-

Judge Mark T. Pittman sided with the Consumer Financial Protection Bureau in ordering the case be moved from Texas to the District of Columbia due to "forum shopping."

March 29 -

The bank is launching KeyVAM, a virtual account management offering it designed with fintech Qolo. Both companies said the nature of the relationship was as important as the technology it produced.

March 28 -

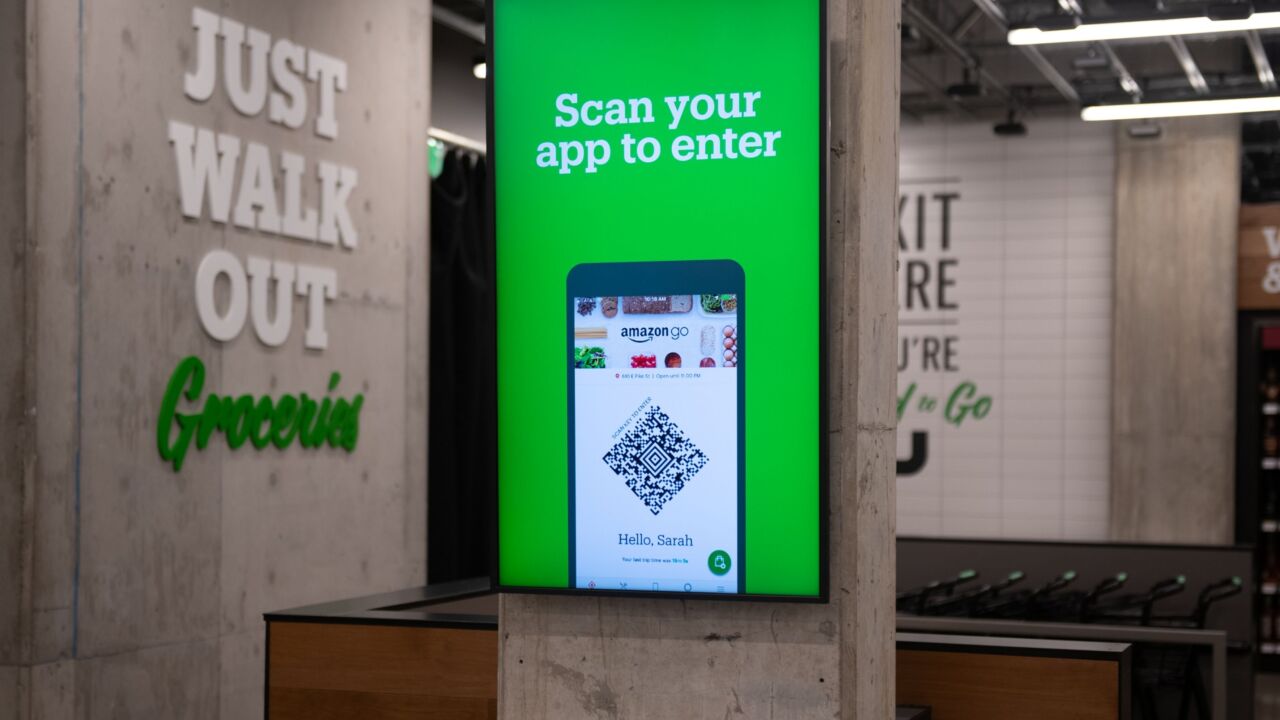

Amazon is working with Stripe to expand its Just Walk Out retail stores in Australia and Canada; Safaricom is working with Onafriq to support remittances sent via M-Pesa to Ethiopia; and more.

March 27 -

A new crop of AI-powered products from Visa tackles scams beyond the company's network to include account-to-account payments and digital wallets.

March 27 -

The potential deal between the major card networks and merchants would see swipe fees reduced and capped for at least three years, pending approval by the U.S. District Court for the Eastern District of New York.

March 26 -

The Consumer Financial Protection Bureau plans to release neutral credit card pricing data in the coming months to help consumers get the best deal, according to Director Rohit Chopra. Deceptive reward programs, late fees and data portability remain concerns, too, he says.

March 26 -

Banks, especially big ones, have become too dependent on hidden-fee income. As the consumer credit market evolves toward greater transparency, the CFPB's rules will be the least of their problems.

March 26

-

Wars in Ukraine and the Middle East. Fiercely polarized U.S. politics. Rapidly multiplying payments options on social media networks and elsewhere. Those factors and more are making it harder than ever for banks to combat illicit financial transactions.

March 25 -

Despite further delays, the country has taken two key steps to opening up access to its Real-Time Rail, including allowing payment companies to participate without a bank partner, but it has yet to commit to a date for the project to go live.

March 25 -

M&T Bank creates new chief communications officer role, Citi cuts London investment banking jobs as deal drought persists, new report by McKinsey advises banks to institute artificial intelligence from headquarters rather than by divisions, and more in our weekly news roundup.

March 22 -

The launch of Apple Pay a decade ago set the tone for how the tech giant would interact with banks and credit unions in the years to come. The Justice Department is now pushing back.

March 22 -

Criminals who buy and sell consumer data on the dark web are perpetrating increasingly complex credit and debit card fraud schemes, according to the card network's latest threats report.

March 21 -

The U.S. Justice Department and 16 attorneys general sued Apple Thursday, accusing the iPhone maker of violating antitrust laws by blocking rivals from accessing hardware and software for digital wallets and other features.

March 21 -

At an American Bankers Association event, Sen. Jon Tester, D-Mont., who's up for reelection this year, said that he hopes the Durbin-Marshall credit card bill won't go anywhere and criticized the Federal Reserve's debit interchange proposal.

March 20 -

The fast-food chain is analyzing the cause of an issue that affected payments in multiple countries. Separately, dLocal, a payments processor in Uraguay, is making changes at the top.

March 20 -

Thomas Halpin, who heads global cash management for North America, talks about real-time processing, generative AI, central bank digital currencies and why the ISO 20022 messaging standard is cool.

March 19 -

Credit card late fees are annoying, but that's why they work as a disincentive to prevent late payments. By making them much smaller, the CFPB will actually be working against the interests of low-income consumers.

March 19

-

Ant Group, the company behind Alipay, plans to set up independent boards for its international, database and digital technologies operations as it pushes forward the overhaul of its fintech business, according to a memo seen by Bloomberg.

March 19 -

-