-

Citing inflation’s effect on rising payment card pricing, the senator convened a Judiciary Committee hearing to reassess rules that resulted in caps on debit transaction fees 11 years ago.

May 6 -

Shortly after the reveal of Stripe Financial Connections, the CEO of its longtime partner Plaid took to Twitter to accuse the company of exploiting their relationship to build the new service. At stake is the growing market for digital transactions.

May 5 -

Financial losses stemming from sanctions and the threat of cyberattacks are just some of the major concerns from across the industry.

May 5 -

Environmental impact calculators, fee reductions and carbon offsets are becoming part of the playbook for BNY Mellon, Visa, Mastercard, Klarna and others.

May 5 -

The card network is making new security tools part of its expansion into non-payment services, hoping it can combat fraud that comes from its own account holders.

May 4 -

A new product called Financial Connections links businesses directly to customers' banks, giving the payment technology vendor a feature that makes it a direct competitor to data-fueled fintechs.

May 4 -

Klarna will begin reporting the use of buy now/pay later products to U.K. credit reference agencies, which could see the increasingly popular mode of financing impact users' credit ratings.

May 4 -

Affirm Holdings, the buy now/pay later startup led by former PayPal Holdings co-founder Max Levchin, will be offering its services to Fiserv’s merchant clients as part of an agreement announced Wednesday.

May 4 -

In global news this week, Grab gets approval to offer digital banking in Malaysia; Italy's post office invests $27 million in a a buy now/pay later lender; Apple struggles to appease Dutch regulators; and more.

May 4 -

Representatives of the retailer community will face off against payment card network and bank executives over credit and debit card interchange during a Wednesday hearing to be chaired by Sen. Dick Durbin.

May 3 -

On Dec. 31, 2021. Dollars in thousands.

May 2 -

"Apple may have restricted competition, to the benefit of its own solution Apple Pay," Margrethe Vestagar of the European Commission said. It's an accusation Apple's fought many times across the globe.

May 2 -

About two dozen banks in the U.S. and Europe, including ABN Amro and Bank of America, are working with The Clearing House and EBA Clearing, using technology from SWIFT, to make instant international transactions ubiquitous for business and e-commerce sales.

May 2 -

10 things to know in April: Apple teams with Visa, the Consumer Financial Protection Bureau examines payday lenders, and more.

April 30 -

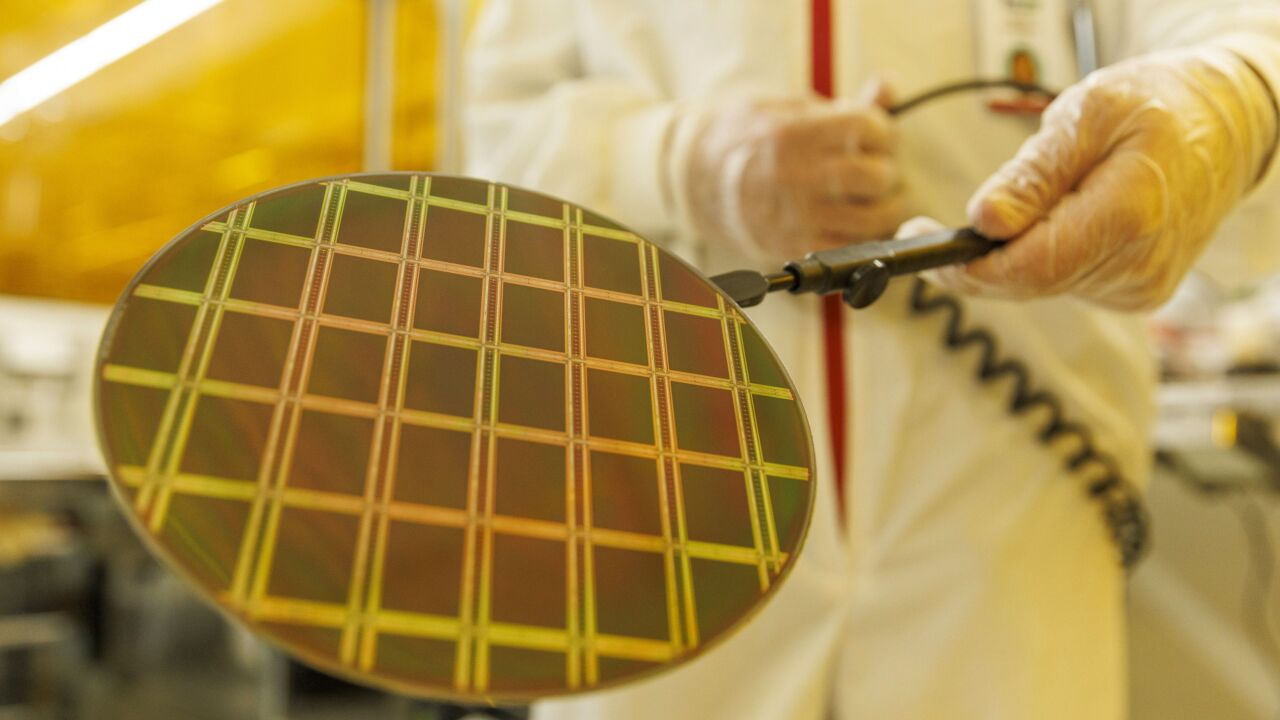

The global microchip shortage is being exacerbated by Russia's war in Ukraine and the COVID lockdowns in China. Experts are warning of an impending strain on the manufacture of cards and point-of-sale hardware.

April 29 -

The recovery for airline and related spending has been robust — and thus far immune to geopolitical and inflationary pressures — according to the card network, following similar reports from Visa and American Express.

April 28 -

Fewer new customers signed up during the first quarter as e-commerce sales momentum slowed and inflation rose, forcing the company to reduce its overall growth expectations for the year.

April 28 -

Analysts were expecting Capital One’s marketing spending to slow significantly after it surged to nearly $1 billion at the end of the year.

April 27 -

In global news this week, scammers target Revolut's program for Ukrainian refugees; Commerzbank applies for a crypto license in Germany; Nium merging with Socash; MyPinPad merging with SmartPesa; and more.

April 27 -

The country was a large part of the card brand's cross-border digital business, though expansion in other markets and new services will help offset the negative impact, according to CEO Alfred Kelly.

April 26