-

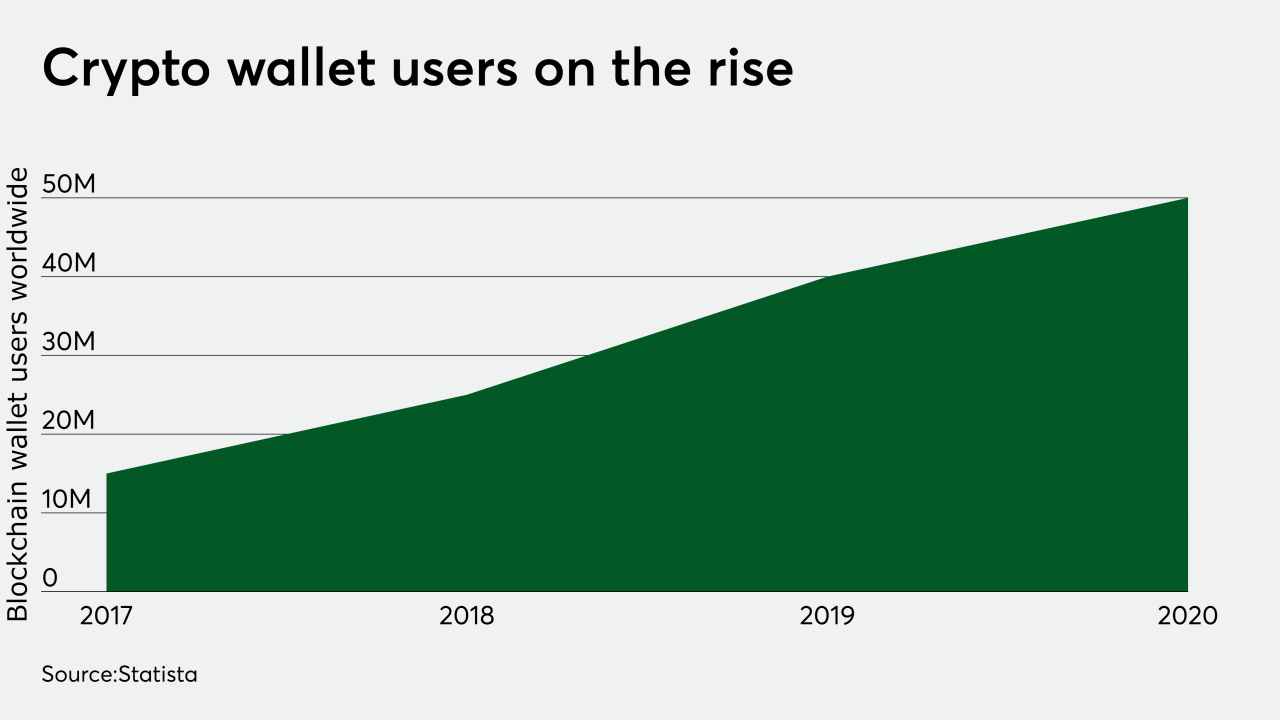

Major payment companies have long looked on at cryptocurrencies as too risky to touch, but too tempting to ignore. Mastercard's latest move indicates that the card brands are ready to make a firm pitch for crypto spending.

August 13 -

The major card networks have heavily invested in broader services as transaction processing loses its luster, a strategy that’s provided a ray of hope as retail and travel industries remain sidelined.

August 3 -

The agency's voice carries even more weight in light of the coronavirus pandemic, which has hastened the transition to digital and remote payments.

July 30 -

EMVCo has developed guidelines that allow the travel industry to provide more data to issuers authorizing ticketing transactions as a way to reduce fraud in air travel, hotel and car rental purchases.

July 15 -

The coronavirus pandemic has generated more interest in pay-at-the-pump apps, a growing segment of the payments industry that may not have grown fast enough to be ready for the sudden surge of interest in contactless payments.

July 15 -

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

July 9 -

At a time when many have shifted to digital payments to weather the coronavirus pandemic, the four main U.S. credit card brands are aggressively expanding their own take on digital commerce.

July 8 -

More than a dozen large European banks plan to launch a payment system that would rival U.S. payment companies and technology firms, an idea that hasn’t worked in the past but may have a better chance given the current global health, economic and political crises.

July 2 -

The economic impact of the coronavirus pandemic could lead to the ongoing expansion of workers’ access to early, or earned wages (EWA) through advances and instant payouts, including to new types of users.

