-

U.S. banks under $10 billion in assets made 60% of the loans in the first round of the Paycheck Protection Program; things go relatively smoothly in the U.K. as 110,000 small businesses apply for low-cost loans.

May 5 -

The central bank’s programs announced since mid-April in response to the coronavirus outbreak match if not exceed the actions it took during the 2007-9 financial crisis.

May 4 -

Payday Loan LLC, which engages in lending and check cashing in 22 stores in California, sued the SBA on April 25 after its request for a $644,000 loan from the Paycheck Protection Program was denied.

May 4 -

Industry groups have called for a variety of measures to help CUs weather the pandemic’s economic fallout, including more money for funds that aid community development financial institutions.

May 4 -

Lenders are throwing money at buyers with stable jobs while making it harder for weak borrowers to get loans; $50 billion in loss provisions may not be enough and could stifle lending.

May 4 -

Small businesses that received loans from the Paycheck Protection Program pandemic still don’t know how much they may have to repay after the government missed a deadline to give specific guidance.

May 3 -

There were few fireworks at Wells Fargo’s first annual meeting under new CEO Charlie Scharf; billionaire investor and entrepreneur Mark Cuban pitches Fed-backed overdraft protection; as hotels sit empty, loan delinquencies pile up; and more from this week’s most-read stories.

May 1 -

More companies will be eligible to apply for the four-year loans, including those with high debt loads; four-year loans will be offered to European banks with rates as low as minus 1% as the eurozone economy tanks.

May 1 -

The Justice Department has begun a preliminary inquiry into how taxpayer money was lent out under the Paycheck Protection Program and has already found possible fraud among businesses seeking relief, a top official said.

April 30 -

Funneling fees from emergency loans to feed the hungry. Supporting psychological counseling for health care heroes and financial advice for the poor. Backing retrofits of customer operations to produce protective gear for front-line medical personnel. Bankers and financial educators have tossed out the traditional playbook to help clients and communities in crisis.

April 30 -

In round two of the Paycheck Protection Program, the bank has sent some 256,000 loan applications to the Small Business Administration for processing.

April 30 -

The millions of dollars earned from Paycheck Protection Program transactions will help cover rising provision costs tied to the new CECL accounting standard and coronavirus shocks to loan books.

April 30 -

It's time for agencies like the Small Business Administration to stop playing catch-up and invest in state-of-the art technology.

April 30 Alliance for Innovative Regulation

Alliance for Innovative Regulation -

Submissions total about $17.8 billion in requested funding for the second round of the Paycheck Protection Program, with an average loan size of $81,000.

April 30 -

A former economist says high-ranking officials engaged in “legally risky” behavior to downplay consumer harm; online payments and contactless transactions jumped in the first quarter, and some think the new habits will stick.

April 30 -

The Federal Reserve chairman pledged to use every tool at the central bank's disposal to limit the economic fallout from the coronavirus and urged lawmakers to take further action.

April 29 -

The Small Business Administration's last-minute plan to temporarily block larger banks from the relief loan program is another example of the agency changing the rules midstream, critics said.

April 29 -

Treasury secretary says big firms that took PPP loans should apologize, not just return the money; German fintech’s shares drop 26% as audit fails to rebut accounting fraud allegations.

April 29 -

The Small Business Administration has processed more than 476,000 applications from struggling small-business owners, but lenders say access to the second round of the Paycheck Protection Program has been spotty.

April 29 -

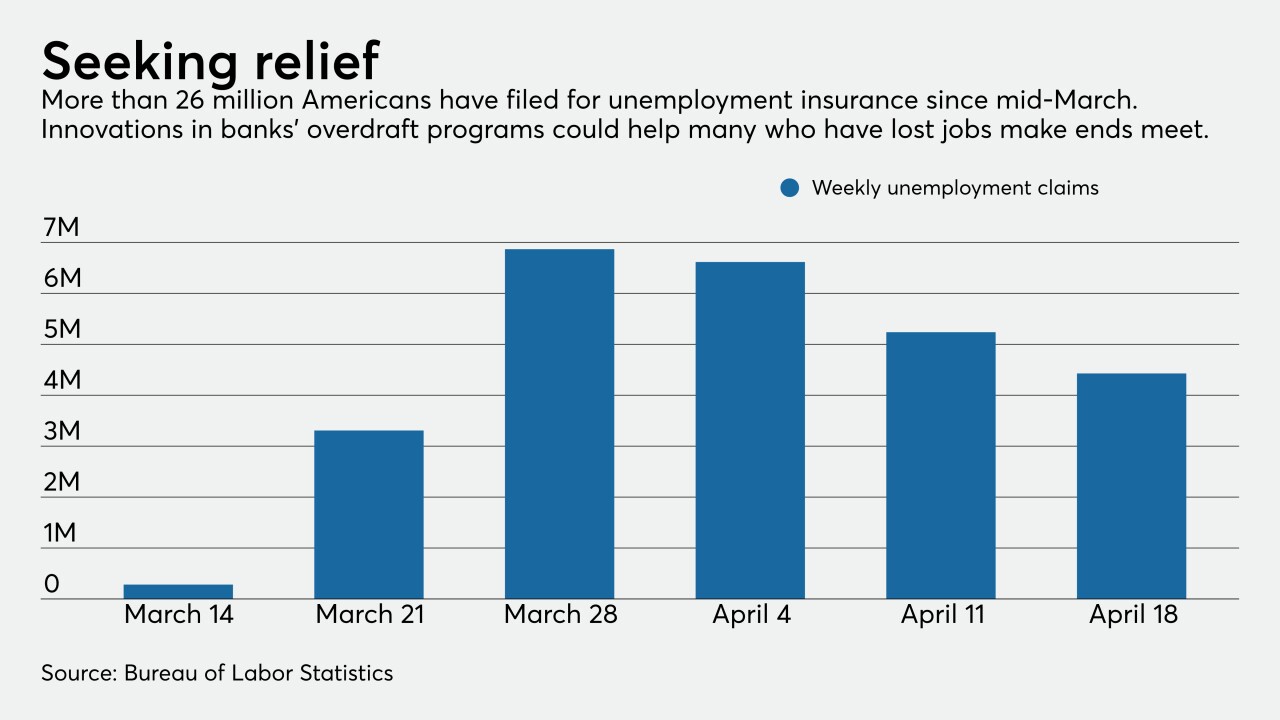

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

April 28