 26 -

The Consumer Financial Protection Bureau issued guidance late Friday that will shield some new mortgage data from the public that lenders are required to report.

December 21 -

The House Financial Services Committee held a hearing to examine the outgoing committee chairman's bipartisan GSE reform bill, but lawmakers were already looking ahead.

December 21 -

The process to confirm Mark Calabria as FHFA director could be lengthy, forcing the White House to consider how it will proceed with housing finance reform under Joseph Otting as acting head of the agency.

December 21 -

The White House said that Comptroller of the Currency Joseph Otting will serve as acting director of the Federal Housing Finance Agency beginning Jan. 6, after Director Mel Watt’s term ends.

December 21 -

Selling $1.6 billion in mortgages, and paying off a similar amount of wholesale borrowings, will allow the company to expand its net interest margin in 2019.

December 21 -

Student loan debt — now at $1.5 trillion in the U.S. — is arguably the greatest pain point for consumers in their 20s and 30s. To court that demographic, banks are increasingly offering help with refinancing and repayment.

December 20 -

Atlantic Equities’ John Heagerty cut his recommendation on JPMorgan Chase to neutral, saying the bank now “offers the least upside” to price targets among the major banks.

December 19 -

The Trump administration wants to work with Congress on freeing Fannie Mae and Freddie Mac from government control, though it's considering pursuing some changes on its own, Treasury Secretary Steven Mnuchin said Tuesday.

December 18 -

Along with a core conversion, the Twin Cities-area credit union deployed new loan origination systems and online and mobile banking platforms.

December 18 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

The current deputy secretary of the Department of Housing and Urban Development, Pam Patenaude, will step down in January.

December 17 -

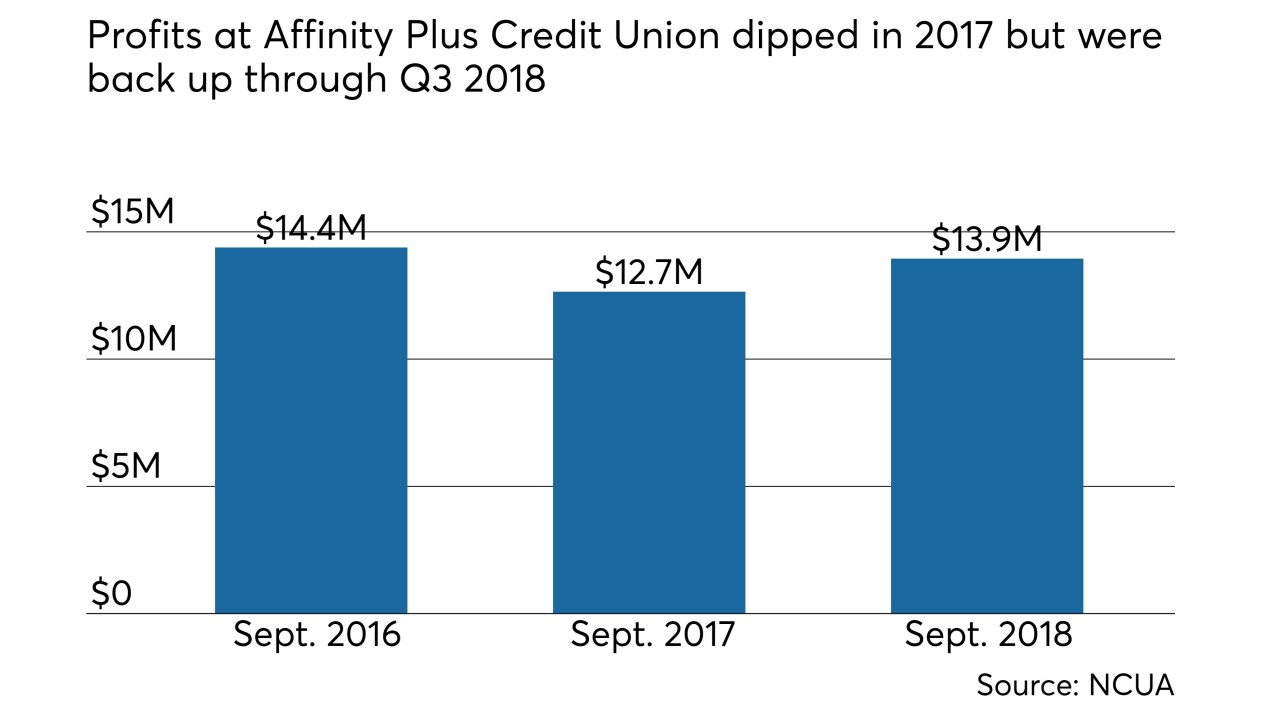

On Sept. 30, 2018. Dollars in thousands.

December 17