-

A record amount of funds have flowed into banks since the coronavirus hit, but a low-rate environment and tepid loan demand are complicating efforts to put that money to work.

June 17 -

Past is not prologue, and a successful strategy for becoming a top-performing bank in 2020 is very different from what it might have been just six months ago.

June 5

-

Fallout from the coronavirus pandemic is pressuring banks that have relied on expansion efforts and fee income to produce outsize investor returns.

June 4 -

With rates so low — after steep emergency Federal Reserve cuts in response to the pandemic’s fallout — banks will struggle to generate bread-and-butter interest income and asset-sensitive lenders will face substantial net interest margin contraction this year and next, analysts say.

May 18 -

Even CUs that don’t directly serve the oil and gas industry are likely to be impacted, experts say.

May 6 -

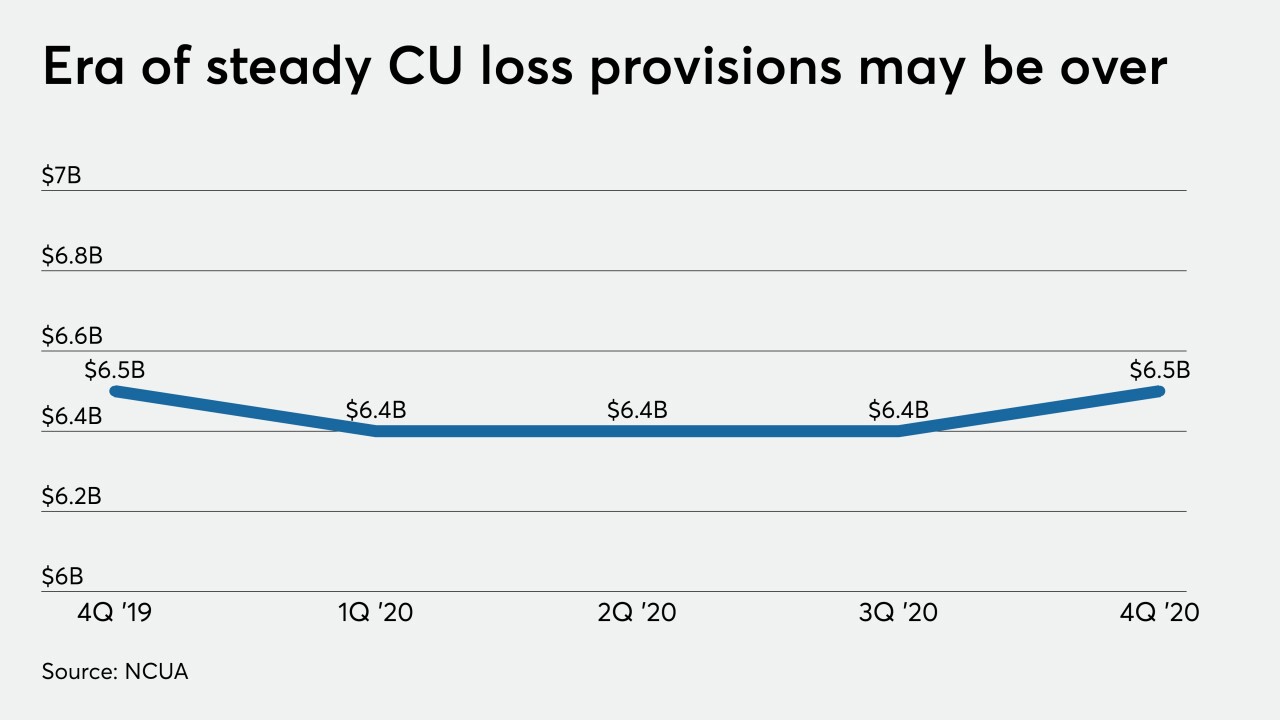

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20 -

Bankers will be pressed on upcoming earnings calls to forecast how the coronavirus pandemic — and the government's response — will shape credit quality, margins and fee income.

March 25 -

Margins will be squeezed after the Federal Reserve lowered interest rates earlier this month to counteract the economic fallout from the coronavirus.

March 25 -

Credit unions intensified their focus on gathering deposits in 2019 but many institutions are still looking for cheaper core funding.

March 12 -

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

March 3 -

The FDIC’s Quarterly Banking Profile said lackluster net interest income, likely resulting from lower short-term interest rates, drove a decline in fourth-quarter and full-year earnings.

February 25 -

Cassandra McKinney's promotion to executive vice president of the retail bank is the latest executive move by Curt Farmer, who became the Dallas company's CEO in April.

January 29 -

Commercial lending was sluggish in 2019, but leaders at Huntington, KeyCorp and M&T are encouraged that rates are stabilizing and business sentiment is improving.

January 23 -

Fourth-quarter fees earned from managing the assets of family offices rose 12% and were a powerful counterbalance to tighter margins.

January 22 -

While the New York bank has a handle on deposit pricing, Joseph DePaolo said a new accounting standard will play tricks with how it addresses credit quality.

January 21 -

While the Maryland company claimed it has margins and credit issues under control, it couldn't provide any clarity on rising legal expenses.

January 16 -

Brian Moynihan said banks must be mindful of pricing and risk as they contend with lower yields on loans and securities.

January 15 -

The country's biggest bank is leaning more on fee income to offset rate pressures, expanding in selected U.S. cities and laying the groundwork for operations in China that CEO Jamie Dimon hopes will endure “for 100 years.”

January 14 -

Net interest margin pressure, modest loan growth and limited operating leverage could weigh on bank stocks in 2020, UBS analysts said.

January 7 -

Steuben Trust received two bites from potential MOE partners, but the New York bank’s lightly traded stock and many other challenges forced a sale to a much larger rival instead.

January 2