JPMorgan Chase's 2022 plan to invest in innovation is off to a quick start with its

The Athens-based payment technology company provides bill pay, virtual payment cards and merchant credit in 23 European countries. The bank hopes Viva's local expertise will help manage the difficult task of merchant onboarding in Europe, where despite a common currency in the euro, the process of accepting payments can vary from nation to nation.

The fintech's merchant credit product could also enable JPMorgan to offer options for short-term credit backed by future payment flows, competing with similar products from Block (the former Square) and PayPal. Viva's range of products includes those from a 2020 acquisition of Praxia Bank, a Greek financial institution that had been owned by former executives of Barclays and Atlas Merchant Capital.

"Viva brings in payment capabilities, but also the value-adds that go with payments," said Max Neukirchen, the New York-based global head of payments in solutions for JPMorgan.

It's the first investment JPMorgan announced following its most recent earnings call, during which the bank announced it would increase spending in marketing, technology and hiring staff in 2022.

"We are very much focused on

Work on integrating European retail payments has been underway for nearly two decades, according to a recent report from the

"It is fragmented in the sense that Europe is actually a region made up of lots of different languages, cultures and payment preferences," said Gareth Lodge, a senior analyst at Celent in London.

A debit card in one country is often different from those issued in most other countries, with different networks, pricing and positioning, Lodge said. "As such, Europe is really 20 markets or more rather than one, meaning getting scale requires patience, experience and deep pockets."

Viva builds its own compliance and onboarding system to accommodate each market's nuances, Neukirchen said. "This approach resonates very well in Europe. While it's the EU, there are still peculiarities in each market."

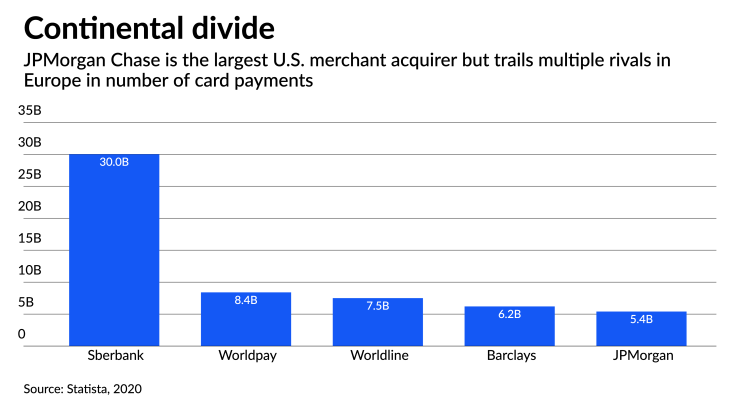

The largest merchant acquirers in Europe are Sberbank, which processed more than 30 billion debit and credit card transactions for European merchants in 2020, according to

In the U.S., JPMorgan is the largest merchant acquirer, processing 27.6 billion transactions in 2020, according to

JPMorgan relies on a handful of relationships with large partners in Europe such as Amazon, according to Eric Grover, a principal at Intrepid Ventures in Minden, Nevada.

JPMorgan's European merchant acquiring footprint otherwise is relatively small, Grover said. "Viva Wallet gives Chase a differentiated, potentially compelling acceptance value proposition for small to mid-sized businesses across the continent."

JPMorgan can expand its acquiring business in Europe by offering merchant credit, though other providers got to that market first.

Block's Square Capital has offered merchant credit for years in addition to its core payment acceptance hardware and other products it offers through its Cash App and its

Point-of-sale lending to merchants, as with buy now/pay later for consumers, provides store-level data to evaluate creditworthiness and instantly open new accounts, according to Richard Crone, a payments consultant in San Mateo, California.

"The point-of-sale solutions also simplify loan repayments out of daily sales, not on a monthly or quarterly basis," Crone said. "That further reduces lending risk and increases the profitability of point of sale lending."

Merchant credit differs from typical balance sheet lending, Neukirchen said, likening it to a working capital solution in which merchants receive short-term loans against future cash flows.

"This is still an emerging product, but working closely with Viva, we can provide the risk expertise and lending while Viva has the franchise and payment capabilities," Neukirchen said, and any potential expansion or product building with Viva would have to take place after the deal closes, he said. "The product is an interesting solution in Europe and North America."