June 10 -

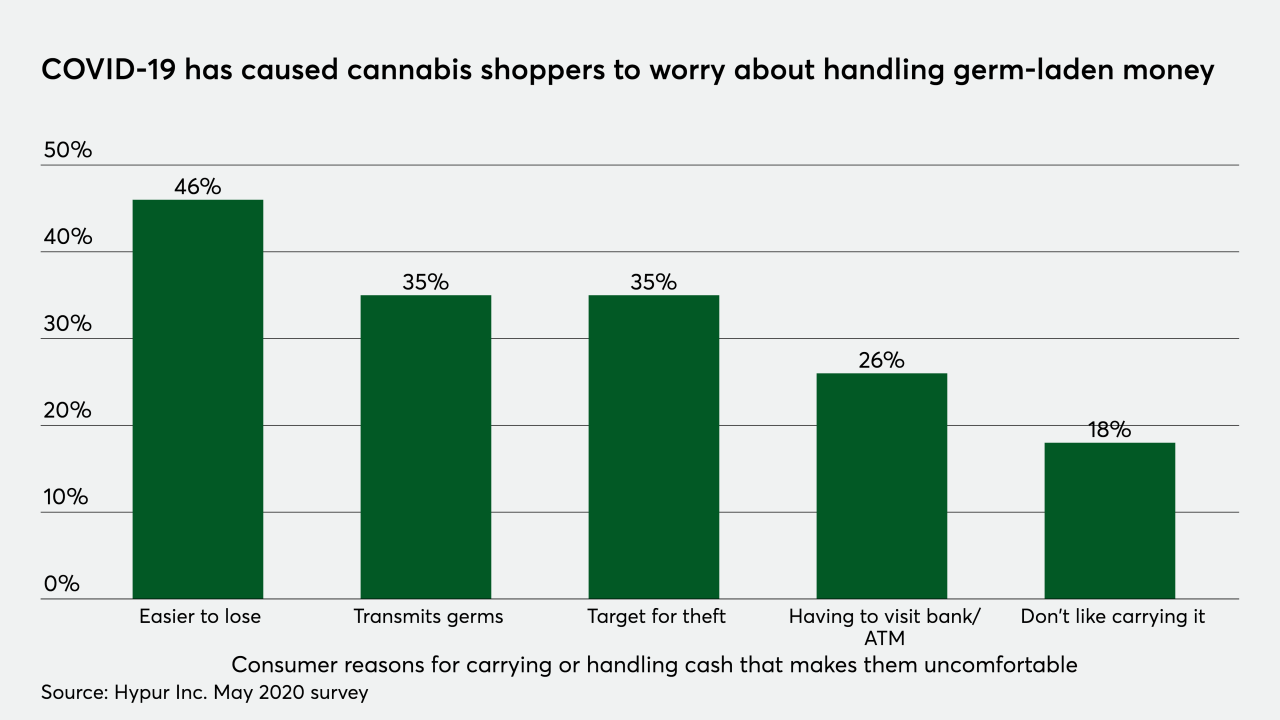

The coronavirus pandemic has changed the way many industries conduct business — and that's especially true of the legal cannabis industry, which was already struggling in the U.S. to find the best way to handle noncash payments.

June 4 -

American Express has added 26 Caribbean nations to the list of countries where it’s raised the ceiling on contactless transactions that may be conducted without PINs, to reduce consumers’ exposure to touching PIN pads.

June 2 -

Sony has invested in digital transaction security firm MagicCube, citing it as the Sony Innovation Fund's first investment outside of Japan.

May 28 -

In line with the other major card brands, Mastercard is extending its EMV liability shift at gas pumps to April 2021. It is also launching a data-driven fraud protection tool for fuel merchants who have not completed their upgrade to chip-card EMV pumps.

May 18 -

The potential for a new card scheme throughout Europe has been a discussion point surrounding the Single Euro Payment Area since its inception more than a decade ago. A new proposal could bring this concept into reality.

May 11 -

Contactless payment volume surged during the first four months of 2020 in Denmark, Norway, Sweden and Finland, accounting for about 70% of all transactions, according to new data from Copenhagen-based payments technology firm Nets.

May 6 -

Visa is delaying previously announced interchange and fee changes until April 2021, except for changes in the supermarket category, which will remain on the same schedule.

May 6 -

American Express will delay the EMV fraud liability shift due to complications from the coronavirus, following reports that Visa has made a similar concession.

May 5 -

Visa’s the first card company to push back the October deadline for U.S. gas station EMV compliance, but that’s just one of a mounting set of challenges petroleum merchants are facing because of the coronavirus.

May 4 -

Fears of catching coronavirus during the payment process has given a sharp boost in usage and awareness of contactless payments since the pandemic began, according to a new survey from Mastercard.

April 29 -

Visa is requiring merchants to be clearer about cancellation options for free trials and subscriptions, as chargebacks related to coronavirus soar.

April 21