-

The number of Paycheck Protection Program loans to U.S. small businesses more than doubled in the third week of the latest round of pandemic relief aid, as Bank of America and JPMorgan Chase each processed more than $1 billion in funding.

February 2 -

Long hours by bankers and the streamlined resolution of Paycheck Protection Program loans helped lenders collect more fees than anticipated in the fourth quarter. It was a rare bright spot at a time when revenue is being pinched.

February 2 -

A rule change that allows farms with just one employee tap the Paycheck Protection Program means more pandemic relief funds are flowing into such states as Nebraska, Oklahoma, Wyoming and North Dakota.

January 29 -

The application process was a mess in the first rounds of the Paycheck Protection Program. Fintechs say their efforts will make it go smoothly in the latest iteration.

January 28 -

The application process was a mess in the first rounds of the Paycheck Protection Program. Fintechs say their efforts will make it go smoothly in the latest iteration.

January 28 -

Businesses owned by minorities and women got a head start this week in a new round of $284 billion funding, and early anecdotal evidence suggests stronger demand coming from these businesses.

January 15 -

First Bank in New Jersey, Northeast Bank in Maine and others have warmed to the idea of using software to streamline Paycheck Protection Program lending so that employees can be more hands-on with customers.

January 13 -

The pace of forgiveness for Paycheck Protection Program loans is expected to accelerate when the Small Business Administration issues guidance on additional steps meant to streamline the process.

January 13 -

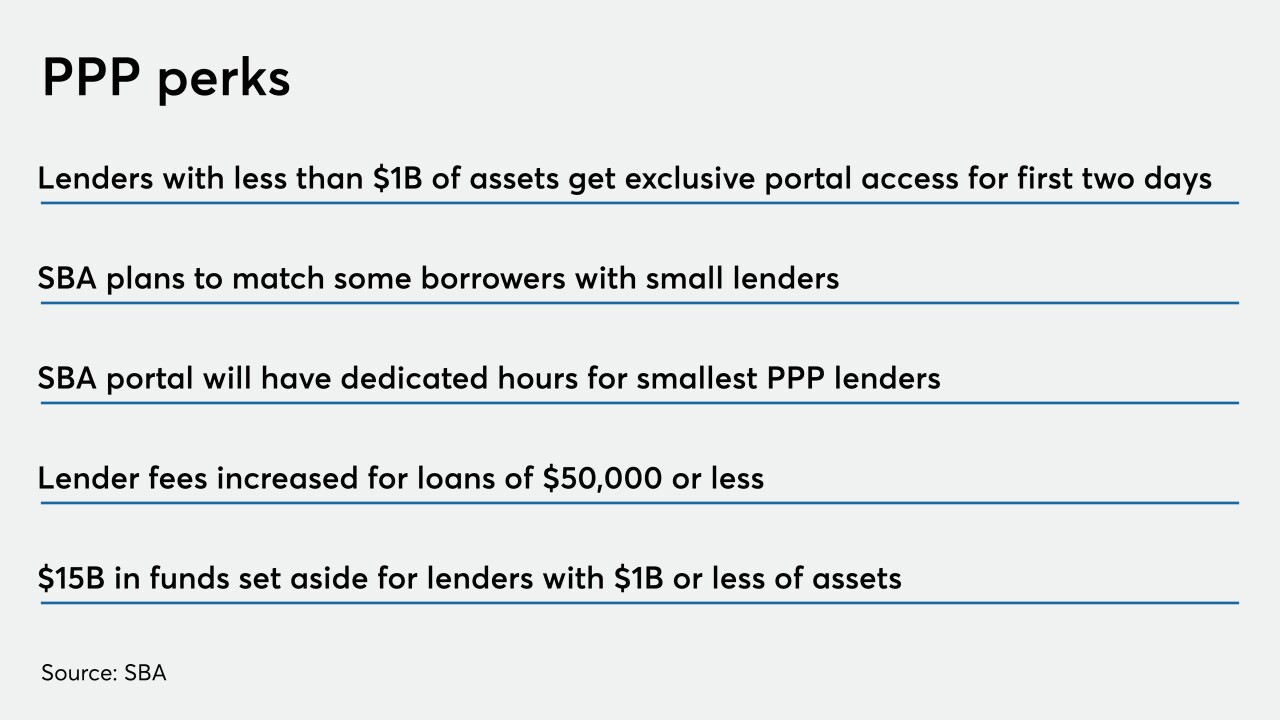

The Small Business Administration will allow lenders with less than $1 billion of assets to process applications in two days. The portal will open to all lenders on Tuesday.

January 13 -

Several community banks said they didn't have enough time to review the Paycheck Protection Program's application forms, forcing them to sit out Monday's reopening. The SBA is not saying when more lenders will be allowed to access its portal.

January 12 -

Some categories of businesses, such as restaurants, have different needs the program doesn't adequately address, says LendingFront's Jorge Sun.

January 12 LendingFront

LendingFront -

Bankers have several unanswered questions about the Paycheck Protection Program before it reopens to select lenders on Monday. Among them: When will forms be available, and which portal will the Small Business Administration use?

January 8 -

Community banks will have access to allocated funds and at least two days of exclusive portal access when the Small Business Administration relaunches the Paycheck Protection Program.

January 7 -

The Internal Revenue Service will allow businesses that got their Paycheck Protection Program loans forgiven to write off expenses paid for with that money, shifting policy after Congress passed new legislation last month.

January 6 -

The recent stimulus law’s relief for renters and extension of the federal eviction ban were meant to ward off a housing crisis. But owners of 1- to 4-unit dwellings still face mounting mortgage and property tax debts, and delinquencies could start rising soon — followed by foreclosures.

January 4 -

Triad Business Bank opened in North Carolina shortly before the launch of the Paycheck Protection Program, which brought in many clients. CEO Ramsey Hamadi, one of our community bankers to watch in 2021, will have to work hard to retain them after their loans are forgiven.

December 30 -

-

The new legislation includes a provision sparing lenders from having to pay such fees on Paycheck Protection Program loans, except in cases where they agree in advance with borrower representatives to do so.

December 29 -

Gilles Gade, one our community bankers to watch in 2021, led an effort that made Cross River Bank one of the biggest Paycheck Protection Program participants. He is ready for his team to pick up where it left off when the new stimulus package kicks in.

December 28 -

The legislation allows the Small Business Administration to waive fees and raise the guarantee for 7(a) and 504 loans, which could encourage more small businesses to apply for loans as the economy recovers.

December 22