-

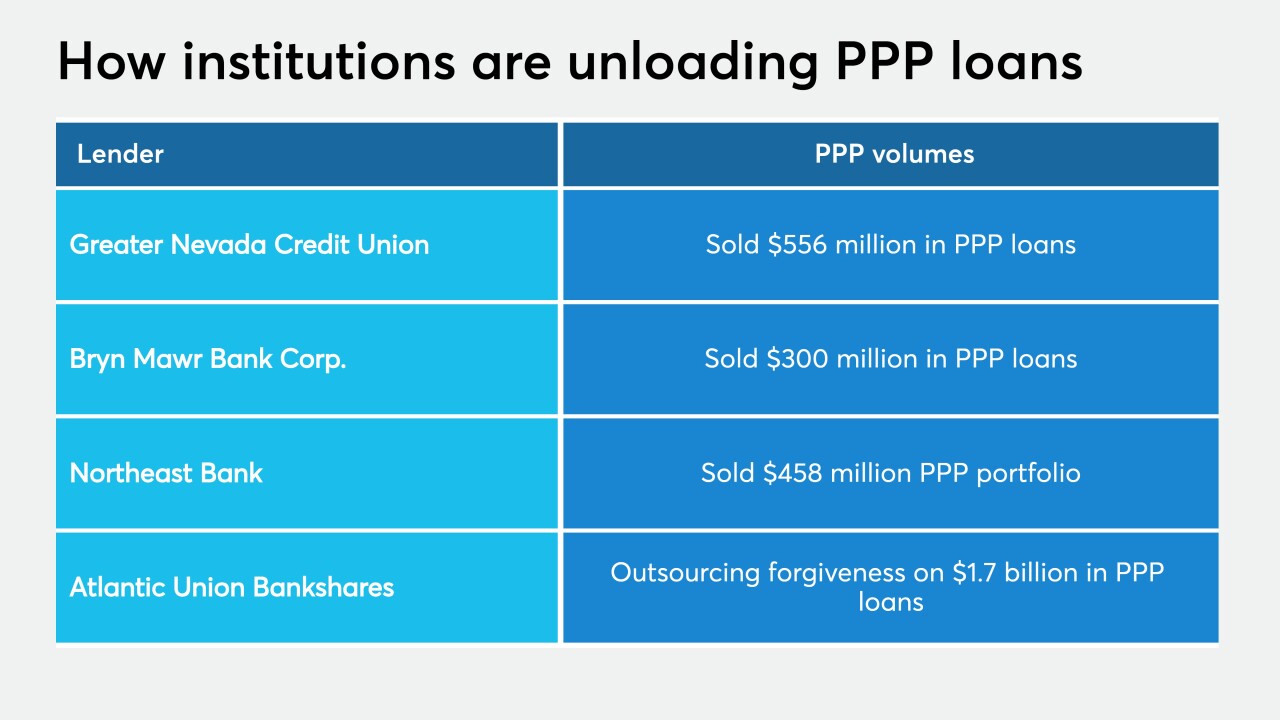

Greater Nevada Credit Union, like a number of community banks, agreed to sell its Paycheck Protection Program loans to avoid having to navigate the complicated forgiveness process.

July 15 -

A growing number of lenders are unloading loans made through the Paycheck Protection Program.

July 15 -

The Senate will consider Kyle Hauptman’s nomination to the NCUA board on July 21, while new data from the SBA details credit unions’ participation in the Paycheck Protection Program

July 13 -

A Bloomberg News analysis shows that the data for Paycheck Protection Program loans totaling more than $521 billion released on July 6 are riddled with anomalies.

July 13 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

July 13 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

July 10 -

After tech firms assisted community bankers in processing applications in the Paycheck Protection Program, small-business lenders are continuing to engage with cloud providers and other outside companies to automate the loan forgiveness process.

July 10 -

Paycheck Protection Program loans were out of reach for the myriad of cash-based enterprises or underfunded businesses that are key to economic growth in the country. This could change the very fabric of New York City, with businesses that were part of people's everyday life disappearing.

July 9 -

The company has established a fund that will provide capital, technical assistance and long-term recovery support to small businesses, especially minority-owned companies. The other megabanks are expected to donate their fees, also.

July 9 -

The German bank agreed to pay $150 million to New York State for its dealings with Jeffrey Epstein; the new tool will help lenders determine which borrowers are in the best shape to weather a crisis.

July 8 -

More than 30 banks across the country, including dozens of community banks and some lenders with more than $1 billion in assets, could generate fees that surpass their 2019 net revenue before set-asides for loan losses.

