-

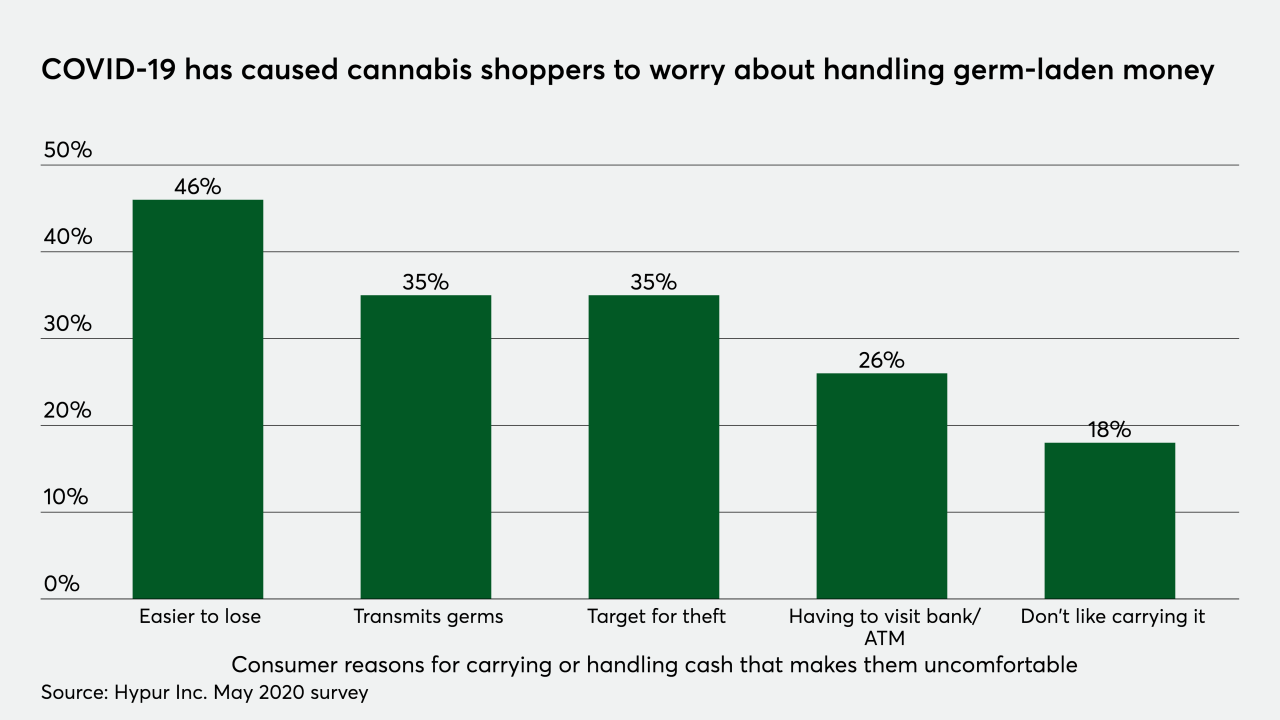

One area of certainty in the 2020 election is the momentum for legalizing cannabis, as a string of ballot box victories makes it harder for banks to avoid working with dispensaries and other legal marijuana businesses.

November 4 -

In a major break from the Payment Card Industry security standards playbook, merchants and service providers using newer technologies would have the opportunity to rewrite network operation and testing procedures when achieving compliance.

November 3 -

As the pandemic and economic downturn take their toll on consumer spending, the card companies are relying on scale, partnerships and subsidiaries to turn consulting, security and fast technology deployment into new and sustainable revenue streams.

November 2 -

As merchants and consumers increasingly favor contactless payments over the course of the COVID-19 pandemic, Visa is removing obstacles to contactless acceptance.

October 21 -

Visa on Monday made an investment in Global Processing Services, which powers the payment rails for several challenger banks and fintechs. It's similar to a January investment Mastercard made in Marqeta, an open API card issuing and processing platform.

October 19 -

The upcoming U.S. election could move the cannabis industry closer to the mainstream, but legal dispensaries will still have to deal with workarounds to accept card or mobile payments.

September 3 -

Discover is working to help Black-owned businesses and other merchants maintain foot traffic — safely — through the use of the card network's payments technology and its marketing heft.

September 3 -

With consumers and merchants alike sharing the need to be paid faster, the case for adopting real-time payments globally has quickly advanced during the COVID-19 pandemic.

August 28 -

Advocates of allowing merchants to add a surcharge to defray the cost of credit card interchange have had to overcome network bureaucracy, state laws and even ingrained habits among the merchants themselves.

August 25 -

A rise in chargebacks has renewed a push for an independent standards body by the SPP, formed in 2018 to represent merchant groups .

