-

Analysts say credit card companies could face a major hit to earnings, while banks would also be under pressure.

January 12 -

The American Bankers Association and other groups contend the president's plan to cap credit card interest rates at 10% would drive consumers toward less regulated, more costly alternatives.

January 12 -

Following a judge's rejection of a 2024 settlement with merchants, the card networks are offering a slightly higher interchange reduction and easing card acceptance rules. It's the latest attempt to end a legal fight that's two decades old.

November 10 -

-

The fees are controversial for card networks and consumers, but the impact on banks has been muted. Here's why that could change.

February 18 -

The $678 billion-asset bank highlighted its payments and investment management and trust business as fee generators in the recently ended quarter.

January 16 -

The Cincinnati-based bank aimed for consistency in the third quarter as it built on strategic initiatives. Executives expect "record" net interest income next year.

October 18 -

Charging a nonsufficient funds fee on a debit, ATM or peer-to-peer payment that gets declined immediately would be considered "abusive" under a proposed rule from the Consumer Financial Protection Bureau.

January 24 -

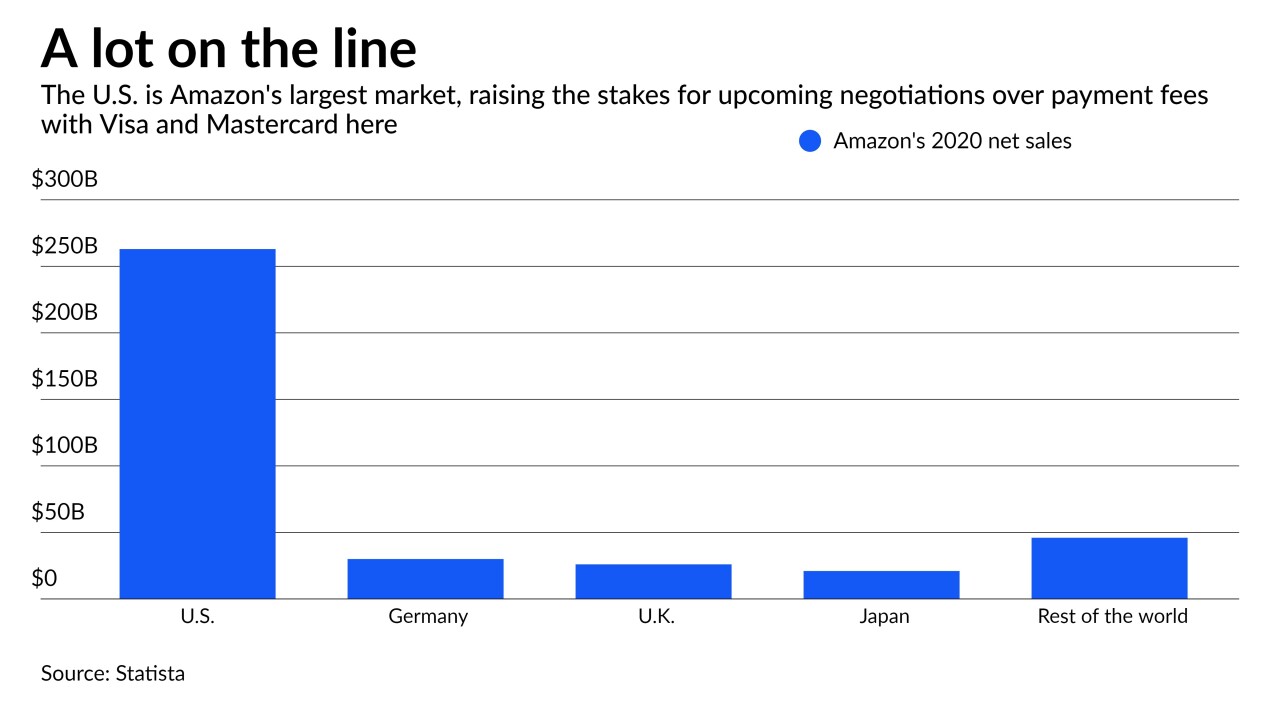

The online retailer’s plan to block certain credit card payments in Britain is seen as an opening move in likely negotiations with Mastercard and Visa ahead of the card networks' planned fee hikes in 2022.

November 17 -

Apple will allow developers of some apps to link from their software to external websites for payments by users, addressing a longstanding App Store complaint and settling an investigation by Japan’s Fair Trade Commission.

September 1 -

The Minneapolis company benefited as business for airlines and hotels picked up sooner than expected. The rebound helped fee income in the bank’s payments business approach prepandemic levels.

July 15 -

European regulators say App Store fees distort competition, a claim similar to Epic Games' contention in legal action in the U.S. over gaming download charges and transaction routing.

April 30 -

Apple Inc. was handed a European Union antitrust complaint over its app payment rules, drawing one of the world’s toughest competition enforcers into a global battle over fees for downloads on smartphones and tablets.

April 30 -

While a merchant may choose to run a program incorrectly, it is our responsibility as professionals to fully understand what the rules are and communicate the impact if they are not followed, says Clearent's Phil Ricci.

April 28 Clearant

Clearant -

Long after the pandemic is finally behind us, the many security and financial benefits owners, management companies and fans alike receive from having the technology in place will remain too invaluable to ignore, says Corsight's Rob Watts.

April 23Corsight -

The unfortunate reality for merchants and their customers is that swipe fees have continued to increase because the payment card market is broken, says payments consultant Mark Horwedel.

April 13 CMSPI

CMSPI -

Paytm’s decision to open its own app store after Google forced developers to use its billing system was a predictable move, as is the potential for fintechs to steal payment volume from the technology giants.

October 7 -

As the pandemic has stretched on further into 2020, with more lockdowns and economic disruption predicted heading into the fall and winter, continuing to offer fee waivers has not always proved financially viable.

September 24 -

Epic, the maker of Fortnite, is suing Apple and Google for forcing app makers to hand over a 30% cut of their revenue to the tech giants. The grievance against Apple is pretty clear-cut; the attack on Google is more nuanced, and could have major consequences for the payments industry.

August 14 Arizent

Arizent -

Oklahoma lawmakers' decision last month to drop the state's surcharging ban was yet another signal that U.S. merchants have the final say in whether to apply extra charges to credit card transactions to offset interchange fees.

January 10