July 7 -

Restaurants, medical offices and car dealerships were the top recipients of large loans; increased usage of the drive-ups is putting a strain on the low-tech lanes.

July 7 -

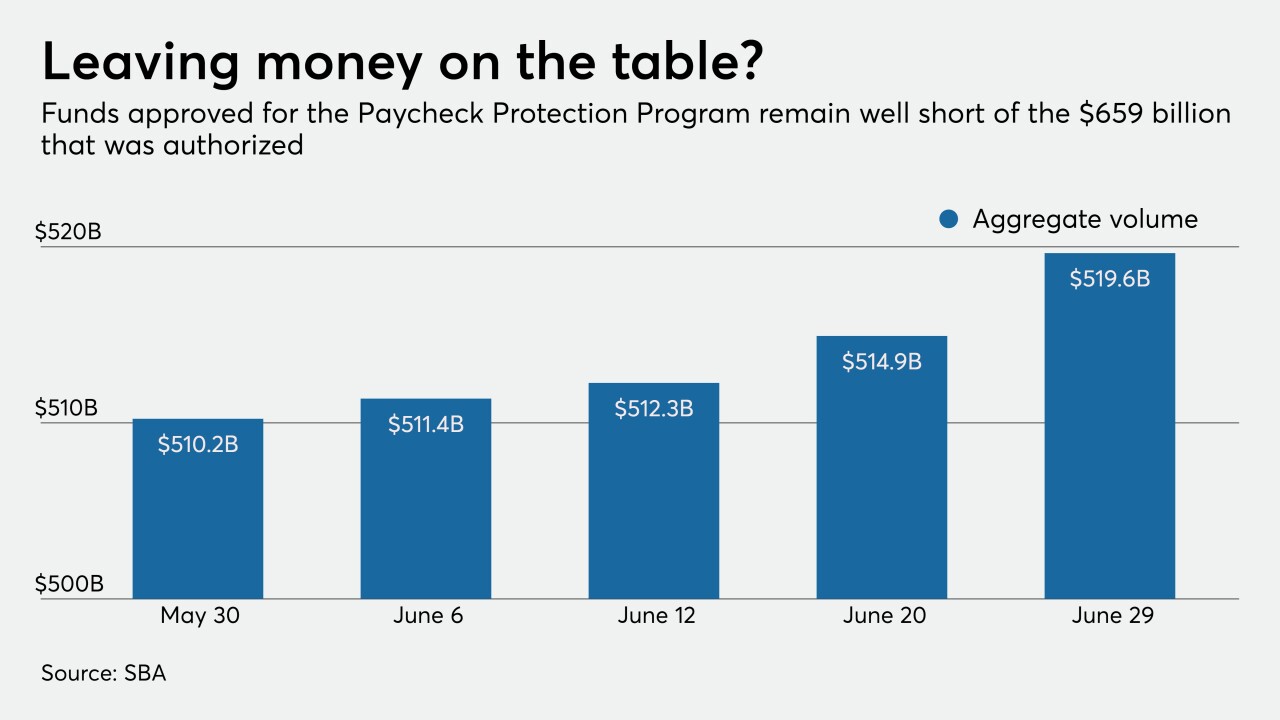

The Trump administration released details of almost 4.9 million loans to businesses — from sole proprietors to restaurant and hotel chains — under the federal government's largest coronavirus relief program so far, the $669 billion Paycheck Protection Program.

July 6 -

As PPP enters forgiveness phase, some banks see outsourcing as best move; after the Fed’s stress tests, Wells Fargo to cut dividend while other big banks boost capital buffer; Supreme Court strikes down CFPB leadership structure; and more from this week’s most-read stories.

July 2 -

The Senate had passed the bill Tuesday, shortly before the Small Business Administration was to stop accepting new loan applications.

July 2 -

The Main Street Lending Program is off to a slow start, while the PPP is extended five weeks to distribute the remaining $130 billion in loans; the European regulator is softening its stance to allow more deals.

July 2 -

The Paycheck Protection Program propped up many banks' balance sheets in the first half of the year, but what will drive loan demand in the second half?

July 1 -

The company seeks to help funnel more loans to minority businesses and consumers; the regulator says short-staffed banks are having trouble handling new government programs.

July 1 -

The extension to Aug. 8 was offered by Sen. Ben Cardin, a Maryland Democrat, and cleared the chamber by unanimous consent. The House has yet to take up the bill but could pass it as soon as Tuesday night.

June 30 -

Lenders are selling their Paycheck Protection Program loans or hiring outside companies to navigate the process in an effort to reduce risk and avoid overloading their employees.

June 30