August 18 -

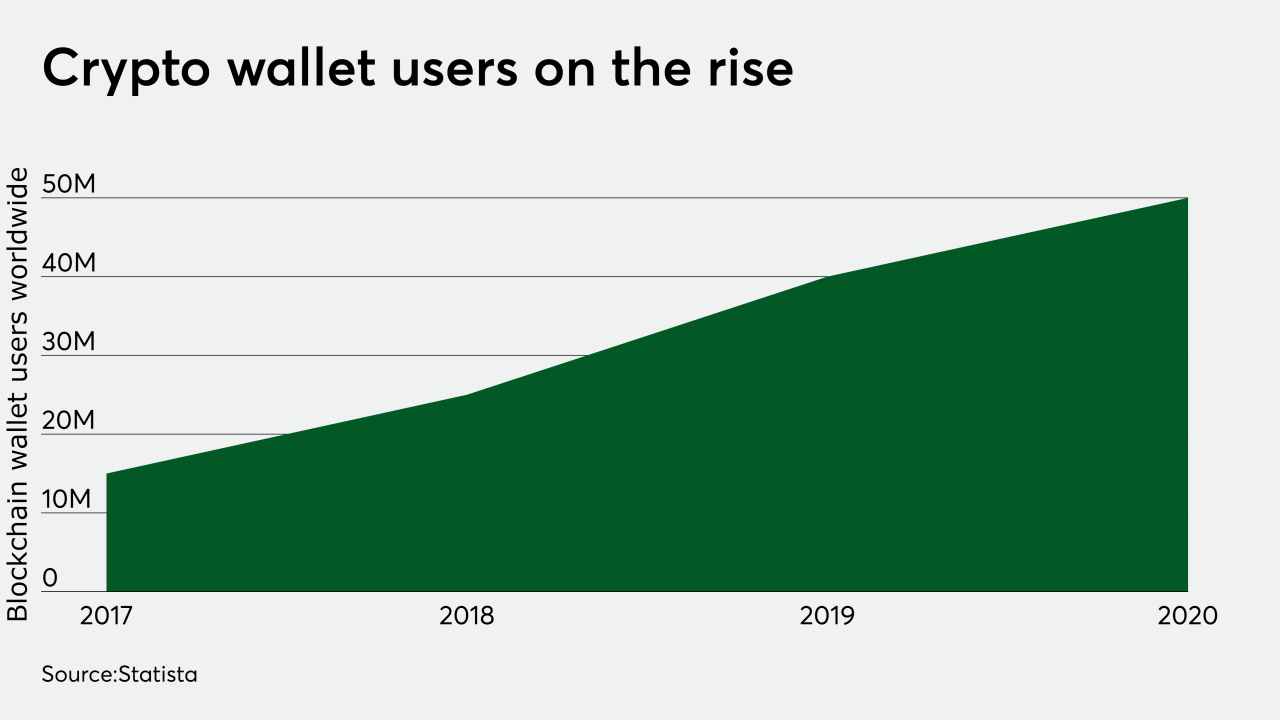

Major payment companies have long looked on at cryptocurrencies as too risky to touch, but too tempting to ignore. Mastercard's latest move indicates that the card brands are ready to make a firm pitch for crypto spending.

August 13 -

The major card networks have heavily invested in broader services as transaction processing loses its luster, a strategy that’s provided a ray of hope as retail and travel industries remain sidelined.

August 3 -

The agency's voice carries even more weight in light of the coronavirus pandemic, which has hastened the transition to digital and remote payments.

July 30 -

EMVCo has developed guidelines that allow the travel industry to provide more data to issuers authorizing ticketing transactions as a way to reduce fraud in air travel, hotel and car rental purchases.

July 15 -

The coronavirus pandemic has generated more interest in pay-at-the-pump apps, a growing segment of the payments industry that may not have grown fast enough to be ready for the sudden surge of interest in contactless payments.

July 15 -

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

July 9 -

At a time when many have shifted to digital payments to weather the coronavirus pandemic, the four main U.S. credit card brands are aggressively expanding their own take on digital commerce.

July 8 -

More than a dozen large European banks plan to launch a payment system that would rival U.S. payment companies and technology firms, an idea that hasn’t worked in the past but may have a better chance given the current global health, economic and political crises.

July 2 -

The economic impact of the coronavirus pandemic could lead to the ongoing expansion of workers’ access to early, or earned wages (EWA) through advances and instant payouts, including to new types of users.

June 10 -

The coronavirus pandemic has changed the way many industries conduct business — and that's especially true of the legal cannabis industry, which was already struggling in the U.S. to find the best way to handle noncash payments.

June 4