-

Meta's departure from the crypto market removes a sizable potential competitor at the same time that nonbank issuers are bracing for tougher regulatory scrutiny.

January 31 -

On Sep. 30, 2021. Dollars in thousands.

January 31 -

The new product will help Barclays' U.S. bank reach customers who may not want — or qualify for — its cobranded cards. It's part of a strategy to reach more consumers after card balances declined last year.

January 31 -

The credit card issuer fielded questions about its fees two days after the Consumer Financial Protection Bureau announced a wide-ranging review of consumer charges. Executives said they would not take a big revenue hit even in the face of new limits.

January 28 -

Few banks have adopted an instant invoicing technology called Request for Pay, but more may get on board to help their customers avoid overdraft charges.

January 28 -

The card network hopes its enabling of digital payments could balance the scrutiny it faces over interchange rates in countries such as the U.S. and U.K.

January 27 -

The recent increase in online payments, whether through shopping or government disbursements, has created more openings for fraud. Companies and government agencies in Europe are trying to combat the problem by developing digital ID systems.

January 27 -

The Massachusetts bank is purchasing a fellow Bay State institution's pot banking operation and says one of its first steps will be encouraging dispensaries to accept credit and debit cards.

January 27 -

Michael Miebach told analysts that the card network expects earnings growth despite the economic impacts of the omicron variant and shipping delays. Mastercard does not have as contentious a relationship with the e-commerce giant as Visa does, he said.

January 27 -

The move could impact payments providers that rely on Apple’s iPhones to facilitate sales, such as Block’s Square, which dominates the market.

January 27 -

The Spanish bank introduced the installment product in Germany nine months ago, and is planning to bring it to 18 European markets this year.

January 26 -

JPMorgan Chase's recent purchase of a stake in the Greek fintech will allow the U.S. company to offer new services like merchant credit in Europe, where it is No. 5 among merchant acquirers.

January 26 -

The expenses jumped 33% last quarter, which was generally in line with trends elsewhere in the credit card industry. The battle for new customers is “intense,” CEO Richard Fairbank told analysts.

January 26 -

Acquiring the earned-wage-access firm and challenger bank would further efforts by the retailer and its partners to develop a "super app" featuring mobile financial tools.

January 26 -

The buy now/pay later craze already has retailers demanding lower fees, according to Klarna.

January 25 -

The controversial cryptocurrency project that Mark Zuckerberg once defended in front of Congress is unraveling after regulatory pressure.

January 25 -

The new service was designed to lower costs for community banks while adding security features and providing customers with access to Venmo and other peer-to-peer payment systems.

January 25 -

American Express predicts travel will account for just 20% of its spending for the foreseeable future, compared with 30% before the pandemic, as younger consumers spend more on merchandise.

January 25 -

The announcement marks JPMorgan’s first deal in 2022, on the heels of its most prolific year for buying and taking stakes in smaller firms since at least the financial crisis.

January 25 -

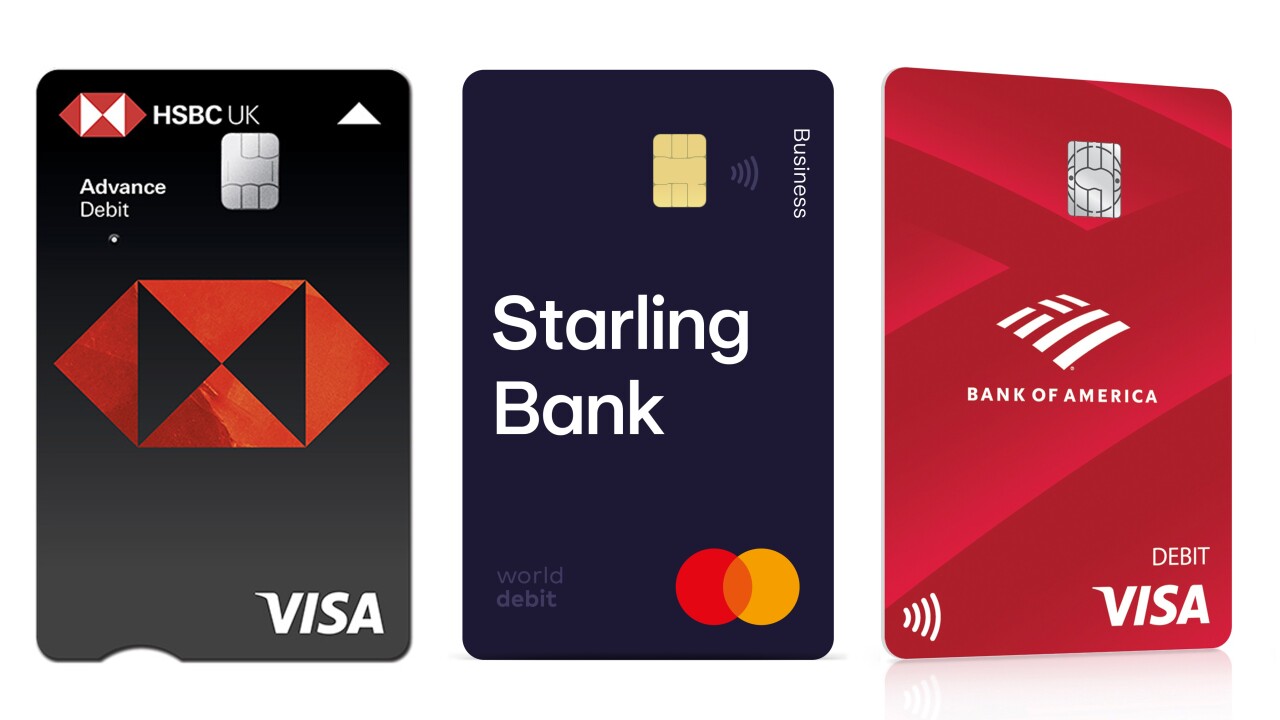

Switching from a horizontal layout — a relic of embossed account numbers — is an attempt by issuers like HSBC, Starling Bank and Bank of America to address accessibility challenges faced by customers with dementia, visual impairments and other conditions.

January 24