-

-

The Federal Reserve governor addressed misconceptions about the forthcoming instant payment system after delivering remarks on financial innovation.

April 20 -

Scams and fraud on real-time payment platforms are well documented. To solve the problem regulators, lawmakers and the public must acknowledge the inherent risks that come with a powerful new technology and develop rules to make it safer.

November 8 American Banker

American Banker -

A criminal group called Prilex has stolen millions in a scheme involving fake repair people installing malware on point of sale terminals.

October 3 -

The popular peer-to-peer payments network is rife with fraud. And as much as the Consumer Financial Protection Bureau might want to crack down on the big banks that own Zelle, the agency is legally handcuffed.

September 20 American Banker

American Banker -

Federal Reserve Vice Chair Lael Brainard said Monday that the central bank's real-time payments network will go live between May and July of 2023 and financial institutions should prepare themselves right away.

August 29 -

Paul Stoddart joins the U.K. company at a crucial time. A specialist in account-to-account transfers, GoCardless sees an opportunity to capitalize on friction over interchange rates.

May 12 -

The U.K. seized 2 million pounds ($2.61 million) from a London-based fintech firm, saying that the funds were linked to a $150 million U.S. wire fraud conspiracy.

April 21 -

To appeal to a younger audience, credit unions are teaming up with third parties that can help them offer Bitcoin accounts, real-time payments and other cutting-edge services.

April 21 -

As rising inflation and supply-chain shortages create new urgency for businesses to settle transactions quickly, more community banks and credit unions are recognizing the need for instant payments, according to The Clearing House.

April 14 -

Each company has introduced its own program to give dealerships access to real-time digital transactions.

April 10 -

The banks that own the peer-to-peer payment network are reportedly considering a retail launch that could fend off rival payment methods — or simply cannibalize the sizable revenue issuers get from credit and debit cards.

April 7 -

The data from these transactions could help millions of borrowers with thin or nonexistent credit files. But how the credit reporting industry collects and treats the data may matter more than the data itself.

March 9 TransUnion

TransUnion -

Tap to Pay on iPhone turns any of the tech giant's recent smartphones into a card reader, but since Apple doesn't provide its own merchant services, it stops short of becoming a direct threat to acquirers and payment facilitators.

February 8 -

The deal is the latest example of a mainstream bank buying a point-of-sale lender focused on financing home improvement projects.

January 19 -

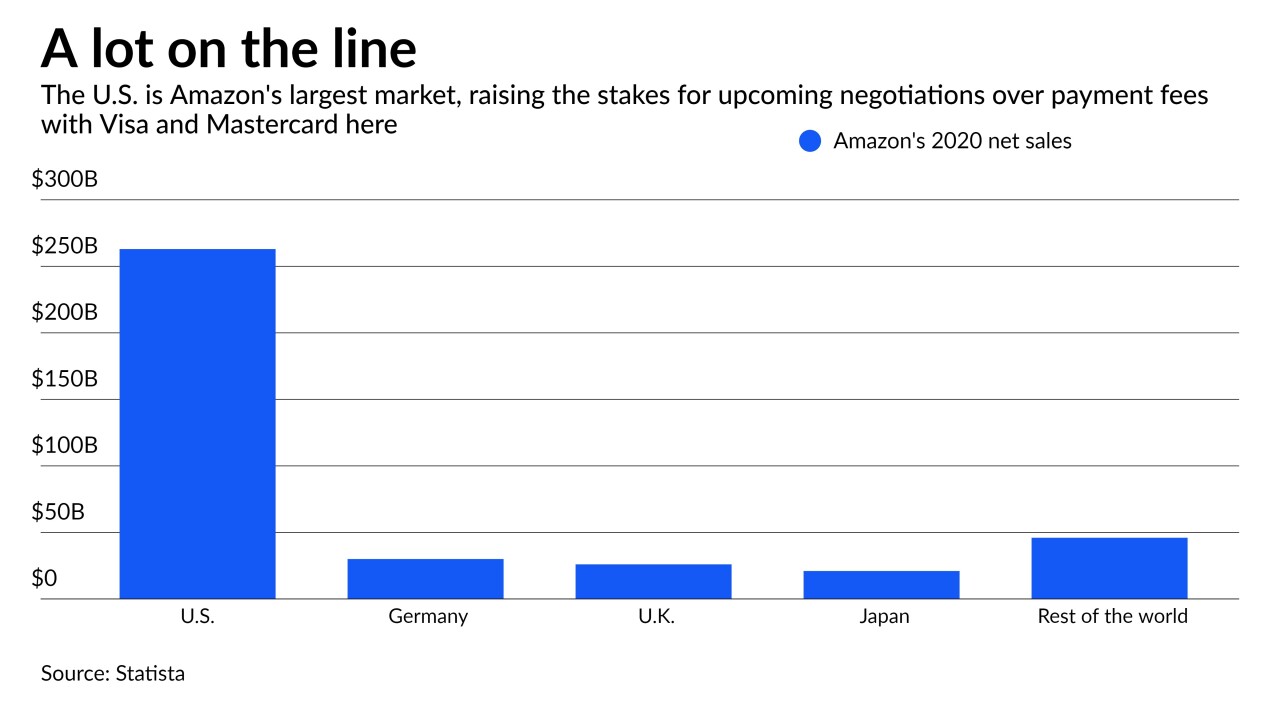

The online retailer’s plan to block certain credit card payments in Britain is seen as an opening move in likely negotiations with Mastercard and Visa ahead of the card networks' planned fee hikes in 2022.

November 17 -

Citigroup, BNY Mellon, JPMorgan Chase and PNC are each working to enable wireless providers, public utilities and other companies to instantly receive funds from the consumers they bill.

November 5 -

Best known as a website management company, GoDaddy began directly offering digital and offline payments after learning that its clients were getting those services from fintechs. The company is also now selling terminals for in-store payments.

October 18 -

The lender is building on a 20-year-old partnership with Fiserv to provide options such as revolving credit, with plans to add buy now/pay later.

October 14 -

Apple will allow developers of some apps to link from their software to external websites for payments by users, addressing a longstanding App Store complaint and settling an investigation by Japan’s Fair Trade Commission.

September 1