-

In round two of the Paycheck Protection Program, the bank has sent some 256,000 loan applications to the Small Business Administration for processing.

April 30 -

The millions of dollars earned from Paycheck Protection Program transactions will help cover rising provision costs tied to the new CECL accounting standard and coronavirus shocks to loan books.

April 30 -

It's time for agencies like the Small Business Administration to stop playing catch-up and invest in state-of-the art technology.

April 30 Alliance for Innovative Regulation

Alliance for Innovative Regulation -

Submissions total about $17.8 billion in requested funding for the second round of the Paycheck Protection Program, with an average loan size of $81,000.

April 30 -

A former economist says high-ranking officials engaged in “legally risky” behavior to downplay consumer harm; online payments and contactless transactions jumped in the first quarter, and some think the new habits will stick.

April 30 -

The Federal Reserve chairman pledged to use every tool at the central bank's disposal to limit the economic fallout from the coronavirus and urged lawmakers to take further action.

April 29 -

The Small Business Administration's last-minute plan to temporarily block larger banks from the relief loan program is another example of the agency changing the rules midstream, critics said.

April 29 -

Treasury secretary says big firms that took PPP loans should apologize, not just return the money; German fintech’s shares drop 26% as audit fails to rebut accounting fraud allegations.

April 29 -

The Small Business Administration has processed more than 476,000 applications from struggling small-business owners, but lenders say access to the second round of the Paycheck Protection Program has been spotty.

April 29 -

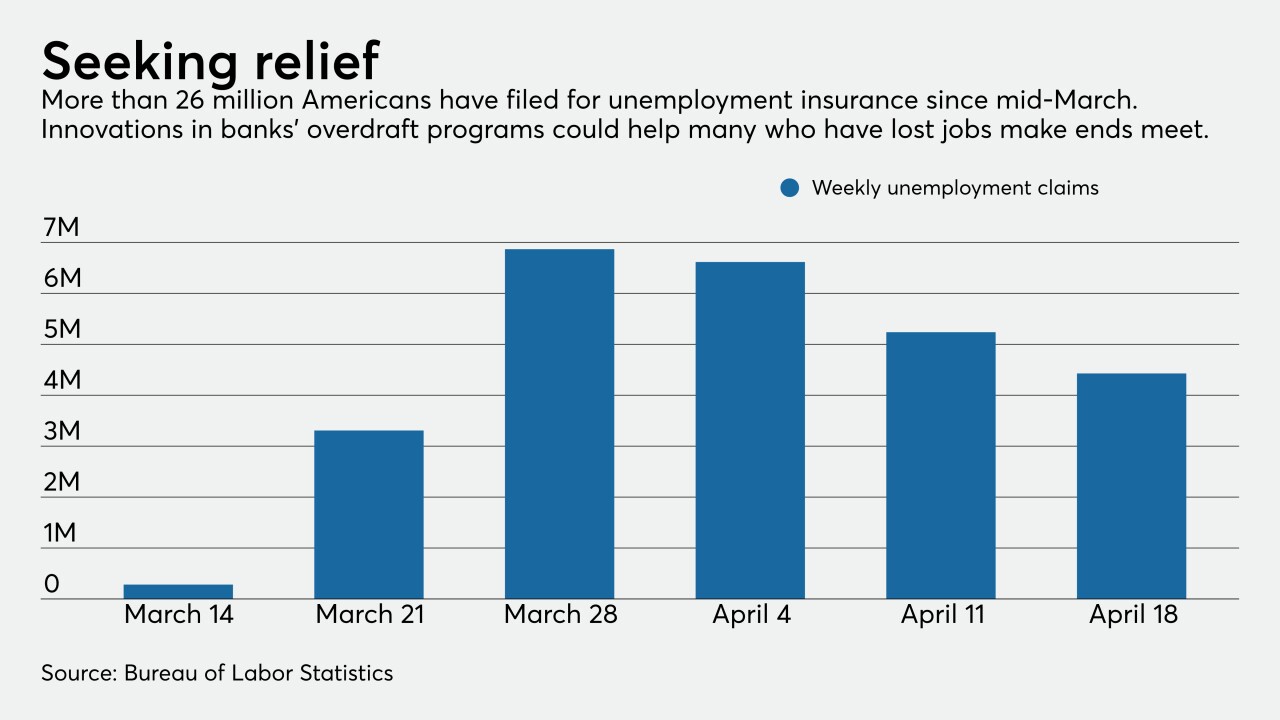

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

April 28